Silver, Gold, and What Could Go Wrong

Commodities / Gold and Silver 2014 Apr 15, 2014 - 06:09 PM GMTBy: DeviantInvestor

Richard Russell is almost 90 years old and has seen it all. He recently stated:

Richard Russell is almost 90 years old and has seen it all. He recently stated:

“My advice, as it has been, is to move to the sidelines while holding large positions in physical silver and gold. Regardless of what the markets do, silver and gold represent eternal wealth, and the bid to sleep undisturbed at night. No amount of money is worth the loss of peace of mind. The power of gold opened the American West and populated Alaska. Men have spent their lives searching for gold. You can own gold by the simple action of swapping Federal Reserve notes for the yellow metal. I advise you to do it.” Richard Russell – April 10, 2014

He stated on March 31, 2014:

“Here’s what I did last week. I took some unbacked junk currency called Federal Reserve Notes, and with them bought some constitutional money, known as silver. I consider gold and silver, now being manipulated, as on the bargain table.”

Richard Russell thinks the stock market is currently dangerous and that silver and gold are safe. He understands that gold and silver are eternal wealth with NO counter-party risk. What is counter-party risk? It is the risk that paper wealth is not real, that debts will not be paid, that dollars, yen, and euros will decline in purchasing power, that your employer will declare bankruptcy and your pension will be cut in half, that your brokerage account will be hypothecated by management, that your bank will declare bankruptcy and your deposits in that bank are unsecured liabilities of the bank and may not be paid either timely or in full. In short, there is counter-party risk in almost everything.

Examine the following graph of the S&P500 Index for the past 20 years. Does that graph inspire confidence in further gains in that index, or does it cause you to think about corrections and crashes?

Yes, the Bernanke/Yellen “put” may support the market as the Fed does not want a market crash. But what happened to the power of the “put” in 1987, 2000, and 2007?

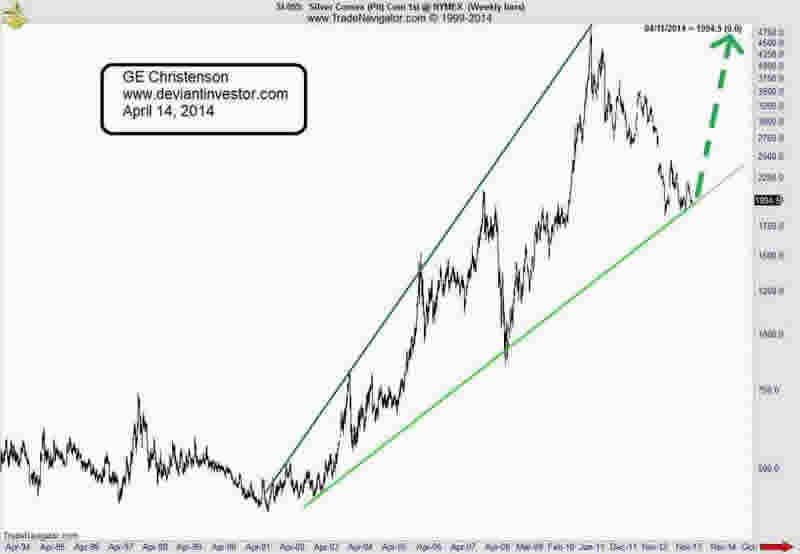

Now look at the following 20 year graph of silver. Instead of being at all-time highs, like the S&P, it is off nearly 60% from its high. Silver looks like a better place to park, as Richard Russell says, unbacked junk currency called Federal Reserve Notes, instead of in the S&P.

What do we know for certain?

- The grass is still green.

- The sun still shines.

- The government is spending and spending and spending.

- The Fed is injecting liquidity, monetizing bonds, creating currency swaps, and “printing money.”

- Inflate or die remains the unspoken command.

- Silver and gold will continue their rise as the purchasing power of fiat currencies declines.

- Politicians talk.

- Debt is increasing and people are realizing it can never be repaid.

- Gold and silver are still real money, even if they are suppressed, denigrated, hated, and lied about. Why should we expect anything different? They are competitors to a paper currency backed only by the full faith and credit of a country that spends roughly $1,000,000,000,000 more each year than it extracts in revenue.

So what could go wrong? Let me count the ways.

- Derivative crash

- Another war in the Middle-East

- Large scale dumping of US T-bonds

- Failure of confidence in the dollar, caused by loss of confidence in either political or monetary leadership

- More foreign policy blunders

- Any war with either China or Russia

- Loss of reserve currency status for the US dollar

- Evidence that most of the gold supposedly stored at the NY Fed is gone, missing, leased, borrowed, or hypothecated.

What else could go wrong? Sarcasm alert!

- Congress balances the budget in an election year and causes an immediate depression.

- The US government admits it will not repay its bonds. Financial chaos overwhelms the nation.

- China and Russia publicly apologize for criticizing the Fed’s “money printing” and agree to all US foreign policy objectives. The world is stunned into silence and then laughs.

- Israel and Iran declare peace and mutual harmony. More stunned silence and laughter.

- Politicians swear they will tell the truth and forego the use of Teleprompters. Wouldn’t it be nice?

- China agrees to dump over 10,000 tons of gold on the market at sub $500 prices in the spirit of international cooperation. The S&P soars, gold crashes, and politicians sprain their arms patting each other on the back.

- Goldman Sachs and JP Morgan announce they will donate 100% of their profits from Proprietary and High Frequency Trading in 2013 to charity. Financial stocks plummet and politicians worry about future payoffs.

Bottom line: There is an abundance of risk in the world that involves other parties, other countries, derivatives, debt, debt, and lots more debt. Gold and silver have no counter-party risk and will retain their value regardless of whether the debts are paid, regardless of political promises, regardless of monetary and fiscal policy, and regardless of the Bernanke/Yellen put.

Your cheerful but sarcastic blogger,

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.