Considering Dumping Stocks? Why You Should Reconsider

Stock-Markets / Stock Markets 2014 Apr 10, 2014 - 09:57 AM GMTBy: DailyGainsLetter

George Leong writes: I’m starting to receive more questions regarding the state of the stock market and whether it’s simply a bout of profit-taking or the set-up of a deeper stock market correction.

George Leong writes: I’m starting to receive more questions regarding the state of the stock market and whether it’s simply a bout of profit-taking or the set-up of a deeper stock market correction.

First of all, panicking is not what you want to do. Yes, we are seeing some selling surfacing, but that doesn’t necessarily mean you should go and dump stocks.

After the year we had in 2013 and the fact that the bull stock market is in its fifth year and devoid of a major question despite the advance, it would not be a surprise to see some selling.

Also, with bond yields beginning to rise, we will see a reduction in the assumed risk and will likely see a shift of capital into bonds and away from the stock market as yields rise.

The reality is that the stock market is already seeing a decline in the assumed risk in 2014. Technology stocks and small-cap stocks are no longer the stars of Wall Street this year.

We are seeing a lack of market leadership and extreme selling on the momentum stocks, which clearly is a red flag. The concern is that the drop-off in the momentum stocks is significant and could likely extend lower since the rise was euphoric.

Instead of seeking added returns, we are seeing a move towards safety as traders are shifting capital to blue chips and large-cap stocks that are better equipped to withstand a stock market sell-off and have largely proven themselves over decades.

On the charts, the NADSAQ and Russell 2000 are down more than two percent in April versus a less than one-percent decline in the S&P 500 and Dow Jones Industrial.

Chart courtesy of www.StockCharts.com

A closer look shows the Russell 2000 down over 5.5% from its record and the NASDAQ is down nearly four percent. After outperforming in 2013, the underperformance of these indices compared to the S&P 500 this year is an indication of the current risk in small-caps.

Assuming we are setting up for a stock market correction, recall that the higher-beta technology and growth stocks will decline faster and bigger than the more conservative large-cap stocks.

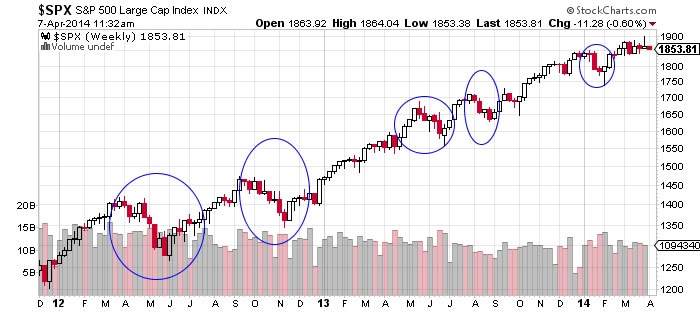

A look at the charts shows a stock market correction is warranted. In fact, we could see a correction of at least five to six percent prior to some support, based on my technical analysis.

Chart courtesy of www.StockCharts.com

Any major correction should be viewed as an investment opportunity.

For those of you who are active in the stock market, capital preservation is key at this time. Even if you are a buy-and-hold investor, it’s always good to take some profits at what could be a near-term top, so you can have some funds available for buying on weakness.

Also, you should make sure you have some put options protection in place in case the decline is bigger than the recent stock market corrections.

The key is not to panic and inadvertently dump everything.

This article Considering Dumping Stocks? Why You Should Reconsider was originally published at Daily Gains Letter

© 2014 Copyright Daily Gains Letter - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.