Has The U.S. Dollar Lost its Safe Haven Status?

Currencies / US Dollar Apr 29, 2014 - 03:59 PM GMTBy: Axel_Merk

The greenback isn't what it used to be. At least for now, when there's a "flight" to U.S. Treasuries; historically a sign of "safe haven" demand; the U.S. dollar has not only not benefited but has increasingly been on the losing end. Is this a temporary sign of special circumstances or has the dollar lost its safe haven appeal? There may be profound implications for investor's portfolios seeking downside protection.

The greenback isn't what it used to be. At least for now, when there's a "flight" to U.S. Treasuries; historically a sign of "safe haven" demand; the U.S. dollar has not only not benefited but has increasingly been on the losing end. Is this a temporary sign of special circumstances or has the dollar lost its safe haven appeal? There may be profound implications for investor's portfolios seeking downside protection.

Let's get right to the point. A sour mood in the markets, often referred to as a "risk-off environment," may be associated with:

- Falling stock prices;

- Rising volatility;

- Rising U.S. Treasuries; and/or

- A rising U.S. dollar.

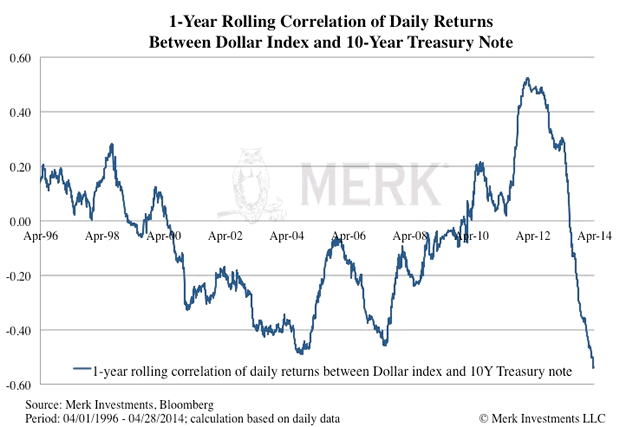

What we tend to forget is that the next crisis is likely to be "different" even as some warnings signs may be the same. As such, many myths have developed that in practice are at best oversimplifications; at worst, may lead investors to be incorrectly positioned for the next crisis. Today, we zoom in on the relationship between the U.S. dollar and U.S. Treasuries. The chart below shows a 1-year rolling correlation between the U.S. dollar index and 10-year Treasury Notes:

To make sure everyone understands this chart:

- Treasuries are rising (bond yields falling) when there's a "flight" into Treasuries.

- The dollar index is rising when the dollar is rising versus a basket of currencies.

- A positive correlation suggests that Treasuries and the dollar move in the same direction. On the days when Treasuries are risings the dollar index will rise as well. Similarly when Treasuries are falling the dollar index declines. In other words, when there's a "flight" into Treasuries on a typical risk-off day, it's associated with a flight into the greenback, out of foreign assets.

- A negative correlation suggests that Treasuries and the dollar move in the opposite direction. On days when Treasuries are risings the dollar index is falling, and when Treasuries are falling the dollar index is rising. In other words, when there's a "flight" to safety (Treasuries are rising), it's associated with a flight OUT OF the greenback. This could happen when domestic investors flock to the greenback, but foreigners prefer other assets.

The steep drop on the right hand side appears to suggest that the U.S. dollar is losing its safe haven appeal. Assuming you have recovered from looking at this chart sufficiently to to read on, let's take a deep breath and assess what this means. A couple of thoughts:

- The dollar "always" benefiting in times of crises - or at least when such crises are expressed in terms of U.S. Treasuries benefiting - is a myth.

- The myth of a "risk off" trade benefiting the U.S. dollar was reinforced in the aftermath of the financial crisis.

Looking more closely, one can't escape the surge up to until the summer of 2012, then the sharp selloff of late. A couple of thoughts:

- The mundane: we are measuring 1 year rolling correlation. Some event caused the correlation to surge; conversely, of late, that event is no longer part of the data set.

- The non-crisis crisis: Treasuries haven't been all that volatile of late. Striking, still, is that rather than moving towards a correlation of near zero (showing that there is no correlation), the correlation has plunged deeply into negative territory. It's possible that the greenback only benefits during a "real" crisis. Possibly in "subtle" crises, the greenback is not favored by investors.

- The real deal: the dollar index has a 56% euro weighting. It was in the summer of 2012 that Mario Draghi, the head of the European Central Bank, announced he would do "whatever it takes" to save the Eurozone. At the time we published an analysis entitled "Draghi's Genius" discussing what we said would be a turning point in the Eurozone debt crisis. And boy it has. The little flare-up in the chart above in early 2013, by the way, is the crisis in Cyprus. Despite some jitters in the markets (that's the flare-up in the chart), there was no longer the so-called "contagion" as risk was priced locally (please click here for a full analysis published at the time entitled "Chaos Investing Unplugged"). The chart above suggests the euro has become a true competitor to the greenback; at least for now.

It's possible that this reversal of fortune for the greenback is temporary. It may also be the proverbial canary in a coalmine; that you can't rely on the greenback any longer as the one "safe" place. Indeed, we have long argued that there may not be such a thing anymore as a safe asset and investors may want to take a diversified approach to something as mundane as cash. This chart appears to support this notion. Next time, we dive into more detail as to how currency risk affects your international investments.

Make sure you have signed up for our newsletter so you never miss a Merk Insight again. If you find value in our analyses please encourage your friends to sign up for this free newsletter, have them follow me on twitter, and/or post a link to this newsletter on your favorite social media site.

1. The ICE U.S. Dollar Index® (USDX) is a trade-weighted geometric average of the U.S. dollar's value compared to a basket of six major global currencies (euro, Japanese yen, British pound, Canadian dollar, Swedish krona, Swiss franc) set by the ICE (IntercontinentalExchange) Futures US. It is not possible to invest directly in an index.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.