Gold - Coming Super Bubble

Commodities / Gold and Silver 2014 Apr 17, 2014 - 10:50 AM GMTBy: Casey_Research

By Louis James, Chief Metals & Mining Investment Strategist

By Louis James, Chief Metals & Mining Investment Strategist

In many of my conversations with legendary speculator Doug Casey since the crash of 2008, Doug has talked about a coming super-bubble.

Everything Doug has studied about human nature, history, and economics—from Roman times right up to the present—has him absolutely convinced that the global economy is headed for high inflation, with a very real potential for hyperinflation in the US.

Ben Bernanke's panicked deployment of squadrons of cash-laden choppers has been emulated around the world. The Bank of International Settlements estimates that global debt markets now exceed $100 trillion.

The laws of economics—maybe even physics—say that this inflation, whenever it arrives, must have consequences… and that those consequences cannot be avoided forever.

The easiest consequence to predict, and the one we're betting heavily on, is that the price of gold will move higher. Much higher. That move will in turn ignite a bubble in gold stocks and, as Doug likes to say, a super-bubble in junior gold stocks.

Jeff Clark, editor of our BIG GOLD newsletter, recently illustrated what such a super-bubble can look like, citing figures from several historic bull markets. I hesitate to repeat any of his figures because the right junior stocks' gains when the market goes bubbly are, frankly, hard to believe. However, it is a fact that quite a few junior stocks achieved the much-vaunted 10-bagger status (1,000% gains) in previous bubbles, and some even returned 100-fold.

Here’s the essential reason why junior mining stocks are Doug's favorite speculations.

Let's start at the beginning: Doug's mantra is that one should buy gold for prudence and gold stocks for profit. These are very different kinds of asset deployment.

It's particularly important not to think of gold as an investment, but as wealth protection. It's the only highly liquid financial asset that is not simultaneously someone else's liability. Every ounce of gold you physically possess is value in solid form—there is no short to your long. Come hell or high water, it is value you can liquidate and use to secure your needs. That's why gold is for prudence.

Gold stocks are for speculation because they offer leverage to gold. This is actually true of all mining stocks and, more broadly, of stocks in commodity-related companies; they all tend to magnify the price movements in the underlying commodity. But the phenomenon is especially strong in the highly volatile precious metals.

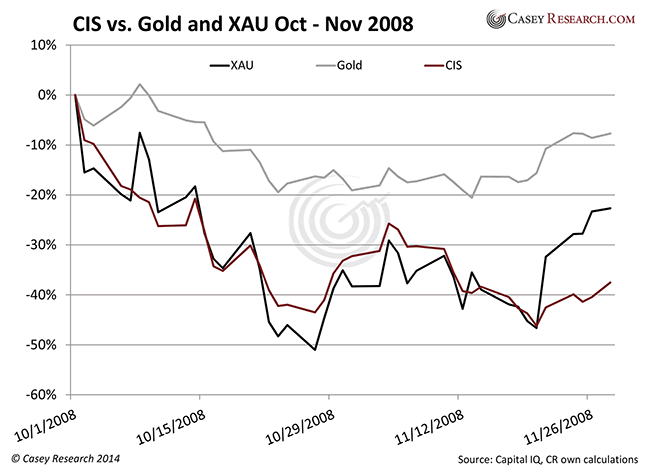

Allow me to illustrate—and in an effort to avoid seeming overly promotional, I'll show how gold stocks' leverage works on the downside as well as the upside. Bad news first: here's a chart showing how gold retreated during October and November of 2008, the worst two months of that year's crash for mining stocks. Also shown are an index of gold juniors and our own portfolio performance. This was, of course, a terrific time to buy, resulting in spectacular gains over the next two years.

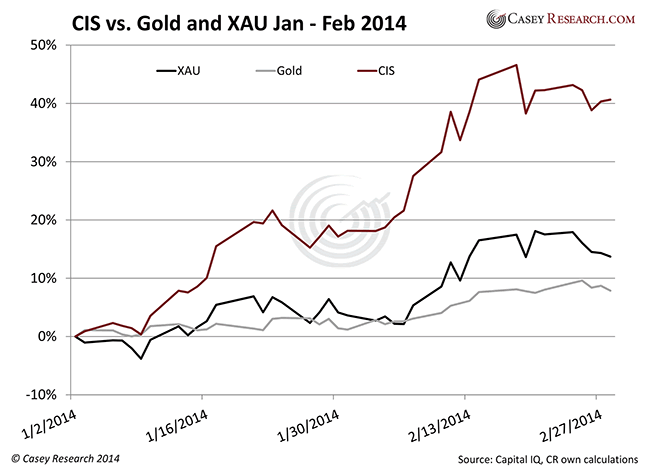

Now the good news: here's a chart showing the performance of the same three things in January and February of this year, which saw a major rally in the gold sector.

