Stocks Bull Market Continues

Stock-Markets / Stocks Bull Market Apr 27, 2014 - 05:56 PM GMTBy: Tony_Caldaro

After a good rally last week, this week made a higher high then pulled back. For the week the SPX/DOW were -0.2%, the NDX/NAZ were -0.25%, and the DJ World index was -0.1%. Economic reports for the week were skewed to the upside. On the uptick: consumer sentiment, the monetary base, the WLEI, leading indicators, the FHFA and durable goods orders. On the downtick: the M1-multiplier, existing/new home sales, and weekly jobless claims were higher. Next week offers a plethora of economic data, including: Q1 GDP, monthly Payrolls and the FOMC.

After a good rally last week, this week made a higher high then pulled back. For the week the SPX/DOW were -0.2%, the NDX/NAZ were -0.25%, and the DJ World index was -0.1%. Economic reports for the week were skewed to the upside. On the uptick: consumer sentiment, the monetary base, the WLEI, leading indicators, the FHFA and durable goods orders. On the downtick: the M1-multiplier, existing/new home sales, and weekly jobless claims were higher. Next week offers a plethora of economic data, including: Q1 GDP, monthly Payrolls and the FOMC.

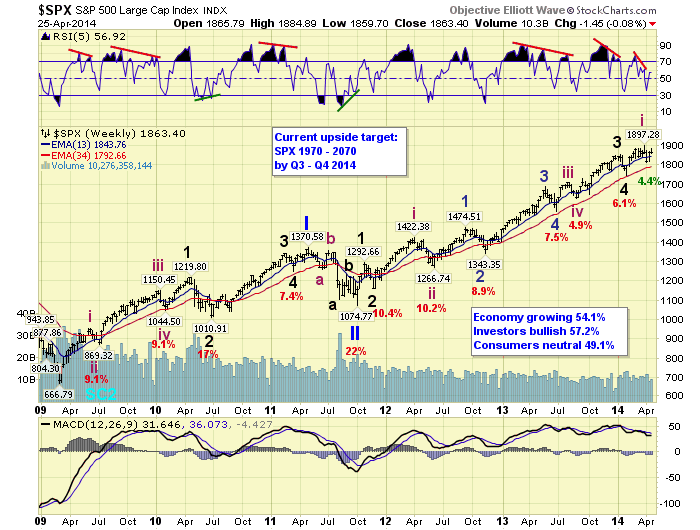

LONG TERM: bull market

Over the holiday weekend I had the chance to review previous bull markets. The objective was to compare SPX/DOW/NAZ bull market OEW wave patterns, looking for subtle wave characteristics. Reported some of the findings in Monday’s update, and posted a modified DOW count. After further consideration this past week I have decided to shift the DOW count to the SPX , since it is the preferred count. And, shift the diagonal count to the DOW, since it actually fits better with that index. The NDX/NAZ counts remain unchanged. This exercise, and refinement, is to track the important Primary wave III as it nears its conclusion. When it does conclude, the Primary IV correction that follows will likely be the largest since 2012 and in the area of 15% or more. A correction we all would certainly like to avoid.

The long term pattern remains unchanged. Primary waves I and II ended in 2011, and Primary III has been underway since then. When Primary IV gets underway it will probably bottom with the 4-year Presidential cycle low scheduled for this year. The last four Presidential cycle lows occurred in: July 2010, July 2006, October 2002 and October 1998. In each case they created the low price for the year. Then after Primary IV bottoms, Primary V should take the market to all time new highs.

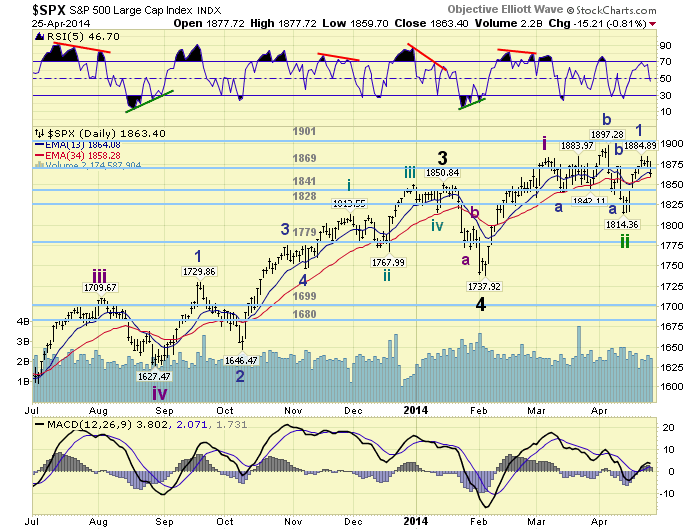

MEDIUM TERM: uptrend probable

After an uptrend, and all time, high at SPX 1897 in early April the market entered a downtrend which appears to have lasted only two weeks. Since the previous downtrend (1851-1738) only lasted three weeks, this short time period still fits. The NAZ uptrend and orthodox SPX high, however, ended in early March. So at the recent low, these downtrends could be considered about a month in duration. The rally off the recent SPX 1814 low had a choppy beginning, but then it rallied from 1816 to 1885 without one notable pullback. Since that high on Tuesday the market has had several notable pullbacks. Again led lower by the NDX/NAZ, just like during the recent correction.

