Is U.S. Housing Ringing The Stock Market’s Bell Again?

Stock-Markets / Stock Markets 2014 Apr 26, 2014 - 05:23 PM GMTBy: Sy_Harding

It is said that they don’t ring a bell at stock market tops.

It is said that they don’t ring a bell at stock market tops.

However, the housing industry has sometimes been quite adept at doing just that. In fact, it has been quite prescient in leading the economy, and thus the stock market, in both directions.

The most obvious tops followed the bursting of real estate bubbles, such as in 1989, which led to the 1990-91 economic recession and 1990 bear market in stocks, and bursting of the housing bubble in 2006, which led to the 2007-2009 ‘great recession’ and bear market.

However, real estate bubbles are rare events.

There were less dramatic instances, like the 20% slowdown in new home sales in 1999, just prior to the stock market top in 2000, and the 30% decline in new home sales in 1980, followed by the 1981-82 recession and bear market.

So, is housing ringing its warning bell again?

Investors are hoping the economic slowdown in the winter months was entirely due to the dismal weather, and that a substantial recovery will take place with the return of normal weather.

That may be necessary to justify the potentially over-valued stock market conditions.

However, reports from the housing industry so far are not encouraging.

This week’s reports included that ‘existing home sales’ were down 0.2% in March, continuing the downtrend that began last summer, well before weather could be blamed.

More discouraging, ‘new home sales’ plunged 14.5% in March to an annualized pace of just 384,000, well below the consensus forecast of 450,000.

Also discouraging, after plunging from 56 in February to a dismal 46 in March, the confidence of homebuilders ticked up to just 47 in April, missing even the cautious consensus forecast of a recovery to 49.

Meanwhile, New Housing Starts were up 2.8% in March, to an annualized rate of 946,000. However, that significantly missed the consensus forecast for 990,000 new starts. In spite of the uptick, starts were still down 5.9% from a year ago, the biggest decline since April 2011, and permits for future starts fell 2.4%.

While we await further reports from the housing industry, I suggest investors keep an eye on the major homebuilders. The housing industry is frequently a leading indicator for the economy, and the stocks of the homebuilders are usually a leading indicator for the housing industry.

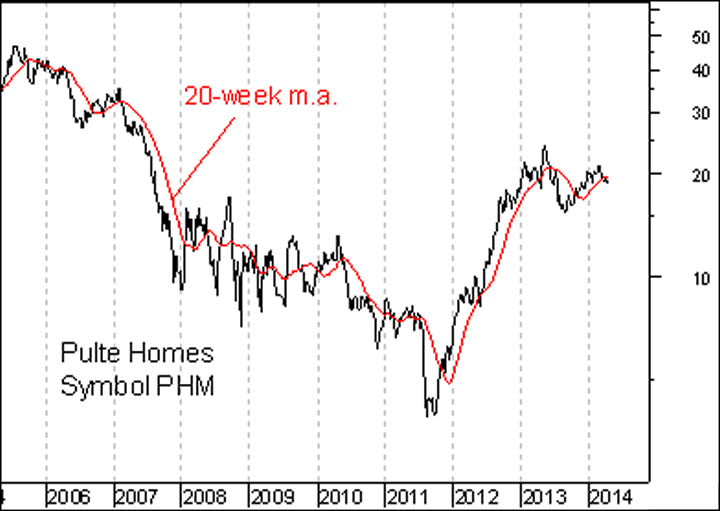

For instance, the major homebuilder stocks topped out in August, 2005, just months before the real estate bubble burst in 2006.

Did the homebuilder stocks possibly top out in May of last year, foreseeing the housing slowdown that is potentially underway this year?

The stocks of the homebuilders, like Pulte Homes (PHM), KB Homes (KBH), DR Horton (DHI), and Toll Brothers (TOL), may not only be indicators of whether the housing industry is again in trouble. If they confirm that by deteriorating much further they should be considered for potential short-sales.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.