Bitcoin - Time to Back Out?

Currencies / Bitcoin May 13, 2014 - 03:46 PM GMTBy: Mike_McAra

In short: we still support having short speculative in the Bitcoin market, stop-loss at $470.

In short: we still support having short speculative in the Bitcoin market, stop-loss at $470.

MasterCard is lobbying on Bitcoin, The Hill reported. The credit card company is thought to be one of the businesses that might potentially lose most if Bitcoin was to become a reliable and widely-acceptable payment network. The article:

MasterCard is paying lobbyists to focus on the growing digital currency bitcoin, according to federal lobbying disclosure records.

In a quarterly report filed this month, lobbying firm Peck Madigan Jones said that five of its lobbyists were concentrating on “Bitcoin and mobile payments,” among more than a dozen other issues, on behalf of MasterCard.

The payment giant is the first company to officially lobby on the virtual currency, according to federal disclosure records.

(…) MasterCard said that it was “gathering information in connection with recent congressional hearings to better understand the policy issues around virtual and anonymous currencies.”

MasterCard is trying to get to know what kind of regulation related to Bitcoin it might expect. This doesn’t necessarily mean that the company itself is trying to forward any kind of agenda for or against Bitcoin. One thing that should remain clear, however, is that the company will not be lobbying for the benefit of the Bitcoin community but rather to fulfill its own goals.

We would expect more such efforts in the future, not only from MasterCard but also from Visa and other companies linked to payment processing.

Let’s take a look at the charts today.

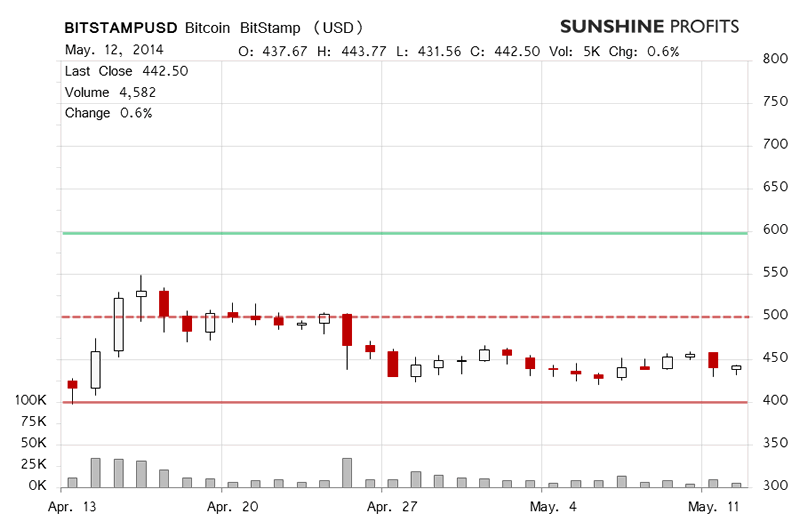

On BitStamp, Bitcoin went 0.6% up yesterday on decreased volume and it looked like the decline had paused but the short-term outlook was not changed, still bearish. Generally, the decline in volume could have been seen as a warning sign that a move up was possible but this was weakened by the fact that Bitcoin closed below $450 for the second day in a row.

Today, we’ve seen depreciation resume (this is written past 9:45 a.m. EDT) on potentially increased volume (the day is far from being over, though). This all looks like a possible step on the way down. The depreciation itself is not extremely strong, 1.1% at the moment of writing but the fact that we might see a third close below $450 makes things that bit more bearish for the short term.

If you recall what we wrote yesterday in our Bitcoin Trading Alert:

Bitcoin has been trading between $400 and $450 for more than two weeks now. It seems as though this period of stabilization might be a prelude to significant moves in Bitcoin. Based on the current short-term outlook, it seems that the next big move will be to the downside.

We’ve seen some of this depreciation today. In fact, our hypothetical position for BitStamp, first suggested in our alert on May 8 when Bitcoin was at $445, is already profitable with Bitcoin currently at $437.78.