We have tentatively labeled the SPX 1814 low as the end of Intermediate wave ii, and the recent high at SPX 1885 as Minor 1 of Intermediate wave iii. The current pullback should be Minor wave 2 of Int. wave iii. When it concludes the market should reach all time new highs during a Minor wave 3, and the uptrend should be confirmed. However, when taking into consideration the NDX/NAZ count, (two more uptrends to complete Primary III), and the seasonality characteristics of this bull market, (sideways to down in the spring), we can not totally rule out a diagonal Major wave 5 forming in the SPX too. We will see how this unfolds in the months ahead. Medium term support at the 1841 and 1828 pivots, with resistance at the 1869 and 1901 pivots.

SHORT TERM

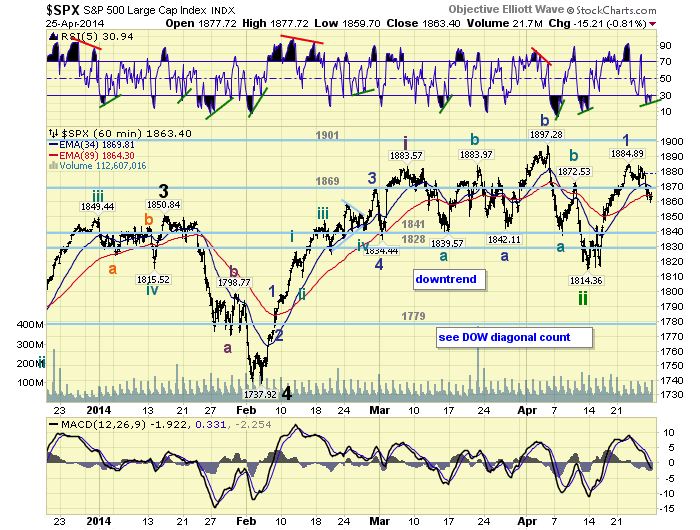

Short term support is at the 1841 and 1828 pivots, with resistance at the 1869 and 1901 pivots. Short term momentum is displaying a positive divergence at the close on Friday. The short term OEW charts are negative with the reversal level now SPX 1870.

The recent rally from SPX 1814/1816 started off with a positive short term divergence. After a choppy beginning, due to the continued selling in the NDX/NAZ, a very strong rally took the SPX to 1885. At that high short term momentum was extremely overbought, and the market started to pullback. We labeled that high Minor wave 1.

The pullback has been somewhat choppy: 1874-1884-1870-1883-1860. Normally one should expect a rally and then another pullback to a lower low to complete this complex pattern. However, Thursday’s quick surge to SPX 1884 could be the aberration in the pattern, as the market made a lower pullback low within the first half hour. This would suggest this simpler pattern: 1870-1883-1860. And, with the short term positive divergence on Friday it may have ended. Also of note, in recent weeks the 1880′s area has been general resistance, while the 1840′s area has been general support. So a continued pullback into the 1841 pivot range can not be totally ruled out.

FOREIGN MARKETS

The Asian markets were mostly lower on the week for a net loss of 0.8%.

The European markets were mixed for a net loss of 0.3%.

The Commodity equity group were mostly lower for a net loss of 1.8%.

The DJ World index lost 0.1% on the week.

COMMODITIES

Bonds remain in a downtrend but gained 0.1% on the week.

Crude appears to be in a downtrend and lost 3.8% on the week.

Gold may have recently bottomed near our $1260 support area, rising 0.5% on the week.

The USD has remained in a narrow trading range for quite a few months. During the past six years this has occurred 4 previous times. Every time has resulted in a breakout to the upside. The USD lost 0.1% on the week.

NEXT WEEK

Monday: Pending home sales at 10am. Tuesday: Case-Shiller and Consumer confidence. Wednesday: the ADP index, Q1 GDP (est. -0.7% to +1.0%), the Chicago PMI, and the FOMC statement. Thursday: weekly Jobless claims, Personal income/spending, PCE prices, ISM manufacturing, Construction spending and Auto sales. Friday: monthly Payrolls and Factory orders. The FED has its two day FOMC meeting Tuesday-Wednesday. Then FED chair Yellen gives a speech at 8:30am on Thursday. With all this activity this could be quite a wild week ahead. Best to your weekend and week!

CHARTS: http://stockcharts.com/public/1269446/tenpp

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2014 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.