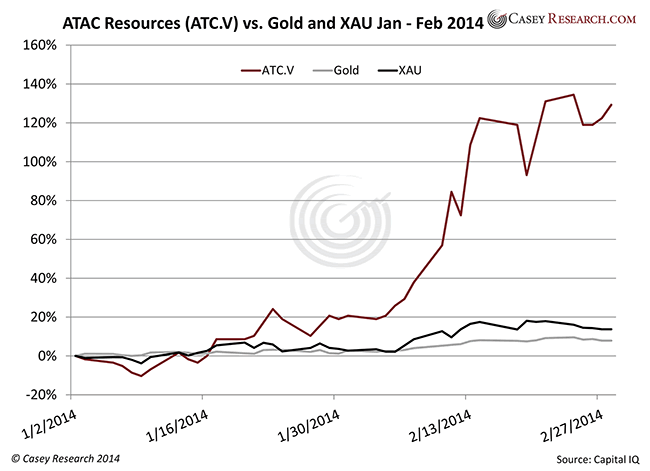

Here's one more, with a particularly telling point to make. This is the stock price of ATAC Resources (ATC.V) over the same time period as the chart above. The point I want to draw your attention to is that the company had no major news during the time period shown. It's a Yukon gold play, buried deep under the famous snows of the Great White North, so there's no exploration under way, and there won't be until the snow melts weeks or months from now.

This third chart shows in one simple yet powerful way exactly why Doug loves buying these stocks when they're on sale and selling them when they go into bubble mode. ATAC essentially did nothing and still shot up over an order of magnitude more than gold. Note that while this third chart looks like the second, the scales are quite different. (ATAC, by the way, is part of my special report, 10-Bagger List for 2014, that details nine companies I believe could show 1,000% or more returns this year. Note that the report was written before the big move upward you see in the chart above.)

It's worth emphasizing that ATAC's performance this year is just on a rebound from recent lows—imagine what a stock like this could do when Doug's super-bubble for gold stocks arrives.

But what if it doesn't? Or worse—what if we already missed it?

I remember a conversation with Doug back in 2011, when gold rose to within reach of $2,000 per ounce. Many mainstream analysts said gold was in a bubble. I told Doug I couldn't understand why anyone would listen to analysts who've called the gold trend wrong every year since the current bull cycle started. I remember Doug chuckling and saying: "Just wait and see—this is barely an overture."

I am certain Doug is right. That's not because he's the guru, nor because I'm a nutty gold bug, but because no government in history has ever multiplied its currency base without sparking serious and often fatal inflation. That's a fact, not an opinion, backed by enough data to make me extremely confident in predicting what lies ahead for the US dollar, even if I can't say exactly when we'll reach the tipping point.

Since that 2011 interim peak, as we all know painfully well, gold has backed off on par with the correction in the middle of the great 1970s gold bull market. But economic realities require that the market turn around and head for his long-predicted super-bubble in junior mining stocks before too long. That makes the correction the last, best time to build a substantial position in the stocks best positioned to profit from the coming bubble.

And now Doug is saying that he believes the upturn is at hand. He expects a steadily rising market for a year or two, perhaps more, but not many more, culminating in a market mania for the record books.

Our market does appear to have bottomed. It may take a while to go into its mania phase, but it's already heating up. No one is going to want to be short when this train leaves the station—and the conductor has blown the whistle.

To find out what you could be missing if you don’t invest in junior mining stocks right now, watch Casey Research’s recent video event, Upturn Millionaires—How to Play the Turning Tides in the Precious Metals Market. With resource and investment experts Doug Casey, Frank Giustra, Rick Rule, Porter Stansberry, Ross Beaty, John Mauldin, Marin Katusa, and myself. Watch it here for free, or click here to find out more about my 10-Bagger List for 2014.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.