How to Collect 4.4% Dividends in the Safest Country on Earth

Stock-Markets / Austrailia May 06, 2014 - 12:29 PM GMTBy: DailyWealth

Australia could be near-debt-free by the end the decade.

Australia could be near-debt-free by the end the decade.

It's nearly impossible to believe in our debt-fueled world. But it's true.

Last week, Bloomberg reported that Australia's national debt could "decline to just over 5% of GDP."

And Australia could sell assets and cut welfare spending to further reduce debt. This is from a country that already has the second-smallest debt burden among developed countries, according to Bloomberg.

In short, Australia is a safe place to put money to work. It is in great financial shape... and it is actively reducing debt – unlike the U.S., which continues to add trillions per year in new debt.

And importantly, we have an easy way to invest today... collecting a safe 4.4% yield in the process. Let me explain...

Money flows where it's treated best.

It's one of the oldest rules in finance. It's the simple idea that investment dollars tend to go where they have the best opportunity for returns, given the risk involved.

Today, your money is NOT treated best in the U.S. Instead, it's treated best in Australia.

Right now, you earn next-to-no interest on your U.S. dollars and euros in the bank. But you can earn nearly 2% in interest on your cash by simply holding Australian currency. That's unbelievable!

The same is true in the Australian stock market. Today, U.S. stocks pay a dividend yield of just 2%... a paltry sum compared to the 4.4% you can earn in Australian stocks.

So I expect Australia to thrive as money continues flowing into it. Plus as I said above, because of the country's low debt, it's a safe place to put money to work. The best – and easiest – way to take advantage is through the Australian stock market.

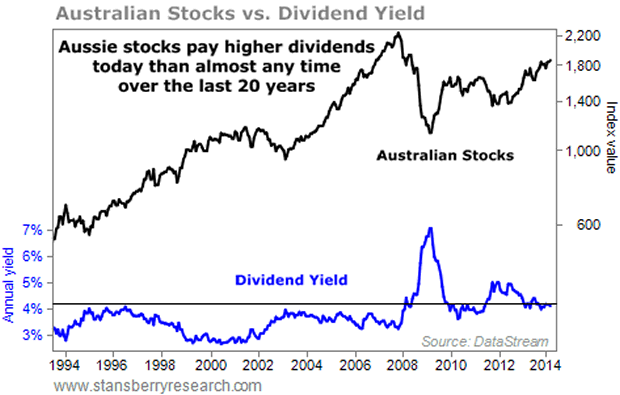

Take a look at the chart below. It shows the 20-year history of Australian stocks and their dividend yields. As you can see, today's dividends are near all-time highs (excluding the financial crisis)...

Over the last 20 years, Australian stocks paid an average dividend yield of 3.8%. But right now, the iShares MSCI Australia Index (EWA) pays a 4.4% dividend. EWA is a simple fund that tracks the Australian stock market.

That means you can buy these stocks for a 10%-plus discount, based on dividends. Not to mention that it's nearly impossible to lock in a safe 4.4% dividend anywhere else these days...

Money should continue to flow to where it's treated best... Over the next few years, money will be treated best in Australia. And with the country actively reducing its minimal debt load, the Australian stock market offers safety.

We have a great way to make the trade today with EWA.

Don't miss this opportunity to move cash into the safest country on earth... and earn a 4.4% yield in the process.

Good investing,

Brett Eversole

Editor's note: If you'd like more insight and actionable advice from Brett Eversole, consider a free subscription to DailyWealth. Sign up for DailyWealth here and receive a report on the five must-read books on investing. This report wills how you how all of the DailyWealth team's "must read" books, which will help you become a better investor right away. Click here to learn more.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.