They Snuck In Eurobonds Through The Backdoor

Interest-Rates / Eurozone Debt Crisis Apr 10, 2014 - 05:01 PM GMTBy: Raul_I_Meijer

The headlines are great, but then so is the headfake. “Greece makes ‘triumphant’ return to the markets in €3 billion bond sale”, says the Guardian. CNBC speaks of a “voracious appetite” for Greek bonds, but does question whether it’s justified. Still, at first glance it certainly looks like the Greeks have been welcomed back into the fold of civilized people:

The headlines are great, but then so is the headfake. “Greece makes ‘triumphant’ return to the markets in €3 billion bond sale”, says the Guardian. CNBC speaks of a “voracious appetite” for Greek bonds, but does question whether it’s justified. Still, at first glance it certainly looks like the Greeks have been welcomed back into the fold of civilized people:

Greece, the country once held responsible for sparking the sovereign debt crisis, managed to attract €20 billion ($27.7 billion) of offers for a new five-year bond and is set to sell €3 billion at a yield of 4.95%.

The bonds were all snapped up by big investors. Like your pension fund perhaps. And if you feel inclined to ask why, you’re not the only one. Of course they pay a much higher yield than most. Bonds of European countries like Germany pay hardly anything (the yield for Germany 5-year bonds is 0.6%). These Greek 5-years pay almost 5%. Plus, the troika restructurings of the past few years mean that Greece doesn’t have huge debt payments to make for another 10 years. Then again, Greek economy looks to have zero probability of returning to growth for as many years as well.

Greek 2013 GDP may have fallen as much as 7%, though the IMF/EC/ECB troika claims a small gain. It also claims a €500 million primary surplus for 2014 , whereas Eurostat shows a primary deficit of €17 billion for the first 3 quarters of 2013. Greek government debt is at 177% of GDP, which is far worse than before the crisis. Unemployment is 28%, and youth unemployment about 65%. Salaries have been cut by 50%. Unemployment benefits have been shattered. 3 million Greeks, or 30% of the population, lost their insurance and have no access to health care.

Why is the troika embellishing the numbers? It seems to fit their agenda. Which mentions European elections next month. And after all, who are the troika members accountable to? The IMF to the whole planet and therefore no-one. The European Commission (EC) to its parliament, but with Barroso at its head for over 10 years, that doesn’t have much meaning. The ECB is accountable to all 28 EU members, but of course in reality first and foremost to Germany.

And that makes this interesting. Because there is no way in hell and high water the institutional investors would have gobbled up, at less than 5%, the bonds of a country with such abominable numbers to show for its economic performance. And if and when 2/3 of your young and promising are out of a job, your economy is not going to be doing well anytime soon. Even if there is a turnaround in the offing, it’ll take many many years. And then the big debt repayments are due. But hey, do let’s discount the future where we can, shall we?

Eurobonds have been on – and under, and hovering over – the table since the recession started, but they have always been politically unpalatable, especially for the rich north, Germany, Netherlands, Finland, because they would carry with them the risk that the rich have to pay more for borrowing. And they like their ultra low yields, if only because it helps them hide their actual financial situation from sight.

But it’s still hard to see how these new Greek bonds are de facto anything else than Eurobonds in disguise. Investors buy them because of the implied, alleged, suggested support from the ECB, where Mario Draghi had pledged to do anything he needs to in order to support the euro and eurozone. For all we know, the ECB itself may have bought a large slice of today’s issue. Not directly, of course, but there are always ways.

I’m still wondering why Germany now allows this. Is Angela Merkel trying to pull one over on her own people? What will she do when Portugal, Cyprus, Spain expect, let alone demand, the same treatment? Obviously, the Greek government can’t decide on its own to do a debt issue. So who’s dealing the cards behind the curtains behind the closed doors? What is Mario Draghi’s role? Is he the man behind the plan, or was he instead overruled by the Bundesbank in order to get this done? Is this all about the elections, and if so, what’s going to happen afterwards, over the summer?

