May Decline in Gold and Silver Stocks Would Create Opportunity

Commodities / Gold and Silver Stocks 2014 May 02, 2014 - 02:56 PM GMTBy: Jordan_Roy_Byrne

Last week we noted that the gold and silver shares had formed a short-term rebound in response to an oversold condition. Yet we felt that the downtrend that originated from the hard reversal in March was still in effect. As we go to publish, the rebound appears to be petering out. Be aware that there is more potential downside in May. The good news is a decline in May will likely create a great buying opportunity at the end of the month and in June.

Last week we noted that the gold and silver shares had formed a short-term rebound in response to an oversold condition. Yet we felt that the downtrend that originated from the hard reversal in March was still in effect. As we go to publish, the rebound appears to be petering out. Be aware that there is more potential downside in May. The good news is a decline in May will likely create a great buying opportunity at the end of the month and in June.

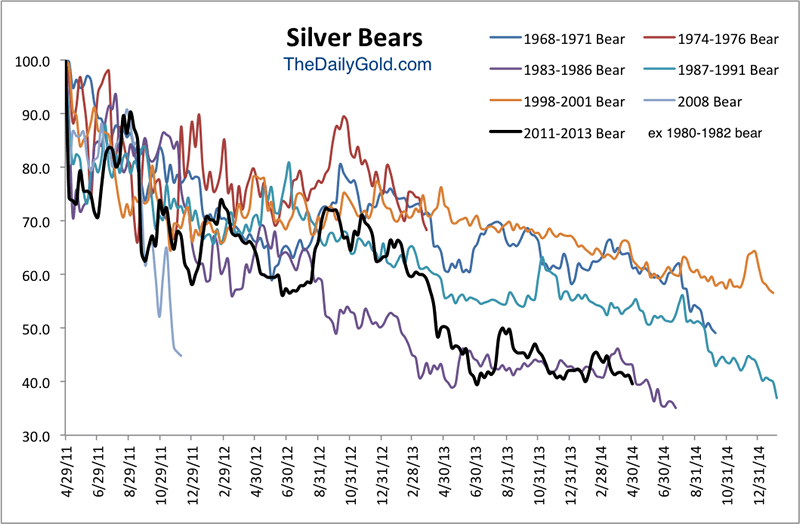

Let me start with the silver complex as its providing the most clarity. We wrote about the coming opportunity in Silver at the end of March. We posited that a break to new lows would likely mark the end of the bear market and signal an excellent buying opportunity. We derived that view from a few charts including the bear market analogs chart which is posted below. The chart (which excludes the 1980-1982 bear) makes a strong case that Silver should bottom sometime in the next four to eight weeks.

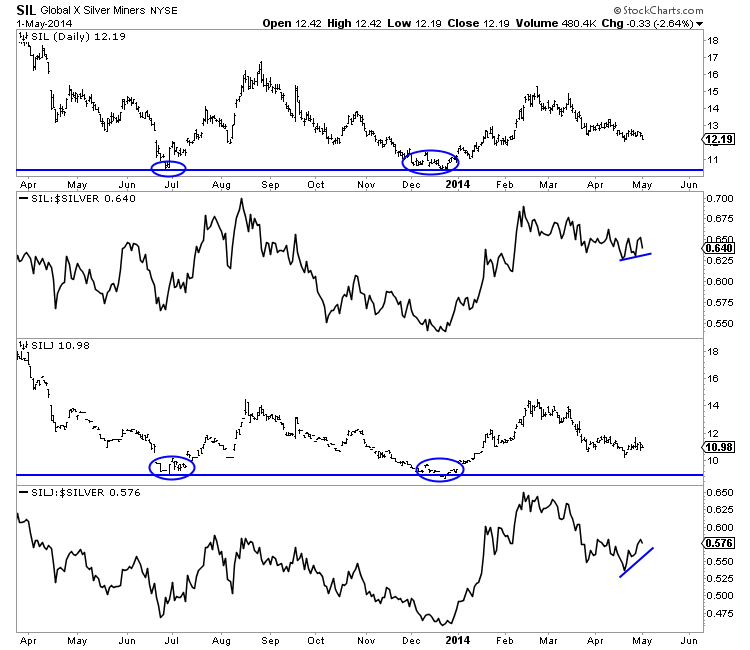

Though Silver has broken below its December 2013 low and is inches from a new bear market low, the silver stocks remain (at the moment) comfortably above their bear market lows. The chart below plots both SIL (seniors), SIL against Silver, SILJ (juniors) and SILJ against Silver. SIL would have to decline 14% to test its December low while SILJ would have to decline 19% to test its December low. The relative strength of the silver stocks amid a breakdown in Silver is a signal that a major trend change is developing.

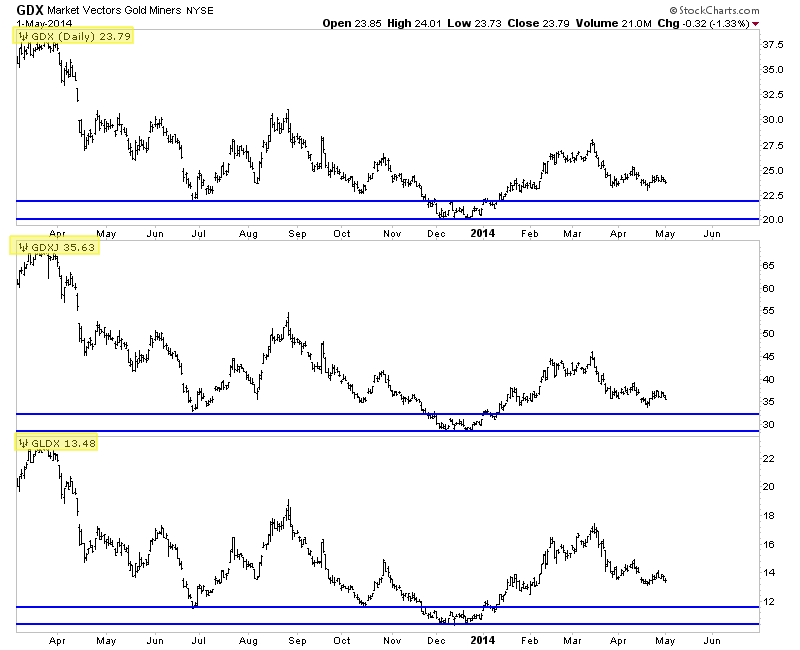

Unlike the silver stocks, the gold stocks haven’t had a chance to prove their relative mettle as Gold is a good $100 above its bear market lows. I reiterate that the gold indices likely bottomed in December. (I say indices because plenty of individual companies have already bottomed). GDX would have to decline 15% to test its December low while GDXJ would have to decline 19% and GLDX would need to shed 22% to test its low. There is a bit of room for these indices to decline but the closer they get to the December lows, the better buys they become.

The near term prognosis looks cut and dry. Until proven otherwise the short-term trend is down. If that is confirmed in the coming days then let these markets fall to strong support before buying. Also, silver and the silver stocks peaked first in the first half of 2011. Keep an eye on the silver complex as it could bottom ahead of Gold. In any case, be patient and let this potential selloff run its course which it could by early June. We are preparing to take advantage of further weakness in the coming weeks.

If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2013 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.