Gold and Silver Stocks Begin Oversold Bounce

Commodities / Gold and Silver Stocks 2014 Apr 24, 2014 - 03:56 AM GMTBy: Jordan_Roy_Byrne

The bottoming process for gold and silver shares has been arduous as they’ve oscillated back and forth for almost a year. We noted a month ago that the failed breakout in March was strong evidence that an interim top was in place. Heading into this week it looked like the miners would fall further before finding support. However, over the past two days the sector clearly reversed its short-term course. For now this appears to be a rebound from an oversold bounce.

The bottoming process for gold and silver shares has been arduous as they’ve oscillated back and forth for almost a year. We noted a month ago that the failed breakout in March was strong evidence that an interim top was in place. Heading into this week it looked like the miners would fall further before finding support. However, over the past two days the sector clearly reversed its short-term course. For now this appears to be a rebound from an oversold bounce.

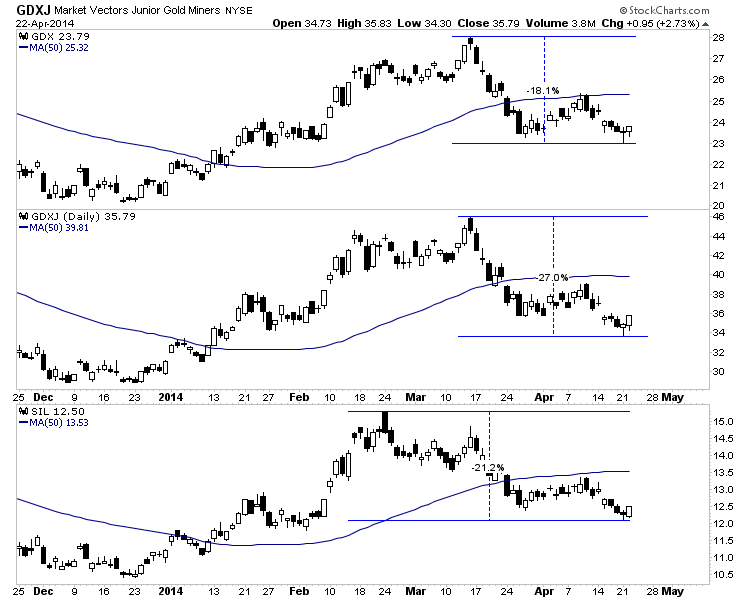

We plot GDX, GDXJ and SIL in the chart below. As of Monday’s low, the miners were very oversold in a small space of time. From recent highs GDX was down 18%, GDXJ 27% and SIL 21%. Thus the miners were ripe for a bounce. The bullish reversal on Monday coupled with confirmation on Tuesday signals that a rebound is underway. The initial upside targets are the open gaps from six days ago and the 50-day moving averages.

Is this low the right shoulder of a head and shoulders pattern and the low that springboards the sector to a sustained advance?

It is really difficult to tell. My gut says no. Most of the precious metals sector failed to rally all the way back to the 2013 summer highs. We previously noted, this in addition to the strong weekly reversal was a sign of weakness. It seems unlikely the market would begin a major move higher only a single month later. Thus, we think more weakness is possible after this rally. However, we always should keep an open mind when the outlook is uncertain.

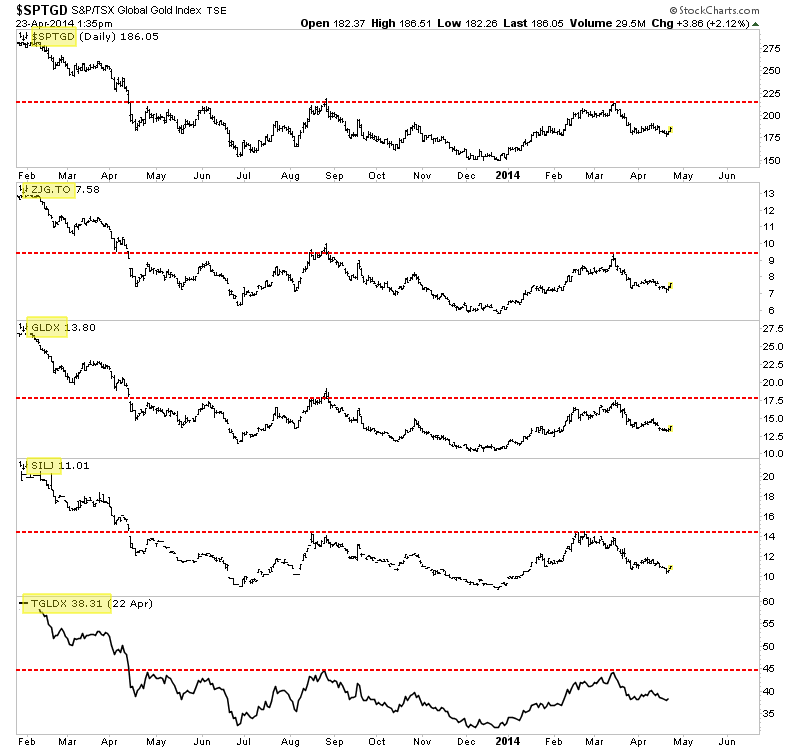

The chart below plots the strongest indices which includes Canadian indices such as the TSX Global Gold Index and ZJG.to (the Canadian GDXJ) as well as GLDX (explorers), SILJ (silver juniors) and TGLDX (Tocqueville Gold fund). While a right shoulder could be forming it appears that more time and consolidation could be necessary. The time between the left shoulder and head is about five and a half months. Translate that forward for the right shoulder and June could be apt for the next low.

We should be vigilant and note the various possibilities. Inflation is starting to creep higher, by the preferred indicators of the market. Last week the Labor Department reported that wages increased at the fastest pace in more than four years. Both the CPI and PPI accelerated from February to March. The WSJ reported that big banks are ramping up lending. Meanwhile, commodity prices (CCI index) broke out of their multi-year downtrend and have held firm close to 12-month highs.

The capital markets only care about the margin. Just a small sustained increase in inflation expectations could drive precious metals to confirm a bottom and the miners to begin a move that would break out of this long bottoming base. We are not saying this is imminent. We are thinking about what could be the driver of the future breakout in this sector. In the meantime, we sold all hedge positions yesterday and continue to actively research the sector for the absolute best opportunities. The next few months could be your last best chance to accumulate the companies poised to benefit from the coming revival in precious metals.

If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2013 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.