Stock Market Elliott Wave Analysis - German DAX and S&P500

Stock-Markets / Stock Markets 2014 May 05, 2014 - 09:57 PM GMTBy: Gregor_Horvat

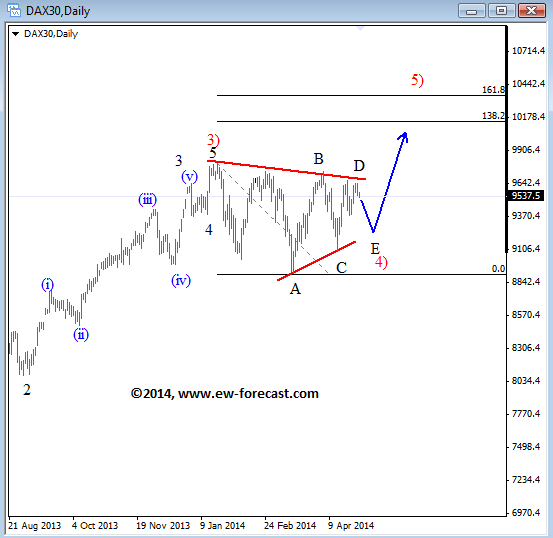

German DAX is still moving sideways within wave 4) which we think it represents a triangle. We see prices at the upper side of a range so ideally a downward retracement will follow in wave E to complete the pattern around 9200-9300.

DAX Daily Elliott Wave Analysis

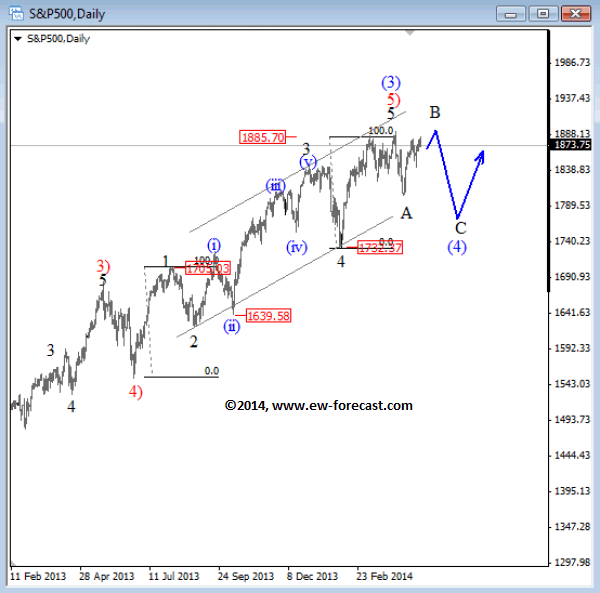

S&P500 has been in bullish mode since February but prices slowed down at 1880/1920 Fibonacci and channel resistance area, where we see zone for a completed fifth wave in red wave 5) of (3) after price fell to 1800 in April which suggests more weakness or maybe just sideways price action in current blue wave (4). Ideally makret will retrace in three legs back to 1732 in flat correction

S&P500 Daily Elliott Wave Analysis

Written by www.ew-forecast.com | Try our 7 Days Free Trial Here

Ew-forecast.com is providing advanced technical analysis for the financial markets (Forex, Gold, Oil & S&P) with method called Elliott Wave Principle. We help traders who are interested in Elliott Wave theory to understand it correctly. We are doing our best to explain our view and bias as simple as possible with educational goal, because knowledge itself is power.

Gregor is based in Slovenia and has been in Forex market since 2003. His approach to the markets is mainly technical. He uses a lot of different methods when analyzing the markets; from candlestick patterns, MA, technical indicators etc. His specialty however is Elliott Wave Theory which could be very helpful to traders.

He was working for Capital Forex Group and TheLFB.com. His featured articles have been published in: Thestreet.com, Action forex, Forex TV, Istockanalyst, ForexFactory, Fxtraders.eu. He mostly focuses on currencies, gold, oil, and some major US indices.

© 2014 Copyright Gregor Horvat - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.