Mainstream Financial Press - All The News That's Fit To Print in 2014

Politics / Mainstream Media Apr 27, 2014 - 06:06 PM GMTBy: Fred_Sheehan

The most astounding rubbish is spoken every day by central bankers and other commentators who hold a monopoly on what the public at large knows. Most of the New York Times column (below) in 1929 fits today and is worth more refection than the next hundred speeches by Federal Reserve Chairman Janet Yellen.

The most astounding rubbish is spoken every day by central bankers and other commentators who hold a monopoly on what the public at large knows. Most of the New York Times column (below) in 1929 fits today and is worth more refection than the next hundred speeches by Federal Reserve Chairman Janet Yellen.

To fill in some background to the Times article (many of these financial mutations have parallels in 2014 - and growing more so by the day), bank customers, both individuals and corporations, instructed the banks to lend their deposits to the call loan market. It has been estimated that corporations (including U.S. Steel, General Motors, AT&T, and Standard Oil of New Jersey) had lent $5 billion to New York Stock Exchange purchases by September 1929. These parties were drawn to the call loan market as rates rose to 10%. In consequence, total securities loans rose from $12.4 billion on October 3, 1928 to $16.9 billion a year later. As a reference, GDP in the United States, not yet calculated but estimated in retrospect, reached $99 billion in 1929.

One sentence in the Times article below requires discussion: "Barring the Wall Street money rates, everything seemed to be going well up to the middle of September." This may have been true, but the call-loan market did warn of severe distortions. This is always easy to say in retrospect.

Just a word on that. Financial calamities usually happen in busy times. It's hard to know how much weight to place on specific developments. There's a je ne c'est quoi in the air, that, by its very nature, leaves people "bewildered," as the New York Times proposes below.

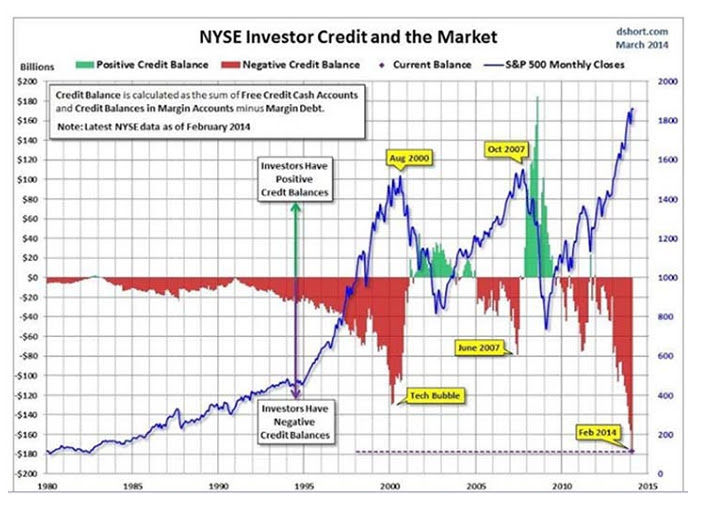

The "call money" distortions of today (see chart at bottom) terrifies some, but not many. Of course, the Federal Reserve (in 2014) has confiscated interest rates, which offer warnings and restrict the flow of lending into an overheated market. This is one more reason central-banking policy is an attack upon humanity.

New issues of securities averaged $5.8 billion between 1924 and 1928; issuance was $11.6 billion in 1929, a record that stood until the 1960s. Common stock issuance in 1929 was 10 times the average volume of 1924-1928. More ominously, the new issues in 1929 were dominated by investment trusts; these vehicles raised money - not to produce anything - but to buy common stocks. To add to the fire, investment trusts generally bought equity participation in companies on margin. With practically no money down, it is no wonder that new issues of common stocks in the month of September 1929 exceeded any previous year, except for 1928.

The New York Times, December 30, 1929, "Financial Markets" column: "Financial Markets: The Ending of a Remarkable Year - How it Appears in Retrospect":

The year that ends tomorrow is regarded now, and will be considered in all future financial reminiscence, with very much mingled feelings. Even the nation-wide speculating public, which has taken its losses, and at least in outward semblance, learned its lesson, will hardly end the year without a sense of bewilderment. Barring the Wall Street money rates, everything seemed to be going well up to the middle of September. Stocks should go higher when business prosperity increases in a striking way, and trade activity, even in the usually dull midsummer months, had reached a magnitude never witnessed in that season.

If prices for industrial products were not rising, profits were. The predicted increase of industrial company dividends had been realized. Few disturbing incidents had occurred in company finance, to suggest that the upward trend of earnings and dividends would not continue indefinitely. Yet this was the very moment selected by fate for a crash in Stock Exchange values quite unprecedented in history.

By people more familiar with past financial history than the outside public of 1929 has shown itself to be, it might be answered that it is precisely in such an hour of seemingly impregnable prosperity that the worst of our older financial crises have occurred. The disastrous deflation of 1920 began on the markets at a time when consuming power was apparently inexhaustible, when visible evidence appeared to be at hand that supplies were inadequate to meet demand. Long after 1907 it was angrily asserted that the October panic of that year could not have been a reasonable occurrence, considering the immense activity of trade and the very large company earnings which had prevailed in the preceding nine months.

The economic explanation of the seeming paradox, however, assigns the great increase of financial or industrial activity, just before the breakdown, as itself the cause for the collapse. On every occasion of the kind, abnormal stringency in the money market had warned, long before the 'panic month,' that credit was overstrained. When, in the face of that condition, activities of general trade or on the Stock Exchange were greatly increased and with them the demand for credit, the breaking-point was reached

Such contributory influences as withdrawal of foreign capital from Wall Street, last September and in 1907, were merely incidents. On none of these occasions did either Wall Street or the banks recognize at the time how extremely bad the situation had already grown; the most energetic effort had been directed to concealing or disguising its precarious nature. But the crash, when it came, was always violent in proportion to the extent by which previous speculation had over-stepped the mark.

In one respect the history of 1929 resembles that of 1920. The two years differ, in that the panicky collapse of nine years ago came in the immediate sequence to inflation of commodity values, whereas last Autumn's breakdown followed inflation of values only on the Stock Exchange. Otherwise the analogy is close. The preceding speculation had on both occasions been built on the basis of pure illusion; in each year the whole country seemed to be deluded into the notion that a new economic era had arrived, in which all old-fashioned economic axioms might be safely disregarded. In both 1929 and 1920 prices had been carried to previously unimagined heights. In both, it was insisted up to the last (even by serious businessmen), that they were destined to go vastly higher.

As a quite inevitable result, the forced readjustment when it came was more sweepingly violent on each occasion than financial imagination had considered possible. Last autumn's 50 percent decline in the average price of stocks surpassed all precedent; yet the average fall of 43 percent in average prices of commodities, between the middle of 1920 and the end of 1921, was almost equally unparalleled. If it seemed, last August, that the price of General Electric, for instance, could not conceivably fall 58 per cent in three months, so it was inconceivable in May of 1920 that wheat would in the next 18 months fall 70 per cent, to less than its pre-war average price. But the reckoning in both years measured with inexorable accuracy the scope of previous excesses.

Source: dshort.com

By Frederick Sheehan

See his blog at www.aucontrarian.com

Frederick Sheehan is the author of Panderer to Power: The Untold Story of How Alan Greenspan Enriched Wall Street and Left a Legacy of Recession (McGraw-Hill, November 2009).

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Frederick Sheehan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.