Why the Stock Market Could Rise 74% in the Next Three Years

Stock-Markets / Stock Markets 2014 May 11, 2014 - 06:45 PM GMTBy: Investment_U

Marc Lichtenfeld writes: We had a bit of a scare in the markets last month. At one point, the S&P 500 fell more than 4%, causing some permabears to proudly proclaim that the "bubble" had burst.

Marc Lichtenfeld writes: We had a bit of a scare in the markets last month. At one point, the S&P 500 fell more than 4%, causing some permabears to proudly proclaim that the "bubble" had burst.

Of course, they're not quite so vocal now that the market has rebounded and is back within 1% of its all-time high.

As you know, we're not market timers at Investment U and The Oxford Club. But I believe this market has a long way to run before the bulls stop making money.

Market History

Although this bull market is getting mature, it is not ready for the rocking chair. The bull has now been around for 63 months. That's longer than nine of the 15 bull markets since 1871.

Surprisingly, though, it still has five more months to go until it is average in terms of length - and 41 months before it reaches the post-World War II average.

Bull markets have been getting longer since the end of the War - a lot longer. Starting with the bull that began in 1949, bull markets have lasted an average of 104 months - or nearly nine years. That five-year old bull doesn't sound quite so old now, does it? Of the seven bull markets (including the current one) since then, this one ranks only fifth in terms of length.

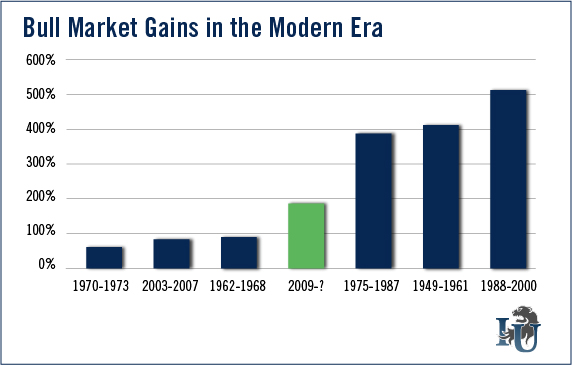

From the low in 2009 at 666.79, to the all-time high of 1,897.28, the S&P 500 has risen 185% - a heck of a move. That's above the 163% average since 1871. However, the modern bull market (since the end of WWII) has averaged 259% gains.

Interestingly, three bull markets gained less than 100% while the other three were up 391%, 414% and 516%, respectively. Could the fact that the current one broke through the 100% barrier mean that it's headed significantly higher?

If the market simply performed according to the average modern day bull market, it would last another 3 1/2 years and rise 74%.

Not Cheap, but Not Expensive

Many pundits call the market expensive at 17.2 times earnings. By historical bull market standards, it's not.

The historical average of the S&P 500 is 16.4. While the current market is not dirt-cheap, it's hardly in bubble territory.

The modern-day bull market on average doesn't top out until the price-to-earnings ratio (P/E) of the S&P 500 hits 21.3.

Applying the 21.3 P/E to trailing 12 months earnings gives us a price target of 2,322, or 22% higher than the all-time high reached last month.

Let's assume that I'm right and the bull market lasts another few years. We'll also assume that Wall Street's consensus estimates for the S&P are right on target. If we apply the 21.3 P/E to 2014 estimates we get a target of 2,510, a 32% gain.

In 2015, we'd be looking at an S&P 500 at 2,791, or 47% higher.

And using 2016's estimates, the S&P would stand at 3,101. A 63% climb from the all-time high.

And if the economy gets better, those earnings could wind up better than the consensus.

Don't Fight the Fed

Lastly, it's never a good idea to bet against monetary policy. And I expect the Fed to keep rates low for the foreseeable future.

Consider the economic statistics that were released last week.

First quarter GDP growth was a pathetic 0.1%. Granted, it was impacted by the severe weather that affected much of the country this winter. But still, it's a bad number.

The jobs data were a mixed bag. There were 288,000 new jobs created, which was positive. But wages did not increase and the unemployment rate fell to 6.3%, mostly due to the fact that more people gave up looking for jobs, so they were no longer counted.

Though the Fed has been tapering (buying back fewer bonds) by about $10 billion per month, it will likely keep interest rates low for a while.

The bond market certainly thinks so. Despite strong nonfarm payroll numbers, the lower unemployment rate and the near record highs in the market, the yield on the 10-year Treasury bond hit its lowest level in six months last Friday.

If you believe as I do, that markets are better predictors of economic events than economists, the bond market is telling you rates aren't going higher for a while.

So let the Chicken Littles, the permabears and the nattering nabobs of negativity tell you why the bull market is over. If history is our guide, the bull still has a lot more gains to give us.

Good investing,

Marc

Source: http://www.investmentu.com/article/detail/37270/bull-market-could-rise-74-percent

Copyright © 1999 - 2014 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.