U.S. Exports A Record Amount Of Gold To Hong Kong

Commodities / Gold and Silver 2014 Apr 25, 2014 - 04:41 PM GMTBy: Steve_St_Angelo

The figures are out and it looks like the United States exported a record amount of gold to Hong Kong in January. Not only was this a one month record... it was a WHOPPER indeed.

The figures are out and it looks like the United States exported a record amount of gold to Hong Kong in January. Not only was this a one month record... it was a WHOPPER indeed.

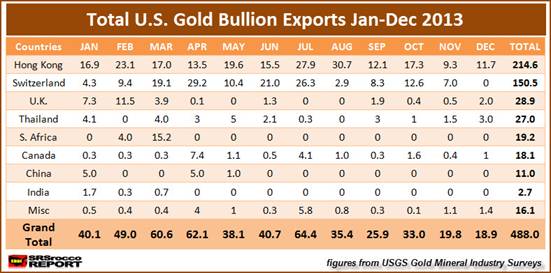

Last year, the U.S. exported a total of 215 metric tons of gold bullion to Hong Kong. This was not the total amount of gold exported to Hong Kong as some smaller quantities of Dore' and precipitates made their way into the country as well.

However, Hong Kong received more gold than any other country... Switzerland came in second at 150 metric tons. The table below shows the breakdown in U.S. Gold Bullion exports in 2013:

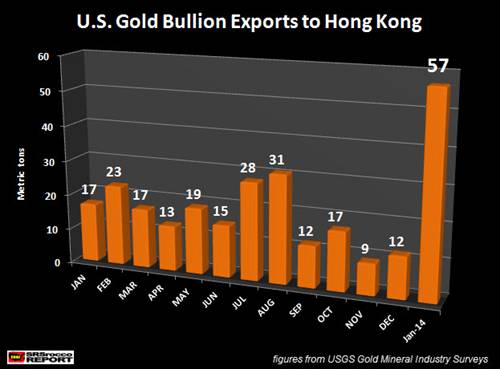

Here we can see that the highest month of gold bullion exports to Hong Kong was August at 30.7 metric tons (mt)... let's just say an even 31 mt. According to the data just released by the USGS, the United States exported a stunning 57 mt of gold bullion to Hong Kong in January.

Not only is this 3 times more gold exported than January, 2013 (17 mt), it was 84% more gold than the record month set in August (31 mt). As we can see, gold bullion is fleeing the U.S. and heading to the East. Again.. that 57 mt figure is just gold bullion.

Furthermore, total gold exports in January nearly surpassed the total hit in March of last year. Total U.S. gold exports in March, 2013 were 80.8 mt compared to 80.7 mt in January of this year.

This is where the majority of the remaining gold was exported in January:

Gold Bullion:

Australia 3.1 mt, Thailand 2 mt, Switzerland 1.5 mt & Singapore 1.0 mt

Dore' & precipitates:

Switzerland 10.6 mt, India 2.7 mt & United Arab Emirates 1.4 mt

As the West continues to play games with Monopoly money and Derivatives manufacturing, the East accumulates as much gold as it possibly can. While Main Stream Media and its Banker cohorts release bearish $1,050 price targets for gold, the Asians and Indians smile as they build the largest amount of gold stocks in the world.

I get a real kick at the degree of negative sentiment coming from many gold and silver investors. Who said this was going to be easy? It's simply amazing to watch a DIEHARD gold or silver bug become bearish and downright nasty now that times are tough.

However, this is exactly what the Fiat Monetary Authorities had in mind. Unfortunately, many have fallen for their plan... HOOK, LINE & SINKER.

GOD HATH A SENSE OF HUMOR.

Please check back at the SRSrocco Report as I will be providing a new REPORTS PAGE including my first paid report, THE U.S. & GLOBAL COLLAPSE REPORT. You can also follow us at Twitter at the link below:

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.