Are We Heading For Another 1987-Style Stock Market Crash?

Stock-Markets / Financial Crash Apr 13, 2014 - 10:54 AM GMTBy: Graham_Summers

The big story developing in the US markets regards the sudden crackdown by regulators, most notably the SEC and Justice Department, on High Frequency Trading or HFT.

The big story developing in the US markets regards the sudden crackdown by regulators, most notably the SEC and Justice Department, on High Frequency Trading or HFT.

For well over five years now, certain trading firms have been using high-speed computers to front-run orders from other investors.

In simple terms, the market exchanges, like the NYSE, would let these firms (for a price of course) see when someone put in a market order to buy or sell shares on the market.

The trading firm would then use super fast computer programs to buy or sell shares in front of that order, before turning around and selling the shares to the investor at a slightly higher price. The trading program may only make a $0.01 profit by doing this, but because they were doing it millions of times a day, they were making billions of Dollars per year.

At one point, this practice accounted for as much as 70% of all market volume. Put another way, 70% of all shares being traded on the market were not from investors actually placing buy and sell orders, but from computers front-running investors and each other.

These firms argued that they were providing liquidity to the markets (an outright lie). The reality is that they spent millions of dollars lobbying in Washington DC to make sure that the regulators didn’t crack down on them.

However, it would appear that things have finally hit a boiling point with author Michael Lewis publishing a book exposing HFT as the immoral and illegal activity it is.

Between this, and a number of high profile media appearances, Lewis has finally raised public awareness on the issue of HFT. And the public is not happy about it As a result both the SEC and Justice Department have opened investigations.

As far as stocks are concerned, we’ve seen a sharp drop in the companies that were highly favored by HFT firms.

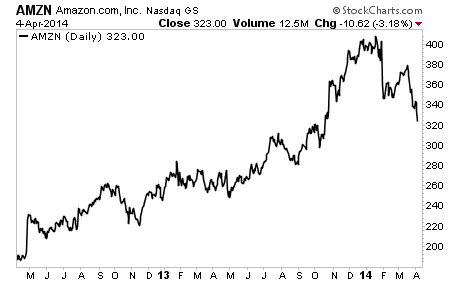

Amazon, an HFT favorite, has imploded from its highs.

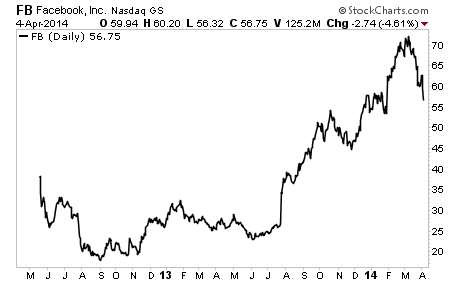

The same goes for Facebook:

This was always the problem with HFT: that these firms were pushing prices higher, through artificial pressure, not real buying power. Now that they’re moving out of the market, we’re seeing the consequences of this.

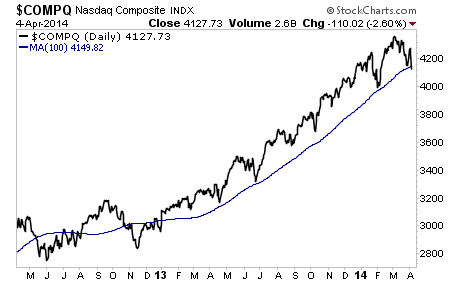

Indeed, the sharp drop in those companies favored by HFT firms predicted the recent collapse in the NASDAQ index as a whole:

Today, the NASDAQ is resting on its 100-day moving average. As you can see in the above chart, this line has help during every correction since 2013.

IF we see a breakdown here (meaning this line doesn’t hold), then the HFT crackdown could become a very serious issue for the markets. With these programs dominating trading so much, removing them from the market will have serious consequences for prices.

The whole situation is very reminiscent of the computer trading, which led to the 1987 Crash.

Could the markets crash again? We’ll see. But smart investors should be prepared for whatever may come.

Best Regards

Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2014 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.