More To U.S. Economic Slowdown Than Weather

Economics / US Economy Apr 18, 2014 - 10:04 AM GMTBy: Sy_Harding

The stock market has hung in there so far this year in spite of negative economic reports from December through February that indicated the economy was slowing significantly.

The stock market has hung in there so far this year in spite of negative economic reports from December through February that indicated the economy was slowing significantly.

Not that the market continued its winter rally. For 2014 so far, the Dow is down 0.9%, the S&P 500 is up just 0.6%, and the Nasdaq is down 2.2%.

Nevertheless, the market has continued to avoid the 10% correction that history says is overdue. Over the last 60 years, there has been a correction of 10%, or more, on average of every 18 months. It has now been 30 months since the last one (the S&P 500’s 19% decline in the summer of 2011).

Hopes are currently the main prop under the market, particularly hope that although the winter’s economic reports were ‘seasonally adjusted’, that the weather was so harsh that it had an unusual impact not handled by the seasonal adjusting, an impact that accounted for the economy’s problems.

It’s widely expected, or at least hoped, that economic reports for March and April will show a significant bounce-back that will confirm that assessment.

So far, the picture is not all that reassuring.

It is encouraging that the Thomson Reuters/ University of Michigan Consumer Confidence Index ticked up some, to 82.6 in April from its four-month low of 80.0 in March, and retail sales were up 1.1% in March, beating the consensus forecast of a gain of 0.8%.

However, manufacturing reports are mixed so far.

The Philly Fed Mfg Index rose to 16.6 in April from 9.0 in March, beating the consensus forecast of economists for an improvement to 10.0. But the Chicago PMI, measuring activity in the Midwest fell from 59.8 in February to 55.9 in March, well below the consensus forecast of 59. And the Fed’s Empire State (NY region) Index also fell sharply, to 1.3 in April from 5.6 in March.

Most troublesome though have been this week’s reports from the important housing industry.

There have only been two so far.

However, the Housing Market Index, which measures the confidence of home-builders, ticked up only to 47 in April from 46 in March, missing the consensus forecast of a recovery to 49, not showing much rebound after the big decline from 56 in February to 46 in March.

More troubling, new housing starts were up only 2.8% in March, to 946,000. That missed the consensus forecast of economists for a bounce back to 990,000 by a substantial amount. In spite of the increase, starts were still down 5.9% from the year earlier period, the biggest decline since April 2011. Meanwhile, permits for future starts fell 2.4%.

More than anything else, the economy and stock market need to see the housing market recover, since it has a strong history of leading the economy in both directions, up into boom times, and down into recessions.

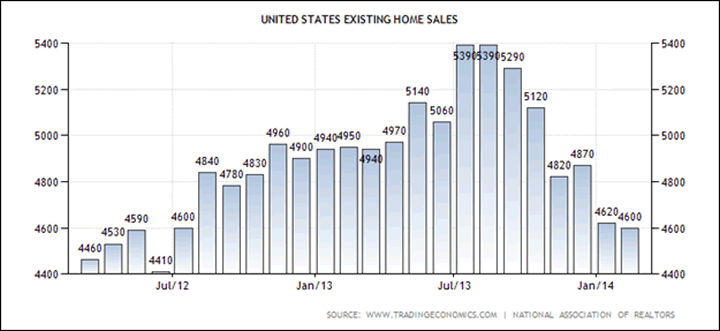

Unfortunately, it may take some doing to have housing recover from its slowdown. It began stumbling last summer, when mortgage rates and home prices began rising, well before harsh winter weather could be blamed.

United States Existing Home Sales

So the jury is still out on how much of the economic slowdown in the winter months was weather-related, particularly in the important housing industry.

The sideways action of the market over the last six weeks indicates investors are cautious. They should remain so, at least until there is more convincing evidence that the winter’s economic slowdown was due only to the weather.

Meanwhile, the market remains overvalued, and overdue for at least a 10% correction, with the end of its favorable seasonal influence approaching, and in the second year of the Presidential Cycle, which since 1934 has experienced an average decline of 21%, usually in the second and third quarter of the year.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.