Better Tone to Gold and Silver

Commodities / Gold and Silver 2014 Apr 11, 2014 - 05:03 PM GMTBy: Alasdair_Macleod

Gold and silver prices gained modestly over the week, during which the latest FOMC minutes were released. These were generally read to be more dovish compared with the previous month.

Gold and silver prices gained modestly over the week, during which the latest FOMC minutes were released. These were generally read to be more dovish compared with the previous month.

FOMC members appear from the minutes to be confused. The previous month’s conclusion, that if it wasn’t for the weather the economy is improving and so interest rates will increase a little earlier than expected, is replaced with renewed anxiety about the outlook now the weather has improved. And who can blame them: after QE1, 2 and 3, some iffy numbers like unemployment have fallen, but where’s the price inflation? The overriding concern for all central bankers is still the prospect of deflation.

As an aside the numbers behind the Fiat Money Quantity <http://www.goldmoney.com/research/research-archive/The-fiat-money-quantity-FMQ> were released this morning, and they have risen a further $135bn, dismissing any thoughts that tapering QE might be the problem. It’s not, because monetary inflation is continuing regardless.

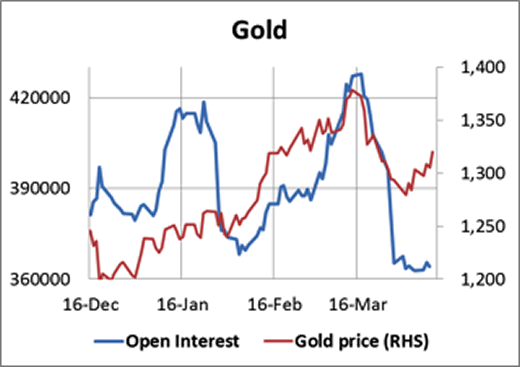

Last Friday I wrote about the divergence in open interest between gold and silver. This has continued into this week and is really unusual. First, gold’s chart:

The low point for gold’s open interest was last Friday, when gold was already four days into its rally. This signals very low levels of speculative interest: the last seller has turned off the lights and left the building. Therefore, gold appears to have built a short-term base under $1300.

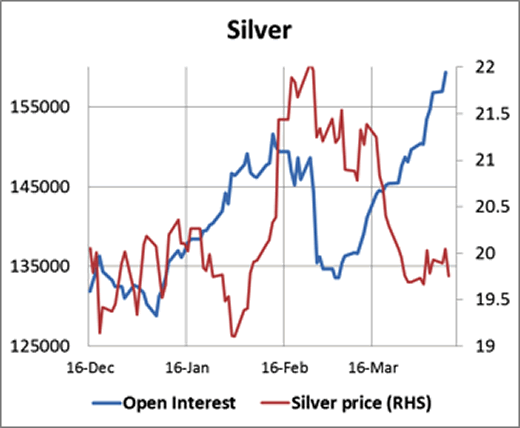

Silver’s chart is chalk to gold’s cheese.

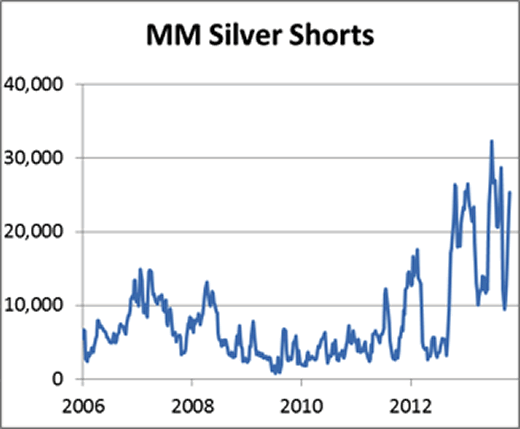

In this case attempts by market-makers to shake out the bulls have been met by solid demand with open interest rising strongly. The exception is the Money Managers category, which suffers frequent and dramatic changes of mind. The chart below shows the dramatic volatility in Money Managers’ short positions.

The long-term average of Money Managers’ shorts before 2013 was 6,130 contracts, yet in the last five weeks they have increased them by nearly 16,000 contracts. This increase in shorts should have allowed the bullion banks to reduce their short positions. Not so: according to the most recent Bank Participation Report they are net short of a total of 35,321 contracts, an increase of over 3,000 contracts last month.

Unlike gold, where Comex volume is moderate, silver volume is high indicating very strong support at current levels. The obvious conclusion is that bullion banks trying to balance their silver books cannot do so at current prices. Yet higher prices are likely to trigger a vicious bear squeeze, so it appears the bullion banks with short silver positions will remain trapped either way.

Next week

Bear in mind the run-up to Easter next week-end, which is why Tuesday and Wednesday have lots of announcements while on Friday there is only one. My next market report will be on Thursday.

Monday. Eurozone: Industrial Production. US: Retail Sales, Business Inventory.

Tuesday. UK: CPI, Input Prices, Output Prices, ONS House Prices. Eurozone: Trade Balance, ZEW Economic Sentiment. US: CPI, Empire State Survey, Net Long-Term TICS Flows, NAHB Builders Survey.

Wednesday. Japan: Capacity Utilisation, Industrial Production. UK: Average Earnings, Claimant Count, ILO Unemployment Rate, Public Borrowing. Eurozone: HICP (Final). US: Building Permits, Housing Starts, Capacity Utilisation, Industrial Production.

Thursday. Japan: Consumer Confidence. Eurozone: Current Account. US: Initial Claims.

Friday. US: Leading Indicator.

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2014 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.