Bitcoin Price at the Beginning of a Move up?

Currencies / Bitcoin Apr 30, 2014 - 10:21 AM GMTBy: Mike_McAra

In short: we don’t support any short-term positions in the Bitcoin market at the moment.

In short: we don’t support any short-term positions in the Bitcoin market at the moment.

It looks like Mt. Gox’s creditors in Canada and the U.S., or at least those of them who took part in the class action lawsuits, have come to an agreement with potential investors. Today, Reuters posted a story according to which former Mt. Gox customers had agreed to settle the class action lawsuits in exchange for the 200,000 bitcoins found at Mt. Gox, $20 million in other currencies and, perhaps most importantly, for a 16.5% stake in a revived Mt. Gox.

This doesn’t mean that the exchange will come back as it was. Most definitely, it won’t. The idea is to use Mt. Gox’s name and former customer base to set up a new company conforming to all the basic rules of business activities. The idea had been pitched by Sunlot Holdings, a company with the backing of entrepreneurs and venture capitalists. Sunlot would assume the assets and liabilities of Mt. Gox for a symbolic payment of BTC1, distribute those assets to the creditors and restart Mt. Gox’s operations in a recast form using know-how of experienced finance professionals. Future revenues the company hopes to generate would help to repay more debt than would be covered by the liquidation procedure.

This is the theory. In practice, it is highly uncertain what kind of reception such a “restarted” exchange could enjoy. There is potential for future revenues but it is far from certain that the exchange would hit off.

Another possible hurdle, an even more important one for the time being, is the fact that dropping class action lawsuits in Canada and the U.S doesn’t mean that the bankrupt exchange won’t go into liquidation. Mt. Gox is a Japanese company and it is the Tokyo District Court that has legal authority over the exchange. Also, Canadian and U.S. customers are not the sole creditors of the company, so even if their voice expresses a possible course of action, it doesn’t necessarily speak for all the people who are owed money by Mt. Gox.

The decision is in the hands of the Tokyo District Court and Nobuaki Kobayashi, the attorney appointed as Mt. Gox’s administrator. If they see the efforts of creditors and potential investors as actions increasing the credibility of a revived Mt. Gox, they might change course and not liquidate the exchange. This is far from certain at the moment.

Now, let’s turn to the charts.

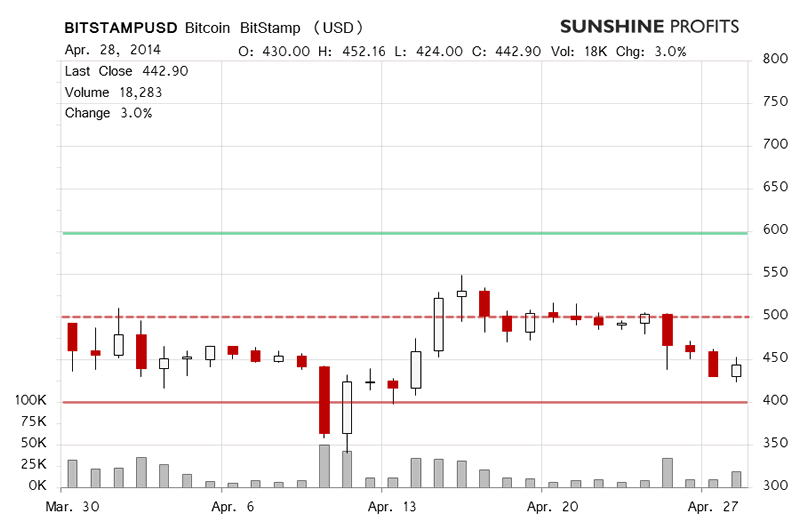

On BitStamp, Bitcoin gained 3.0% yesterday and the volume was almost twice as high as on the day before. This was a move up on increased volume – a development bullish on its own, but not necessarily in the context of the recent decline.

Today, more appreciation has followed and Bitcoin is up another 2.2% (this is written at 10:45 a.m. EDT). The volume, however, is down to the levels we saw in the two days before yesterday’s surge. Yesterday, in our Bitcoin analysis we wrote:

(…) Bitcoin has gone 3.3% up so far (this is written at 12:00 p.m. EDT) and the volume is already higher than it was yesterday. We don’t view this move up as anything more than a pause after a period of declines and expect to see some wrangling around $450 or a decline to $400 in the near future. The next days will probably help in answering which scenario will exactly happen.

What’s happening in the market is in line with what we wrote. Even though Bitcoin has moved higher today, it hasn’t gone visibly above $450 and the decrease in trading volume suggests that this move might be just a weak correction. Right now it seems that we’re see more fluctuations around $450 before the move down continues.

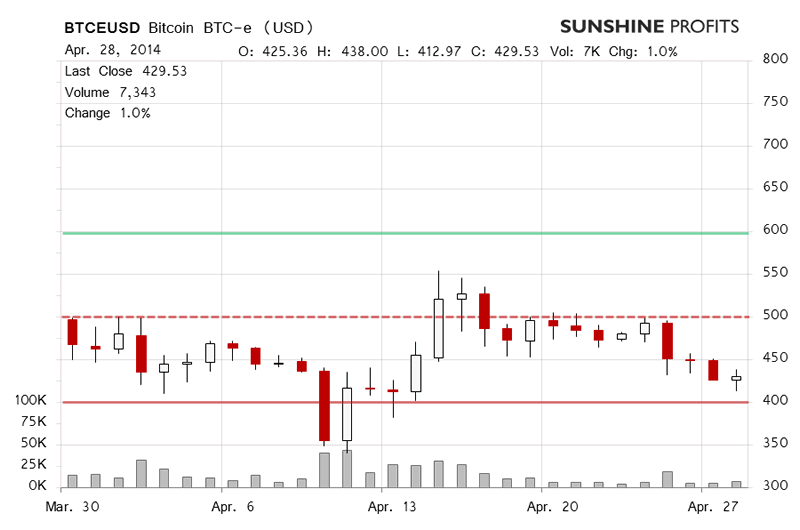

On BTC-e Bitcoin went up 1.0% yesterday on increased volume. The move was visibly weaker than on BitStamp – it could even be considered noise hadn’t we seen a stronger move up on BitStamp. The short-term outlook remained unchanged and bearish.

Today, there’s been a stronger move up, 2.4% but the volume is down. This move doesn’t read as anything more than a correction after the recent downswing. Again, the move has been weaker than on BitStamp and right now it seems that BTC-e is slightly less prone to swings in the value of the currency.

Based on the recent action, we would expect Bitcoin to go up and down around $450 before going down more decisively, perhaps to $400 or slightly below.

Summing up, in our opinion no short-term positions should be kept in the Bitcoin market now.

Trading position (short-term, our opinion): no positions. We’re waiting for signs of the short-term outlook deteriorating for Bitcoin.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.