Glaring Q.E. Failure Spotted - Money Velocity Is Falling Rapidly

Interest-Rates / Quantitative Easing Apr 16, 2014 - 04:21 PM GMTBy: Jim_Willie_CB

Sometimes pictures are far more effective in communicating an important point. They are extremely effective in undermining respect and confidence, when in the cartoon format. A sequence of graphics struck the cognitive circuits recently. Long explanations will not serve well. The US Federal Reserve has been printing money since 2011 to cover USGovt debt securities in a frenetic manner. They have lost control. They call it stimulus, when it is actually the opposite. It does assist the speculators with nearly zero cost money to borrow, but one must be a club member to win loan grants.

Sometimes pictures are far more effective in communicating an important point. They are extremely effective in undermining respect and confidence, when in the cartoon format. A sequence of graphics struck the cognitive circuits recently. Long explanations will not serve well. The US Federal Reserve has been printing money since 2011 to cover USGovt debt securities in a frenetic manner. They have lost control. They call it stimulus, when it is actually the opposite. It does assist the speculators with nearly zero cost money to borrow, but one must be a club member to win loan grants.

The Quantitative Easing programs are deceptive. When the program was initially announced, the Jackass claimed it would be part of an endless sequence. With QE1 and QE2 and Operation Twist and QE3, following the failed trial balloon called Taper Talk, it is quite clear to anyone with an active brain stem and absent rose colored glasses that the USFed is caught in a trap called QE to Infinity. It is not stimulative. Instead, the uncontrollable bond monetization causes capital destruction. It causes economic degradation. It causes lost jobs and vanished income. It is a gigantic wet blanket to smother and destroy the USEconomy slowly, amidst unending propaganda. QE is the device that will result in Systemic Failure, which is already flashing signals of its arrival.

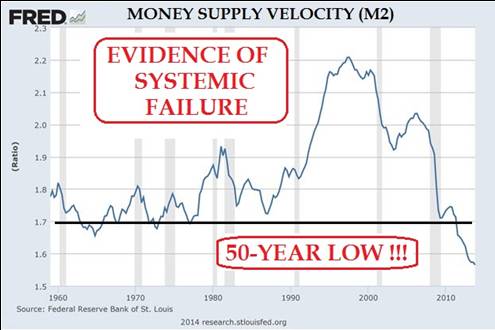

MONEY VELOCITY FALLING RAPIDLY

Money Velocity continues to fall rapidly in both the USEconomy and that of Canada, reaching 50-year lows in the Untied States. The indication is failure in monetary policy, as hyper inflation has killed capital on an extensive basis. The capital destruction is in its fourth year, probably having reached critical mass. Compared and contrasted with fast rising money supply, the systemic failure is obvious to conclude. The exception is to morons, Wall Street junkies, Big Bank criminal elite, and USGovt hacks. The fast decline in Money Velocity means that it is not moving in the body economic. The reason is simple. The blood system is contaminated with the USDollar, a toxic currency with no backing in a hard asset. The new money is toxic currency under phenomenal debasement by its own steward, the USFed itself. They redouble their harmful policy instead of abandoning it.

The Money Velocity picture is not pretty. The declining rate has broken lows set 50 years ago. Technically, the velocity of money is the frequency at which one unit of currency is used to purchase domestically produced goods and services within a given time period, like an inventory cycle time. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy. The result would be that growth (as measured in GDP) should be rising. With falling velocity of money, then fewer transactions are occurring and a recession is indicated. Such is the present case in astonishing rapid deterioration. Consumers and business are holding firm their money rather than investing it, as they see poor prospects. New capital formation is not occurring inside the USEconomy, or pitifully little. Debts are being dissolved, usually in default. It should be noted that the velocity of money has also been falling in the EU and Japan. The entire global economy is in recession, the pathogenesis shared.

DESTRUCTION OF CAPITAL

The claim that the QE bond monetization is stimulus is pure propaganda, and could not be further from the truth. The claim disguises the nature of the hidden Wall Street bailout, which is to cover their worthless mortgage bonds, and to cover all manner of derivatives, in addition to the obvious coverage of USTreasury Bond sales. Nobody wants the USGovt bonds anymore, except for Belgium operating as hidey hole on behalf of the Euro Central Bank, and for Japan operating as the usual lackey servant. The claim of stimulus is 180 degrees wrong. The bond monetization is pure unsterilized monetary inflation, free money shoved into the system without offset. To be sure, Bernanke had a machine to produce money at no cost, except that like with acid it ruins capital. The result is pure inflation, and extreme motivation for the entire world to take on hedge positions with energy, metals, farmland, and more in order to protect themselves from the ruin of money. The effect is felt as a rising cost structure, felt across the world, and thus shrinking profit margins for the entire global business sector.

