America Will Go Dark... Unless These Companies Come to the Rescue

Companies / Electricity May 13, 2014 - 03:08 PM GMTBy: Money_Morning

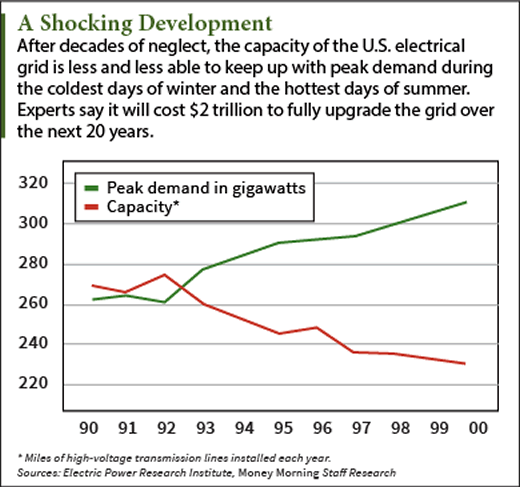

David Zeiler writes: Over the next two decades in the United States, it’s going to cost $2 trillion to keep the lights on.

David Zeiler writes: Over the next two decades in the United States, it’s going to cost $2 trillion to keep the lights on.

We’re talking about repairs and upgrades to the nation’s electrical grid, which means some of the best stocks to buy now are the companies that do that sort of work.

The situation is dire. After decades of neglect, we’re depending on an electrical grid that has components a century old or more – and much of the rest is based on antiquated technology. The grid is fragile and prone to failure – it’s downright scary.

But from an investing standpoint, this is ideal.

The nation has no choice but to spend the billions it will take to ensure that the U.S. electrical grid remains reliable and has sufficient capacity to power our homes and businesses.

It’s not an exaggeration to say our very civilization depends on it.

Before we get to the stocks to buy, here are a few points that show just how severe this problem has become – and why the nation will spend whatever it takes to fix it.

America’s “D+” Electric System

A 2013 report on the state of America’s infrastructure by the American Society of Civil Engineers (ASCE) gave the nation’s electrical grid a lowly D+.

“Aging equipment has resulted in an increasing number of intermittent power disruptions, as well as vulnerability to cyber attacks,” the ASCE report said. “Significant power outages have risen from 76 in 2007 to 307 in 2011. Many transmission and distribution system outages have been attributed to system operations failures.”

At the same time, the tired old grid is getting even more stress as demand for electricity rises along with the population. The U.S. Energy Information Administration has estimated that electricity demand will increase 8% to 9% by 2020.

One issue that has already exposed the weakness of the grid is how it performs at times of peak demand.

“We plan our system around the extremes, when people are trying to use electricity in extremely cold weather or extremely hot weather. That’s when the system has to be able to operate, and operate very well,” explained Nick Akins, Chief Executive Officer of American Electric Power Company Inc. (NYSE: AEP) in an appearance on Fox Business’ “Opening Bell” program. “The polar vortex showed us that during those periods it was very important for us to make sure that we are able to satisfy that demand, and it became very close as to whether we could do that or not.”

“We plan our system around the extremes, when people are trying to use electricity in extremely cold weather or extremely hot weather. That’s when the system has to be able to operate, and operate very well,” explained Nick Akins, Chief Executive Officer of American Electric Power Company Inc. (NYSE: AEP) in an appearance on Fox Business’ “Opening Bell” program. “The polar vortex showed us that during those periods it was very important for us to make sure that we are able to satisfy that demand, and it became very close as to whether we could do that or not.”

Further complicating matters is, ironically, America’s wealth of energy sources, from fossil fuels like coal, oil, and natural gas to nuclear to renewables like solar and wind. It’s not only a capacity problem; the technology of the electrical grid also needs to be improved so it can manage all these types of energy sources, particularly the intermittent nature of renewables.

“Our industry needs to spend $2 trillion over the next two decades just to refurbish the existing grid and put new resources in place,” Akins said. “Our industry is spending over $90 billion a year in doing that.”

Now here are five stocks to buy that are perfectly positioned to reap some of those profits…

The Best Stocks to Buy Now to Profit from Electrical Grid Upgrades

Many of the companies that will benefit from the upgrades to America’s electrical grid aren’t that well known, which for investors now is an advantage.

Both the problem and the companies that can solve it are off the radar screen of the majority of investors.

Check out these stocks to buy:

- Quanta Services Inc. (NYSE: PWR): Quanta is involved in oil and gas pipeline infrastructure as well as electric power infrastructure. The company had an earnings beat this week, reporting $0.44 a share when expectations were for $0.37. Out of 18 analysts, nine have a strong buy on Quanta, while seven rate it a buy. The one-year price target is $40.65. PWR closed Thursday at $34.01.

- Pike Corp. (NYSE: PIKE): Pike is closer to a pure play on the electrical grid. It offers comprehensive services, including engineering, design, and installation. One recent bullish sign for Pike was an uptick in insider buying. Of the seven analysts that cover PIKE, four rate it a strong buy and three a hold. The one-year price target is $11.80. PIKE closed Thursday at $8.62.

- Goldfield Corp. (NYSE: GV): Goldfield is focused mainly on electrical construction, but also has a real estate arm. Goldfield is a relatively small company (with a market cap of just $53.45 million), so if it can capture just a small part of the flood of spending on the electrical grid, it could have a big impact on the stock. No analysts follow Goldfield at this time. GV closed Thursday at $2.10.

- MYR Group Inc. (Nasdaq: MYRG): MYR is a holding company that specifically serves the electrical infrastructure market in the United States. This company is particularly well-positioned to benefit from a surge in grid infrastructure spending, as it has $63 million in net cash and no funded debt. Out of 11 analysts, five rank MYRG a strong buy, two a buy, and four a hold. The one-year target price is $27.88. MYRG closed Thursday at $22.76.

- Cisco Systems Inc. (Nasdaq: CSCO): Some may be surprised to see a tech giant like Cisco on this list, but the company’s long history as the primary supplier of networking equipment for the Internet makes it an excellent candidate to benefit from the upgrades to the electrical grid – which is, after all, a high-tech network. Cisco in particular could be a leader in smart grid technology. As far back as 2009, CEO John Chambers was saying that this project could end up being a bigger business than the Internet build-out. While this is a less risky play than the other stocks on the list, Cisco won’t get as much kick as the others out of the money spent on the grid. Of the 41 analysts that cover CSCO, eight rate it a strong buy, 14 a buy, and 16 a hold. The one-year price target is $23.84. CSCO closed Thursday at $23.02.

Were you aware of the state of the nation’s electrical grid? How much do you think the companies we’ve listed here will benefit? Tell us on Twitter ;@moneymorning or Facebook.

One of the biggest roadblocks to building a truly smart electrical grid is close to being solved. This breakthrough has been called the “holy grail” of energy. And this company holds the key…

Source : http://moneymorning.com/2014/05/13/the-feds-growth-b...

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.