Stock Market Flash Crash Alert!

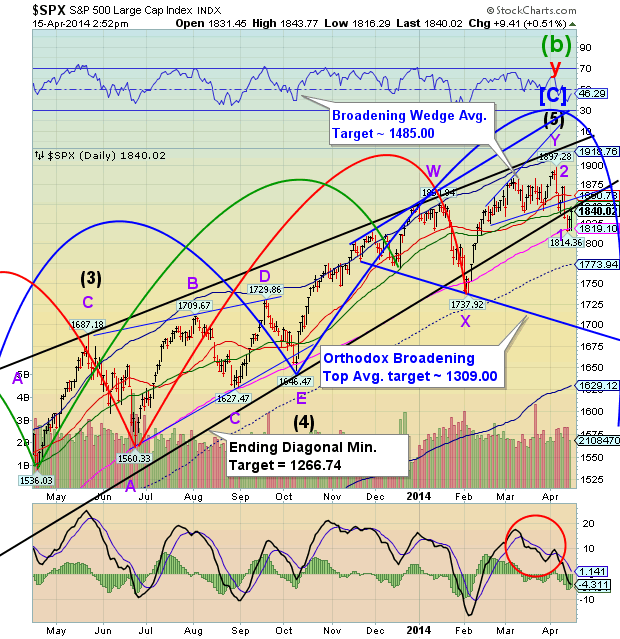

Stock-Markets / Financial Crash Apr 16, 2014 - 10:57 AM GMT I have been attempting to find the reason for the triple bottom at 1814, 1815 and 1816. The best I can figure is that SPX is finding support at the 120-day moving average and Wave [ii] is expanding for another challenge of the trendline. It appears to be a desperate situation. The powers that be managed to re-cross the trendline in February, so there may be an attempt to duplicate that event.

I have been attempting to find the reason for the triple bottom at 1814, 1815 and 1816. The best I can figure is that SPX is finding support at the 120-day moving average and Wave [ii] is expanding for another challenge of the trendline. It appears to be a desperate situation. The powers that be managed to re-cross the trendline in February, so there may be an attempt to duplicate that event.

The alternate view of this scenario is that, since we can see three waves down, it may be a [larger degree] Wave (A) and we are now in a Wave (B) retracement. Wave (C) will be the barn burner that may have to crack the larger Orthodox Broadening Too with its target near 1300.00.

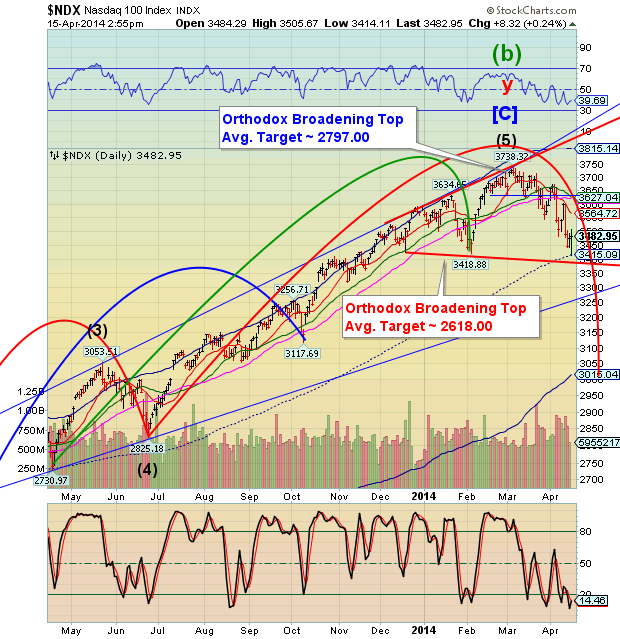

The NDX has seven waves, which may also qualify as a Wave (A). The waves overlap, which confirms that view.

The support in the NDX chart is clearer…it’s the mid-Cycle support at 3415.09. I haven’t had time to re-label the waves, but I would have to conclude that this is the most probable scenario.

This is where it gets interesting, since we may now have a shorter Wave [c] situation again. If so, there may be a flash crash once the indexes drop below the supports that I have portrayed.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.