What’s Going on With the U.S. Dollar

Currencies / US Dollar May 12, 2014 - 09:06 AM GMTBy: Jonathan_Davis

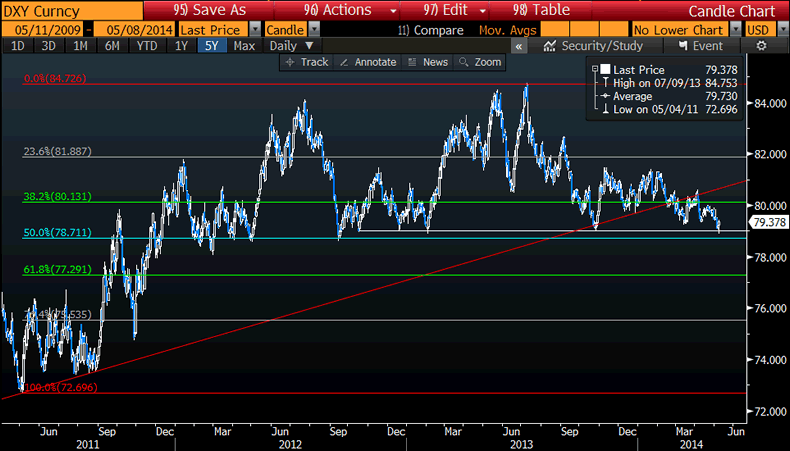

The below is the index of the US $ against a basket of currencies, such as € (c 58% of index), £, CAN$, CHF (Swiss Franc) and Japanese ¥ and (strangely) Swedish Krona.

The below is the index of the US $ against a basket of currencies, such as € (c 58% of index), £, CAN$, CHF (Swiss Franc) and Japanese ¥ and (strangely) Swedish Krona.

As you can see the US$ was in confirmed uptrend from the all time low in 2011 to last Summer (red diagonal line indicates).

However, since last Summer the $ has fallen to the White horizontal support line. This has been support – from where it bounced several times – during the last 2 years.

Curiously, the $ rose sharply on Thursday and Friday just gone. Is the bounce sustainable?

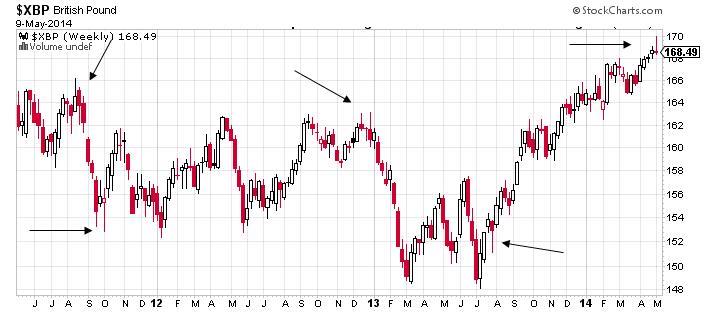

As Sterling based investors what has this meant for the $ : £ relationship?

The above shows the £ : $ price. You will see the £ has risen strongly since last Summer… as the $ has been weak, generally.

As far as we can see the media says the £ has been strong because the UK has higher growth right now than the US.

Maybe. More likely, it is because the US$ has been weak, rather than the £ has been strong.

So, if you ask me where is the £ v $ going? I cannot say. What I can say is the following:

1. The US $ is sitting, right now, at multi year support from which it has bounced several times.

2. The £ : $ shows a weekly bar (candle in the jargon) last week which showed the £ rose strongly but ended the week on a low, near where it started the week. Such a candle, with a top or bottom wick has previously indicated a change of trend or confirmation of new trend, as shown by the arrows.

3. If the $ breaks below support then that’s probably it – $ dying and £ to rise further.

4. If $ rises again off support then the opposite to #3.

The level of the US$ is normally important to the level of US share prices and global commodity prices.

By Jonathan Davis

http://jonathandaviswm.wordpress.com/

25+ year veteran of the world of financial services, the last 10 doing the same thing under his own name. We work with families all over the UK and in Switzerland and, indeed, on 2 other continents. If interested in our Wealth Management work, cast a glance at the firm’s website.

From time to time media folk call me and ask me to rant live or in the press. JD in the media.

I don’t buy hype. I don’t believe it’s the end of the world but I do believe, within a generation, the West will have no welfare state. The maths don’t lie. We’re toast. It’s obvious if you think about it.

© 2014 Copyright Jonathan Davis - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.