The Stock Market’s Annual Seasonality is a Real Concern This Year

Stock-Markets / Stock Markets 2014 Apr 05, 2014 - 11:15 AM GMTBy: Sy_Harding

As we move into April, it’s important to look at the stock market’s long history of making most of its gains each year in a favorable ‘season’ of November to April, while most of its corrections and bear market down-legs take place in an unfavorable season from May to October.

As we move into April, it’s important to look at the stock market’s long history of making most of its gains each year in a favorable ‘season’ of November to April, while most of its corrections and bear market down-legs take place in an unfavorable season from May to October.

Many academic studies and investment strategies going back to the 1970’s have confirmed the pattern, long referred to as ‘Sell in May and Go Away’.

In recent times, an academic study published in the American Economic Review in 2002 concluded that, “Surprisingly, we found this inherited wisdom of Sell in May to be true in 36 of 37 developed and emerging markets. Evidence shows that in the United Kingdom the seasonal effect has been noticeable since the year 1694. . . . . . The additional risk-adjusted outperformance [over buy and hold] ranges between 1.5% and 8.9% annually, depending on the country being considered. The effect is robust over time, economically significant, unlikely to be caused by data-mining, and not related to taking excessive risk.”

A 2012 study of the 40-year period from 1970-2011, published by the Social Science Research Network, concluded that, “Surprising to us, the old adage “Sell in May and Go Away” remains good advice. . . . . On average, returns are 10 percentage points higher in November to April semesters than in May to October semesters.”

In spite of decades of such studies and overwhelming evidence, the financial media still refers to market seasonality not as fact, but as a ‘theory’. They point out that it’s an “iffy thing”, since some years it doesn’t work out, and investors can be “hurt” by being out of the market in the summer months.

It is true that seasonal investing does not outperform the market every individual year. However, that is a nonsensical argument against it. There is no strategy that outperforms every single year. That applies most emphatically to ‘buy and hold’.

Secondly, seasonal investors do not get ‘hurt’ by being out of the market in those individual years when the market continues to rally in its unfavorable seasons. They do not have losses by doing so. They merely take their profits from the winter rally and miss out on some additional gains while safely on the sidelines.

Additionally, the historical evidence that clearly shows seasonal investing substantially outperforms the market over the long term (while taking only 50% of market risk) includes those individual years when it did not outperform

However, an investor who holds through the unfavorable seasons does have losses, sometimes large losses, and is significantly hurt in those years when seasonal timing does work. And the statistics show it does work in most years.

The willingness to ignore seasonality is particularly staunch this year. Investors are unusually bullish and confident, and there has not been a significant correction in the summer months for two straight years (when the Fed pumped in massive amounts of QE stimulus to prop up the economy, much of which instead flowed into paper assets like stocks).

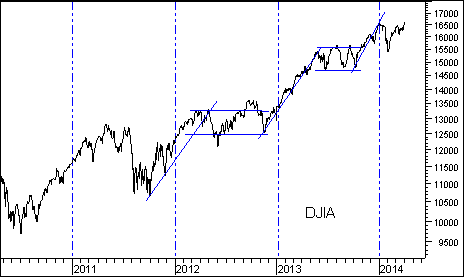

Yet, for those paying attention, even against that massive Fed influence in those years, the effect of seasonality was still clear.

Though there was no correction in 2013, the market still made most of its gains for the year in the traditional favorable seasons, and moved basically sideways in the unfavorable summer season. That was also true of 2012.

The big question for this year is whether it will be three straight years that seasonality does not ‘work’. Or will it more likely resemble 2011 (or worse), when massive QE stimulus did not prevent a 20% market plunge in the unfavorable season. (The only thing that prevented it from becoming worse in 2011 was that the Bernanke Fed rushed in to double the QE from $40 billion a month to $85 billion a month).

This year the Fed is tapering back stimulus, and will have it back down to $35 billion in May.

There are additional reasons to expect seasonality will be especially important this year. The market is significantly overvalued by historic standards. It is the usually negative second year of the Four-Year Presidential Cycle (in which since 1934 the average decline has been 21%). Meanwhile, the current bull market is now 61 months old. Not many have lasted as long.

While the traditional ‘Sell in May’ strategy calls for exiting May 1, in my work I prefer to use a technical momentum-reversal indicator in addition to the calendar. Doing so sometimes delays the exit signal into June, while other years it triggers the exit signal in April.

This year in particular, investors constantly pounded with advice to buy this or that promising stock or etf, might want to step back for a few minutes to look at the big picture of seasonality. Being ready to take downside positions in ‘inverse’ etf’s or short-sales when the time comes may be preferable.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.