As businesses realize the lost profitability, they shut down and retire their capital. They turn idle their factor machinery, their design workstations, their office computers, their transportation vehicles, their company buildings and offices. The destruction of capital is the ugliest dirty secret behind the official New Normal of central bank monetary policy. They are killing the system, so as to avoid liquidating the big banks. By refusing to take the proper capitalism path in liquidating failed corporate structures, they have instead chosen to kill capital, force income engines to the sidelines, generate capital formation in other nations (like the East & Asia), and destroy the USEconomy. The US and West has forgotten capitalism and embraced socialism with a fascist twist.

RAMPANT MONETARY GROWTH

Contrast the declining Money Velocity with fast rising Money Supply growth (presented in March). The conclusion is both galloping economic recession and systemic failure, hardly a reward. Yet it continues without interruption, only the promise of interruption. The systemic failure and breakdown is upon us, the evidence stacking up, the message no longer escapable. The two charts back to back make the point convincingly. New money is wrecking the financial structures and economic systems by destroying capital. The USFed balance sheet is well over $3 trillion, and continues to grow. The new money is going largely in a hidden Wall Street bailout of their bonds and derivatives. The USFed is a grand liar, as their QE volume is growing, not tapering. They are using proxies and back doors, in addition to airborne dirigibles like the Interest Rate Swap contract. Like with the Hindenburg, the floating monsters will explode someday. The growth in money supply is frightening and alarming, evidence of the wrecked capital and wrecked system. Many have called the Jackass a lunatic and alarmist, but they seem incapable to explain the fast rise in monetary base, yet fast decline in money velocity. Monetary policy is a failure. The fiat paper money is toxic. The big banks are insolvent. The global franchise system of central banks should be shut down, except they control the governments, control the finance ministries, control the central banks, control the regulators, and control the militaries.

LOST CRITICAL MASS IN INDUSTRY

It is very confusing that money velocity is falling fast, yet central banks are creating new money very rapidly. Imagine a Ferrari or Lamborghini race car spinning its gears, burning its engine out, running out of oil, making no movement. It aint working, started by Alan Greenspan, amplified by Benjamin Bernanke, and to be continued by Janet Yellen. They are stuck with failed monetary policy, and cannot alter the destructive course. The Jackass has maintained that a critical error was committed by granting China the Most Favored Nation status for trade. It was actually a fatal error. The industrial investment is taking place in Asia, led by China. Wall Street and the USGovt leadership at the time, under President Clinton and Robert Rubin, betrayed the nation. They leased gold from the Chinese, in order to perpetuate the fiat paper USDollar regime. They deployed the lunatic Rubin Doctrine, to wreck next year for a few more tomorrows. In doing so, the Chinese benefited from $23 billion in foreign direct investment in the space of a mere two to three years. But the blowback was fatal. The USEconomy lost its industrial critical mass, and has inadequate traction from monetary policy in accommodation. It still has some industry, but not enough. The ultra-low interest rate makes borrowing costs low, but grotesquely inadequate new capital formation has taken place in the USEconomy. It is being done in Asia. Worse, the new industrial parks are springing up across the US landscape, operated by Chinese industrial masters. The QE is not stimulating the USEconomy because 1) the US lacks critical mass industrially, 2) the regulator burden and corporate tax burden and ObamaCare burden are too great, and 3) the nation is too busy with court cases against the big banks and waging war against fabricated enemies. This is Game Over !!!

As David Chapman points out, "It all seems counter-intuitive that the velocity of money should be falling even as the ECB, the Fed, the BOJ, and the Bank of Canada have been maintaining low interest rates for years in order to encourage borrowing and keep the cost of money low. The central banks have also pumped billions of dollars into the economy through QE and other stimulative measures. The result has been an explosion in the monetary base, a sharp rise in M1 but lower growth for M2 and sluggish M3. The economies are weighed down with debt, banks are reluctant to lend, consumers and corporations are unwilling to borrow. The money instead has been used for speculation, primarily going into risk assets such as the stock market. Corporations instead of investing in new plants and investment are sitting on cash hoards or buying back their own shares. Both are non-productive."

