The Dark Side Of The Silver Mining Industry

Commodities / Gold and Silver Stocks 2014 Apr 21, 2014 - 04:49 PM GMTBy: Steve_St_Angelo

There is an insidious Dark Side to the silver mining industry that goes unnoticed by the majority of investors and analysts. Actually, I haven't come across one mining analyst who puts out comprehensive data on this very subject for the silver mining industry.

There is an insidious Dark Side to the silver mining industry that goes unnoticed by the majority of investors and analysts. Actually, I haven't come across one mining analyst who puts out comprehensive data on this very subject for the silver mining industry.

According to my figures for 2013, the top primary silver miners suffered the lowest average silver yield ever. That's correct... another year of declining ore grades and yields.

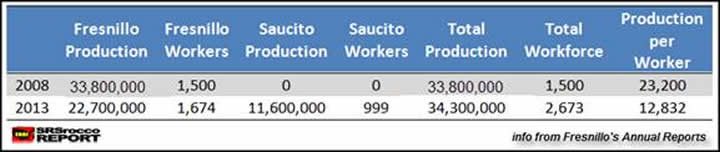

Looking at the chart below, the top 6 primary silver miners average yield for 2013 was 7.6 ounce a tonne (oz/t) compared to the 8.1 oz/t recorded in 2012. Thus, the top miners shed another half ounce of silver yield... falling 6% in 2013.

The top primary silver miners average yield declined 41% from 13 oz/t in 2005, to 7.6 oz/t in 2013. The top 6 mines and companies included in the chart above are BHP Billiton's Cannington mine, Fresnillo, Pan American Silver, Polymetal's Dukat & Lunnoye mines, Hochschild and Hecla.

Four of the mines suffered year over year declines while two actually increased yields. Here is the breakdown:

Change in Yield (2012-2013)

BHP Cannington mine = - 1.0 oz/t

Fresnillo mine = -1.2 oz/t

Pan American Silver = -0.3 oz/t

Polymetal = +0.6 oz/t

Hochschild = -0.4 oz/t

Hecla = +1.0 oz/t

Both BHP Cannington and the Fresnillo mine will continue to see their average ore grades decline in the next few years, however Fresnillo's silver grades should stabilize at 271 grams per tonne.

Hecla increased its average yield at its Greens Creek mine in Alaska by more than an ounce in 2013, which was the contributing factor pushing its average yield higher last year.

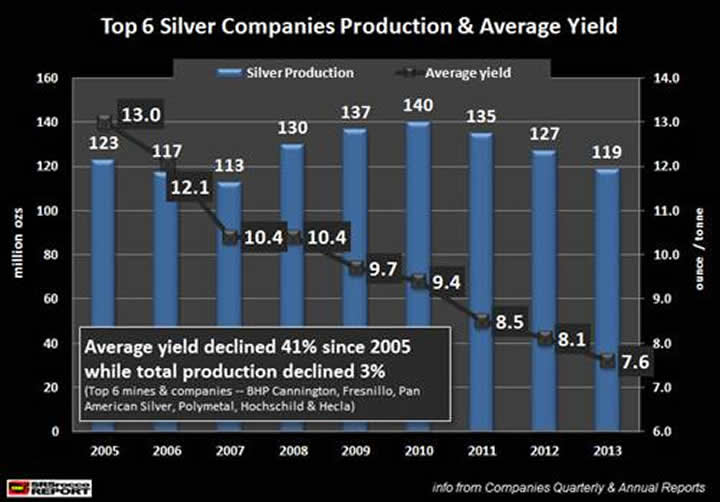

Declining ore grades are the Dark Side of the mining sector because the industry would rather not advertise its impact on the cost of producing silver. This next chart shows the increase in total processed ore since 2005.

Even though the average silver yield only declined 41% since 2005, the amount of processed ore increased 65% from 9.4 million tonnes in 2005 to 15.5 million tonnes in 2013. Not only has the amount of processed tonnage increased to produce less silver in 2013 compared to 2005... the costs of energy, labor and materials have doubled or tripled during the same time period.

