Spanish Style Riots Coming to a Country Near You

Politics / Social Issues Apr 14, 2014 - 02:02 PM GMTBy: Jeff_Berwick

James Guzman writes: Screams and sirens pierce the air as rocks, firecrackers, and sharp glass go flying in every direction. Police try to beat back the hordes of protesters by smashing indiscriminately into the crowd with their billy clubs.

James Guzman writes: Screams and sirens pierce the air as rocks, firecrackers, and sharp glass go flying in every direction. Police try to beat back the hordes of protesters by smashing indiscriminately into the crowd with their billy clubs.

This was the scene recently in Madrid, Spain, as tens of thousands of people took to the streets to fight against the budget cuts and tax increases put into place by Mariano Rajoy, the current Prime Minister of Spain. The protesters chanted “no more cuts” as they demolished storefronts and threw firecrackers at police.

The march was organized by the group Marcha de la Dignidad (M-22) which also had the support of the labor unions. You can read the demands of this organization on its own website. They consist of:

- A law establishing a basic income for every citizen

- Universal, free and high quality public services for all

- Making eviction illegal and establishing water and energy as a human right

- Nationalization of all banks along with all “strategic” sectors

As you can see from these demands, the M-22, along with their labor union allies, are outright communists. They block public venues to voice their impossible demands. Once the demands are not met, violence and destruction of private property ensue. The results are realized the next day when those that live in or are visiting the historic city wake up to the formerly beautiful streets being littered with piles of trash and graffiti, others who are not so lucky wake up in a jail cell or hospital gurney.

Some of the protesters complaints are well-taken. They point out that the Euro was forced upon them without their consent, which has now resulted in their country’s loss of economic competitiveness. The Euro has indeed caused disruptions that have been thoroughly analyzed in books such as The Tragedy of the Euro by economist Philip Bagus.

He shows how the Spanish have been able to borrow at the same rate as the more thrifty cultures such as Germany. This has created a free-for-all, where countries with less overall saved capital are incentivized to take advantage of the low interest rate provided by the saved capital of individuals in the core. This has created a spending binge in peripheral countries that is now coming to a head.

The answer to this problem given by the M-22 crowd is that the debt is not legitimate and should be defaulted on. They claim that the debt is being forced upon them and that they should not have to suffer for the government’s mismanagement of the economy. I find this argument to be sound overall. From an ethical standpoint, individuals should not be born into the world with a giant albatross of debt piled up by past generations.

These arguments become disingenuous, however, if you are then out of the other side of your mouth demanding higher government spending for public services. These protesters are not adverse to government debt; in fact, the foundation of their entire platform is government debt. They have been the ones screaming for higher government spending, which has now put the government in this precarious position. Now the bills have come due, and they are accusing the ones who’s saving they have squandered of predatory lending.

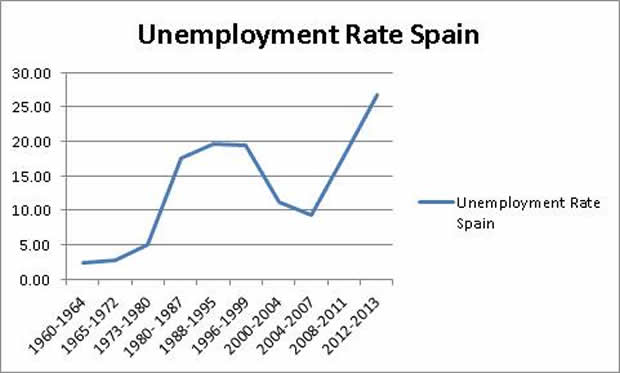

This leads to the false communist/fascist dichotomy, which the world has been plagued with for the last century. As a private business owner, you have no choice but to hope that the police will protect you from the mass of lunatics who have no respect for property rights or the operation of your business. Many pray for a strong man to come in and bring back order with an iron fist. They reminisce of the 1960s and the dictatorial rule of Franco, when Spain had one of the lowest unemployment rates in the world.

Although this is a temping trap to fall into, it is only one of many choices that there are. In fact, both sides of this struggle are collectivist in nature and based on one group forcing their opinion on the other. They are both culpable for the current mess that the country is in, and it is dangerous for citizens to feel obliged to pledge allegiance to either side.

The current turmoil is much like what was predicted in Atlas Shrugged. The world’s economy in shambles, as the citizenry clamor for more and more control by the government. The difference is that in reality there is no Galt’s Gulch to escape to, as each economy comes apart at the seams.

The global economy is now so intertwined that disruptions in one part of the world inevitably affect us all. What many people think of as “sustainable” or “living off the grid” is in fact just a justification for lowering your standard of living. Our current luxurious way of life is impossible without free international trade.

While many in the United States see this as a far off country without much in common with themselves, I would beg to differ. Union power is growing in the United States, and their demands are getting more and more ludicrous. We have recently seen the union backed “fight for 15″ rallies harassing fast food chains and other major US employers, and the United States has not yet seen the budget cuts that other countries have been forced to endure, but they will.

What will happen on the inevitable day that the government is forced to announce cuts to Social Security or food stamps?

What will the people do as medical costs continue to spiral out of control and the Affordable Care Act turns out not to provide the cornucopia of medical services they were promised?

If you really want to know the answer to that question, take a look at the riots in Spain.

Join the discussion at The Dollar Vigilante.

James Guzman is the manger of TDV Groups and a real estate agent with Coldwell Banker, Smart based out of San Miguel de Allende, Guanajuato. He specializes in helping international clients buy and sell property in all of Mexico. Have any questions, feel free to post in this forum.

© 2014 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.