CANADA DITTO ON FAILURE

The Jackass howls in laughter at the claim that Canada is different, an independent nation, a refuge of wiser leadership, the Great White North with more integrity. What nonsense! Canada is in the US pocket, and has been for a very long time. The arguments that Canada is different or better or free from gold corruption are truly baseless and stupid. The big Canadian banks short gold with Wall Street banks, and have been doing so for a long time. See the Scotia Mocatta alliance with JPMorgan in recent months. The Canadian Govt efficiently vacated all their gold in the 1980 and 1990 decades. It was probably stolen in part by Mulroney, just like as Bush & Clinton & Rubin stole the US gold. See the hidden brisk activity at Barrick Gold, where the ex-prime minister sat on the Board of Directors. Pay close attention to the Evergreen gold contracts by Barrick, which never force under contract the delivery of gold, only the sale under dubious specious contracts. Then the big Canadian banks are deeply committed in the Wall Street and London derivative entanglements, just like the big US banks. All their big banks are hollow reeds, just like in the Untied States. Lastly, the Canadian stock exchanges engage in rampant naked shorting of the mining stocks, not by those who wish to preserve the fiat currency system, but rather by the investment banks that fund the capital requirements for the mining firms themselves. They sell more shares than granted on finance deals. The most disturbing gold factor from Canada in the last year has been the collusion of Scotia Mocatta with JPMorgan in the provision of gold bullion. They have been offered some special deal for the future, but that future will include a charred landscape and devils as warlords. Scotia Mocatta is in Satan's service at the Wall Street altar. The old formula still holds: CANADA = UNITED STATES / 10 (just like always). The Jackass expects an extreme conflict very soon, as Canada is far more a Chinese commercial colony than the Untied States. My expectation is that Toronto, Ottawa, and Vancouver will soon begin marching to a different drummer out of Beijing, Shanghai, and Hong Kong. A big hat tip to David Chapman for his recent article (CLICK HERE) on the Money Velocity subject, where the graphic was obtained.

BLACK HOLE DYNAMICS

Bernanke was correct. The cost of newly printed electronic money is zero. But he left out the other half of the statement, since he is a lousy economist. The value of the newly printed electronic money is zero. Due to his pathetic education, Bernanke overlooked or fails to comprehend the effect of hyper monetary inflation. Endless spigots of new fiat money are not the salvation of a system, but rather a cornucopia of new capital formation can lift the system in an effective legitimate manner. The unchecked inflation results in the destruction of capital, the wreckage of income producing engines, the extreme ruin of jobs. The new money goes down a drain. The curvature to the drain is defined by toxic bonds even as the inflection is marked by harmful derivatives. The stubborn behavior of the central bank franchise system operations, their deep collusion, their phony patches to the bond structures, their self-dealing $23 trillion in near zero interest loans to themselves, their waged war to protect the King Dollar regime, it is all destructive. Sooner or later the people and madding crowds will awaken, surely very late in the end game.

GOLD STANDARD PROTECTION, SOLUTION, FUTURE

The protection is with Gold & Silver bars & coins. The solution is not more bond purchases, broader monetization programs, more liberalized bank reserve rules, or suspended accounting rules. The solution is liquidation of the big dead zombie banks, and a return to the Gold Standard. It will be put in place. It will be installed. It will arrive with a vast new structure of legitimacy. It will include barter systems and decentralized mechanisms. It will include new Letters of Credit based in Gold Trade Notes. But the East led by Russia, China, and followed by India, Japan, and South Korea will be the promoters, installers, and architects of the new strong stable equitable Gold Standard system that the Untied States dreads and fears. The West will continue its rapacious confiscation of wealth and its vicious devotion to war until the platform they stand on built of USD ceramic tiles and USTBond cables and SWIFT pylons collapses. The return of the Gold Standard will relieve the global economy of the burden and wreckage of central bank ruinous and criminal actions. The damage will be extensive. The survivors will be owners of Gold & Silver. The rest will become debt slaves in a nasty fascist state.THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

"Jim Willie is a gift to our age who is the only clear voice sounding the alarm of the extreme financial crisis facing the Western nations. He has unique skills of unbiased analysis with synthesis of information from his valuable sources. Since 2007, he has made over 17 correct forecast calls, each at least a year ahead of time. If you read his work or listen to his interviews, you will see what has been happening, know what to expect, and know what to do."

(Charles in New Mexico)

"I commend the Jackass for being the most accurate of all newsletter writers. Others called for the big move in Gold right away, but you understand that the enormous fraud in the system needs to play out before free market forces can begin to assert themselves. You seem to have the best sources and insights into the soap opera that is our global financial system. Most importantly, you have advised readers to be patient, stay safe, and avoid mining shares like the plague. Calling the top in the USTreasury Bond (10-yr yield at 1.4% yield) stands out as a recent fine accomplishment. The Jackass understands the markets, understands the fraud, and also has the sources to keep him the most up-to-date on the big geopolitical and financial events and scandals. Few or no other writers have all three of these resources."

(Austin in California)

"A Paradigm change is occurring for sure. Your reports and analysis are historic documents, allowing future generations to have an accurate account of what and why things went wrong so badly. There is no other written account that strings things along on the timeline, as your writings do. I share them with a handful of incredibly influential people whose decisions are greatly impacted by having the information in the Jackass format. The system is coming apart on such a mega scale that it is difficult to wrap one's head around where all this will end. But then, the universe strives for equilibrium and all will eventually balance out."

(The Voice, a European gold trader source)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com, which includes a Squirrel Mail public email facility.

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.