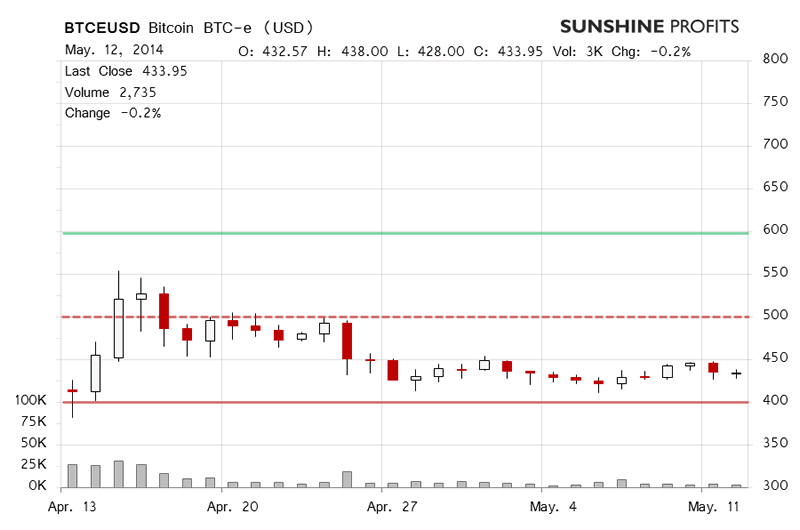

On BTC-e Bitcoin barely edged lower yesterday and the trading volume was lower than on the day before. This looked like a possible breather in a decline. The currency was still between $400 and $450 and the short-term outlook was bearish.

Today, trading activity might have ticked up (we still haven’t seen the daily close figure) but this hasn’t been accompanied by a visible move down. Bitcoin has lost 0.2% so far, which is hardly a move suggesting any sort of short-term outlook on its own.

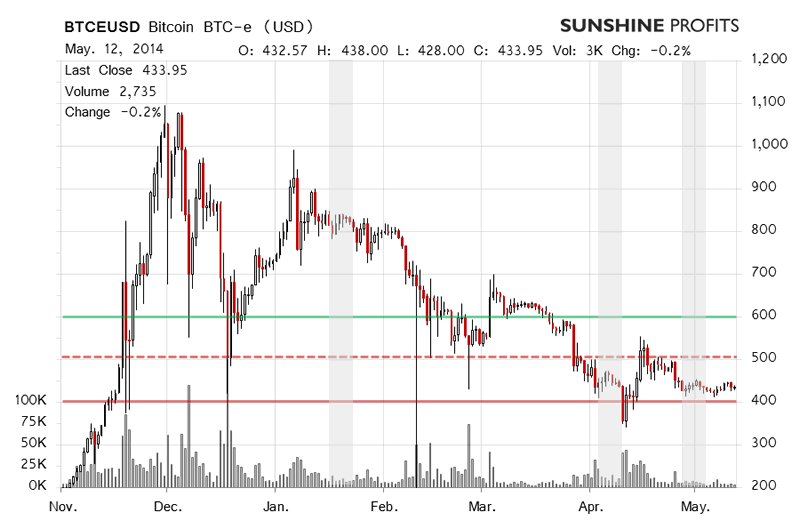

In the lack of a clear reading of the situation on BTC-e, we resort to another sort of analysis. We will look at situations in the recent past that were similar to what we see today.

The chart above presents a longer time perspective than the charts we usually post in our Bitcoin Trading Alerts. Recently, we’ve seen a move up, not a very strong one but still and this move was followed by depreciation erasing most of the previous gains and then by an inconclusive close. Similar developments have been marked in grey on the above chart. We have one such case in January, one in April and one at the turn of April and May. All of these cases were followed by further depreciation, stronger (April) or weaker (April/May) but we didn’t see a decisive move up in any of these cases. If we assume that nothing has changed in the market since January, this analysis partly reinforces the bearish short-term outlook and might help clear up the muddled signals coming from BTC-e.

Consequently, we still stick to our opinion that short speculative positions might be the way to go now.

Summing up, in our opinion short speculative positions might become (even more) profitable in the near future.

Trading position (short-term, our opinion): short, stop-loss $470. We would expect to see a stronger move down in the near future.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.