Stock Market Minor Correction Imminent

Stock-Markets / Stock Markets 2014 Apr 21, 2014 - 12:40 PM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Very Long-term trend - The very-long-term cycles are in their down phases, and if they make their lows when expected (after this bull market is over), there will be another steep decline into late 2014. However, the Fed policy of keeping interest rates low has severely curtailed the full downward pressure potential of the 40-yr and 120-yr cycles.

Intermediate trend - Failed to overcome resistance at the high. May have started an intermediate decline.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Daily market analysis of the short term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at info@marketurningpoints.com

MINOR CORRECTION IMMINENT

Market Overview

We have a two-tiered market! The strong indices consist of SPX and DJIA. The weak indices are Russell 2000 and NDX. There are others which fit in both categories, but I am only differentiating between some of the most widely followed indices. The weak indices made their all-time highs in the second week of March and the strong ones in the first week of April. Actually, DJIA only exceeded its 12/31/13 high by a fraction on that date so, in a sense, it could be considered the weakest index of all. But for our purposes, since we want to focus on the recent market action, we will put it in the strong category because it is conceivable (but by no means certain) that it and SPX could make new highs as the current rally unfolds. The weak ones, however, stand little chance of doing so. Most likely, they have already started an intermediate decline.

The heading of the previous newsletter warned about a short-term low. This week's says that we should expect a minor correction, probably starting on Monday. The fifty-point rally (which may have peaked on Friday) was the result of an oversold market and a bullish background: good economic reports, a speech by the Fed chair, a lessening of tension in Ukraine, and options expiration week. This bullish potpouri will not repeat itself this week and indicators are saying that we could experience a short-term top on Monday. "Minor" is a guesstimate based on the cyclic background for the next couple of weeks which should keep the market buoyant overall for that time period. After that, there is a good chance that the decline will resume.

Chart Analysis

Let's continue with our comparison of the SPX to the leading indicators. IWM and QQQ (proxies for Russell 2000 and NDX), and XBD all rallied approximately .382 of their entire declines which had taken them down to their 200-EDMA. On the way back up, they all found resistance just below their 89-EDMA.

Considering the 50-point rally of the SPX and the 400+-point rally of the DJIA, these three indices did not perform all that well. QQQ is looking to grab the prize for the weakest of them and closed practically unchanged on Friday. Looking at their indicators, the MACDs are all negative and in a downtrend, unable even to make a bullish cross in their moving averages in spite of the rally. It's going to take much more market strength to turn their trends back up and if they can't, their 200-DMAs will risk giving way on the next market decline.

I think that it is very important to acknowledge the weakness in these indices because they are among some of the best "leading indexes" and their poor performance probably reflects what we can expect of the entire market in the future.

We'll now compare their charts with that of the daily SPX chart (courtesy of QCharts.com).

The first thing that we notice is that SPX had a much stronger rally than any one of the above indexes. In fact, it rallied more than two-thirds of its previous decline while the others managed about one-third. That enabled it to break its minor downtrend line by a sizeable margin while the others still remain far below theirs.

I could go on with multiple other examples, but it would quickly become repetitious and boring. I have drawn several potential channels to define the downtrend of the SPX. The index has already broken out of its narrowest one and will most likely stop its current advance at the top line of its middle one. If the correction which we are about to start is not too weak, SPX will have a chance to challenge the top of the widest channel and, if successful, it could make a new high. Even if it does, it would not change my view that we may have started a meaningful market correction. What would change it is if the three indexes shown above started to gather exceptional strength. I do not expect that to happen!

I am not going to spend any more time on the daily chart, but will move on to the hourly chart (also courtesy of QCharts.com) to show you why a correction is expected.

By the time the decline ended, positive divergence was showing in the A/D indicator and SRSI was oversold. You could also say that MACD showed positive divergence by barely breaking its previous low. It took some volatile bottoming action before SPX could start its rally in earnest. The two initial attempts were stopped by overhead resistance at the previous lows and the third time was the charm. SPX kept going, breaking through its downtrend line -- as well as some important moving averages that had been penetrated on the way down -- all in one fell swoop!

By Friday's close, things were looking toppy. The day's action formed a structure that looks very much like a terminal pattern (ending diagonal); all the indicators had become overbought, and two of them (the A/D and the SRS) had already turned over in the proper sequence. The A/D is always first to warn that a reversal is coming (up or down), followed by the SRSI. MACD is always last, although advance notice is given by its histogram. In this case, the histogram dropped very close to the zero line, implying that the MAs are getting ready to make a bearish cross.

The price has also practically reached the top of the middle channel -- as well as the level of the previous high. This is where it should meet with resistance and traders already appear to be taking some profit. This is why the indicators have turned down.

Still, there is no sell signal. There is no valid trend line to break, but the pink MA does a pretty good job of substituting for one. With the price closing above that MA, it is still possible that Monday will see a little more buying before we have a reversal. After going beyond several phase projections, one remains at 1871 which, on the P&F chart, encompasses the distance between the two sides of the base. SPX may want to reach it as a final touch before rolling over.

Cycles

A short-term cycle high was expected over the week-end, so it could have topped on Thursday. If not, on Monday.

More important cycles are expected to top in the first couple of weeks of May. This would allow SPX time to complete its minor correction and resume its uptrend into that time frame.