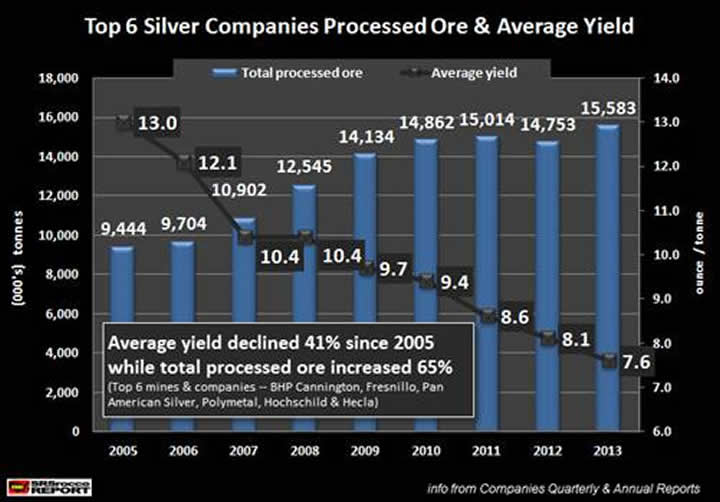

The negative impact of falling ore grades can be seen using Fresnillo as a perfect example. Fresnillo Plc only had one primary silver mine prior to 2009 -- its Fresnillo mine. Since then, it added another silver mine (Saucito) and several gold mines. The charts above present data from the Fresnillo mine only.

Adding Fresnillo Plc's Saucito silver mine, which started production in 2009, this would be the net result on average yields for these two operations:

From 2005 to 2008, the Fresnillo mine accounted for total production in this chart. In 2009, Saucito came online which is shown by the ramp up in total production from 2009-2011. However, total mine supply started to decline in 2012 due to Fresnillo's average yield and production falling sharply that year.

Even with production from both mines in 2013, the total was barely a million oz more than what the Fresnillo mine produced alone in 2005. Furthermore, it now takes the cost of running two mines to supply the same amount of silver in 2013 as the company did in 2005.

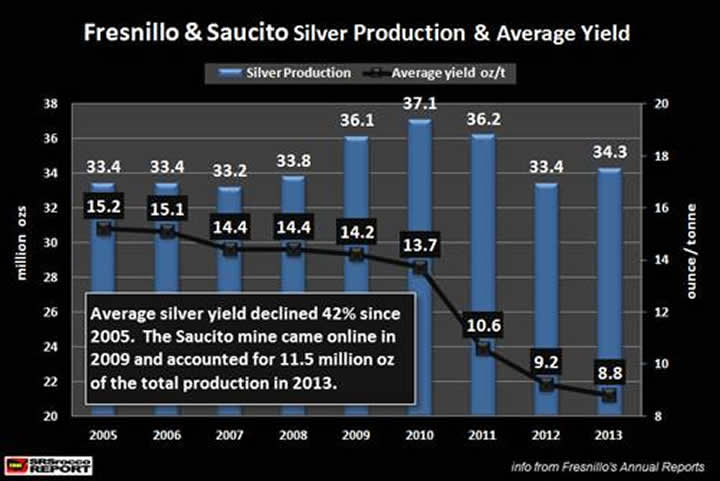

The table below shows the increase in workforce over a five-year time period from 2008 to 2013.

In 2008, Fresnillo had approximately 1,500 workers at its mine producing 33.8 million ounces of silver. I estimated the worker figure for 2008 as they offered no employee data in their 2008 Annual Report. According to their 2009 Annual Report there were 1,531 workers.

Now, if we look at the situation in 2013.. we see a much different picture. In 2013, the Fresnillo mine increased its workforce to 1,674 and Saucito had 999 for a total of 2,673. Thus, it now takes nearly 1,200 more workers to produce about the same silver in 2013 than it did in 2008.

Furthermore, the type of workers at Fresnillo have changed in the past five years. In 2008, the Fresnillo Mine had 894 employees and 637 contractors working at the project. By 2013, the number of employees grew 13 to 907, while its contractors increased 130 to a total of 767.

Moreover, the Saucito mine has no company employees whatsoever... the 999 workers are all contractors. So, the amount of contractors working at these two mines are nearly double (1,766), compared to 907 company employees.

This is the new way of the mining industry.... utilizing contractors so the company isn't responsible for providing any healthcare or retirement benefits. You see, the mining companies are forced to make these kind of changes to keep costs from getting out of control.

Using Fresnillo as an example, the company added 1,200 more workers since 2009 to maintain silver production at the same level. In 2008, Fresnillo produced an average of 23,200 oz of silver from each worker, but by 2013 this figure fell to 12,832... nearly half.

Falling ore grades and yields are impacting all mining companies. It will become more expensive to produce silver in the future as ore grades continue to decline while costs of energy, materials and labor increase.

For those analysts who believe the price of silver is heading lower in the future... the falling yields and increased costs will prove otherwise.

Please check back at the SRSrocco Report as I will be providing a new REPORTS PAGE including my first paid report, THE U.S. & GLOBAL COLLAPSE REPORT. You can also follow us at Twitter at the link below:

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.