Inverse relationship between the Yen and SPX

Stock-Markets / Stock Markets 2014 Apr 23, 2014 - 12:45 PM GMT The daily SPX chart shows two Orthodox Broadening Tops in place. This is natural for fractals…yes, you are seeing double. This often happens with other formations as well. For example, smaller Head & Shoulders formations will appear within larger ones.

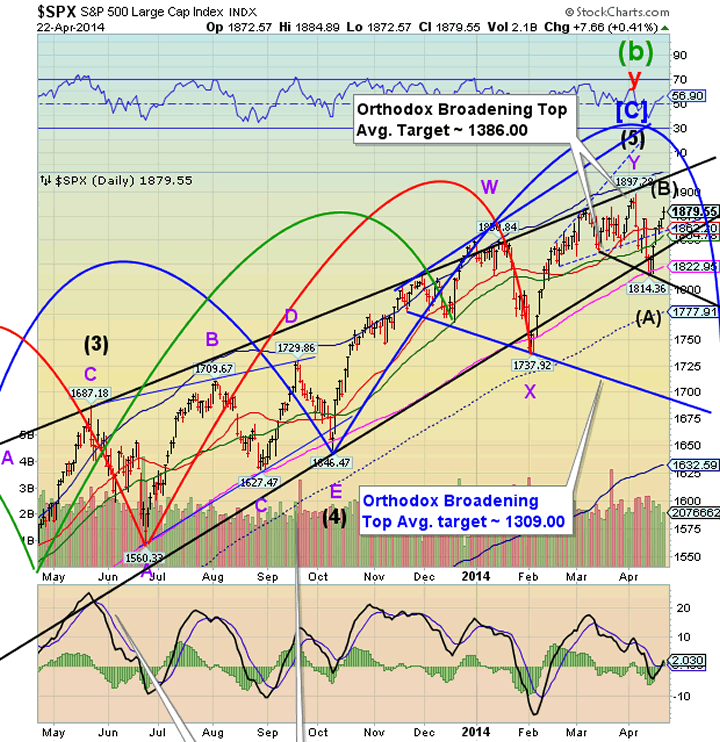

The daily SPX chart shows two Orthodox Broadening Tops in place. This is natural for fractals…yes, you are seeing double. This often happens with other formations as well. For example, smaller Head & Shoulders formations will appear within larger ones.

There are signs of weakness in these formations. The upper trendline of the blue Orthodox Broadening Top was overridden by the Ending Diagonal trendline, but it persisted in making a seventh point at 1897.28. Within that top is yet another Orthodox Broadening Top which may be failing as we speak. A failure to reach the upper trendline may be construed as a sell signal.

The Pre-market is modestly down. The rally appears to have run its course.

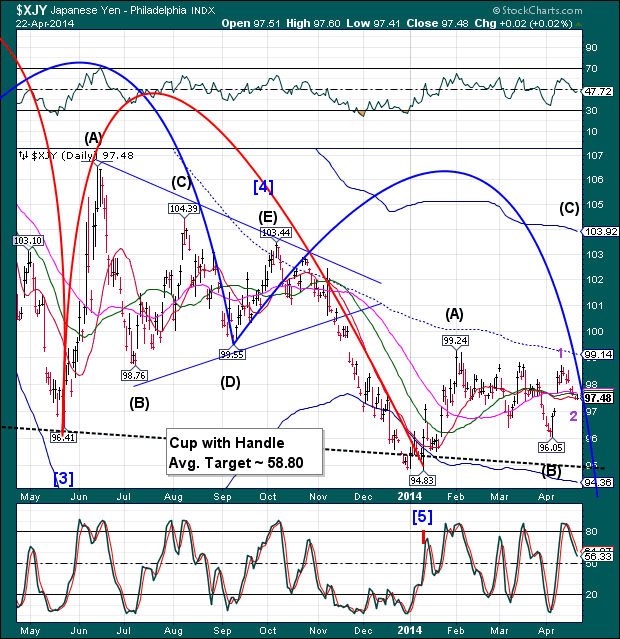

XJY closed at Short-term support last night and may be ready for another surge higher. Note that a declining Yen is indicative of monetary expansion which provides fuel to move markets higher. A rising Yen will have the effect of “pulling” money out of equities.

Nippon Life is increasing its Yen holdings in anticipation of currency appreciation.

ZeroHedge reports, “Keep an eye on the USDJPY which has had seen some rather acute "trapdoor" action in early trading and is approaching 102 after breaching its 55-DMA technical support of 102.38. If the support is broken here we go again on the downside. Keep an eye on biotechs and GILD in particular - if the early strength reverts into more selling again (after the two best days for the biotech space in 30 months), the most recent euphoria phase is now over.”

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.