Breadth

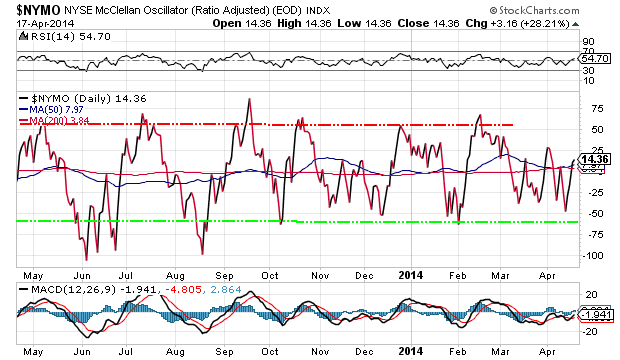

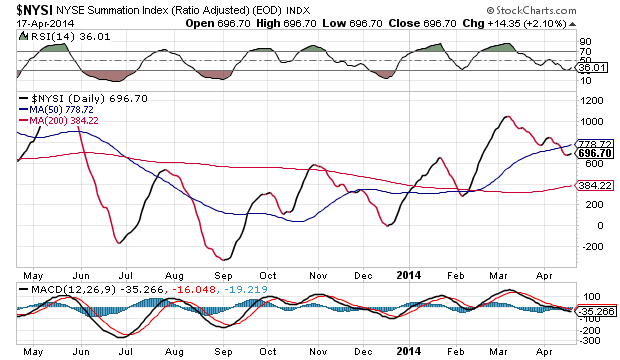

Below, we have the McClellan Oscillators and the Summation Index (courtesy of StockCharts.com).

After a month of relatively shallow consolidation the McClellan Oscillator has risen back to a slight positive which still gives it a neutral reading. If I am correct about the leading indexes being the precursors of a more protracted decline starting in the first half of May, we should not see too much strength in this indicator over the next couple of weeks.

NYSI has now started to turn up and will probably not achieve much of an upward extension over the next week since most of that should be taken by a minor correction which is not likely to produce positive readings in the A/Ds.

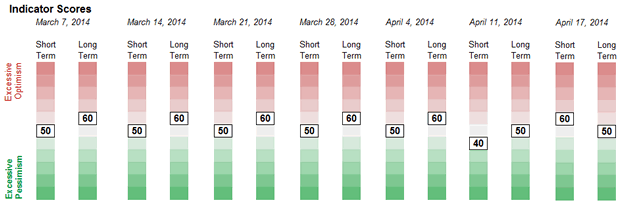

Sentiment Indicators

The SentimenTrader (courtesy of same) long-term indicator remains the same as last week, but the short-term one has moved closer to a reading which suggests that the market is now slightly overbought.

VIX (CBOE volatility Index) vs. VXN (NASDAQ volatility index)

The following charts (courtesy of QCharts.com) compare the VIX to the VXN. Recently, the VIX has tried a couple of times to start an uptrend but each time has failed, as not enough buying could be generated in the index or, conversely, not enough weakness could be generated in the NYA. The result is that the index has remained in a flat trading range. This is in contrast with the VXN which has already established the beginning of an uptrend as the NDX has had a much sharper decline. This is another way of showing the relative weakness of the NDX and of the NASDAQ to the SPX and NYA.

XLF (Financial ETF)

XLF is also a leading indicator for the market, but it is attuned to economic conditions while the other 3 (above) reflect other factors affecting the market which produce a more diversified bullish or bearish background. The XLF chart shows that it is not as weak as the NDX or Russell 2000, but neither is it as strong as the SPX and NYA. Let's see how it performs vs. these last two during the next 2 or 3 weeks.

TLT (20+-yr Treasury Bond Fund)

TLT is slowly attempting to re-establish an uptrend. Currently, it does not seem to have much predictive value for the trend of the equity market. In January, it rallied while the market declined. In the past week, it has rallied along with the market. TLT has now decisively overcome its 200-DMA and is aiming for the top of the corrective long-term channel where it will undoubtedly encounter resistance which could stop its advance -- at least temporarily.

GLD (ETF for gold)

After making a (sort'a) double bottom across a 25-wk cycle span, GLD had a decent rally which took it above its 200-DMA, but found resistance at its mid-corrective channel line and backed off, with prior lows and the 200-DMA now providing support. Very often, a longer-term cycle will divide into two equal segments. This could be what is happening here and GLD may still have a chance to find its second wind and attempt another rally before succumbing to the next cycle low in July.

UUP (dollar ETF)

That UUP did not decline to the bottom line of its corrective channel is a positive. Its first attempt at overcoming a downtrend line has failed and it is re-grouping at the former low. We'll see if it holds and develops a base for its next attempt at moving up. Even if it fails to hold that low, continuing to crawl just under the downtrend line is a sign that it will eventually break it.

USO (US Oil Fund)

For the past couple of years, USO has been trading in a broad, shallow channel whose lower trend line goes back to the beginning of the bull market. This channel has internal resistance lines which have previously stopped the advance of the index. After overcoming one at a lower level, USO has been stopped for the second time by the next higher one. The indicators suggest that this could have met with enough resistance to push it back once again, but let's give it a little more time to see if it can overcome that level.

Summary

After an 82-point correction, SPX has had a 50-point rally. NASDAQ and Russell 2000 have fared worse on the downside as well as on the upside. Since these two are considered to be reliable leading indexes, we have to conclude that this rally may only be a rally in a downtrend. However, since the cyclical configuration favors the upside for a bit longer, we should probably expect it to continue -- but only after a minor correction has taken place.

Since it is a corrective rally, we can probably say that the first wave concluded on Friday (or will do so on Monday), and that the second (down) wave is about to start. After the latter's completion, it should be followed by another uptrend wave which should come to an end -- as well as the entire rally from 1815 - in the early part of May.

FREE TRIAL SUBSCRIPTON

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: ajg@cybertrails.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.