The funny thing is I don’t see any analyst or talking head calling these things for what they are. The news stories are all about Greece recovering and being the new darling of the debt markets. And that’s such obvious nonsense that there’s no way we can not ask ourselves what’s happening behind the curtain. Athens can borrow because Brussels has implied it’s good for it. In 5 years time, or 10. And no matter how many justified questions there may be about this murky process, one thing is certain: the first Eurobonds have been issued. After having recognized that, we can see what it all means.

A great set of graphs from Lance Roberts at STA. Recommended reading.

• No One Will Ring The Bell At The Top (Lance Roberts)

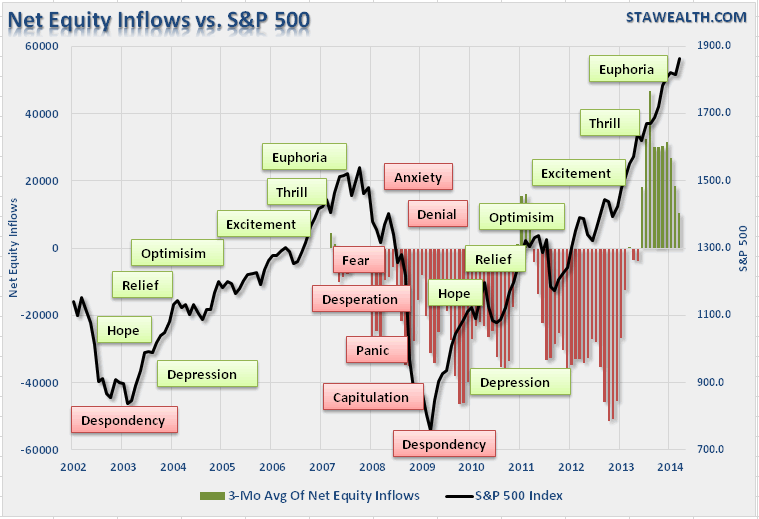

Throughout human history, the emotions of "fear" and "greed" have influenced market dynamics. From soaring bull markets to crashing bear markets, tulip bubbles to the South Sea, railroads to technology; the emotions of greed, fear, panic, hope and despair have remained a constant driver of investor behavior. The chart below, which I have discussed previously, shows the investor psychology cycle overlaid against the S&P 500 and the 3-month average of net equity fund inflows by investors. The longer that an advance occurs in the market, the more complacent that investors tend to become.

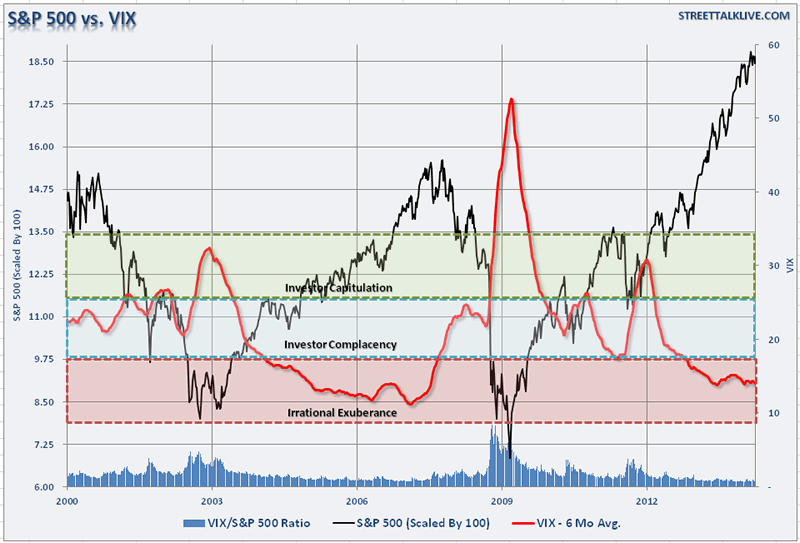

Complacency is like a "warm blanket on a freezing day." No matter how badly you want something, you are likely to defer action because it will require leaving the "cozy comfort" the blanket affords you. When it comes to the markets, that complacency can be detrimental to your long term financial health. The chart below shows the 6-month average of the volatility index (VIX) which represents the level of "fear" by investors of a potential market correction.

The current levels of investor complacency are more usually associated with late stage bull markets rather than the beginning of new ones. Of course, if you think about it, this only makes sense if you refer back to the investor psychology chart above.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.