Bitcoin Price Moving up to $500 but Is This to Last?

Currencies / Bitcoin Apr 01, 2014 - 05:13 PM GMTBy: Mike_McAra

In not too many words: we don’t support any short-term positions in the market now.

In not too many words: we don’t support any short-term positions in the market now.

Mobile payments company Square announced yesterday it would accept Bitcoin on its online website Square Market, which enables retailers to feature their merchandise. Ajit Varma, Square Market Lead wrote:

Sellers should never miss a sale. We’re building tools so sellers can accept any form of payment their customers want to use. Making commerce easy means creating easy ways to exchange value for everything from a massage to a DODOcase for your iPad.

In that spirit, starting today, buyers can purchase goods and services on Square Market with Bitcoin.

(…)

For sellers, the experience won’t feel any different. Whether selling services or goods, sellers don’t have to change a thing, except potentially expecting new trailblazing customers and more sales.

Whether the buyer is new to paying with Bitcoin or not, it should feel like a VIP experience. We focused on making the experience smooth and simple.

This is good news as another online marketplace accepts Bitcoin now, which brings the currency to a wider audience. The particularly important fact here is that Square moved to accept the currency even though it has depreciated for the last couple of months. The company doesn’t seem to be too concerned with fluctuations in the exchange rate:

Keeping it simple for the seller, the seller receives the amount of the purchased goods or services in USD and in the amount of USD advertised to the sellers' customer at the time of transaction, so the seller takes no risk on Bitcoin value fluctuations. The seller then fulfills their customer's order. Seamless!

So, even though Bitcoin can be quite volatile, this doesn’t necessarily have to hinder the ability to use the currency as a means of payment, particularly for retailers. With expected merchant fees of $1 billion for 2014 and valuation at $5 billion, Square is another heavyweight jumping on the Bitcoin bandwagon.

Now that the U.S. IRS has issued official guidance on Bitcoin, we would expect further companies to start accepting payments in Bitcoin.

Let’s move on to the charts and see what’s been going on in the Bitcoin market.

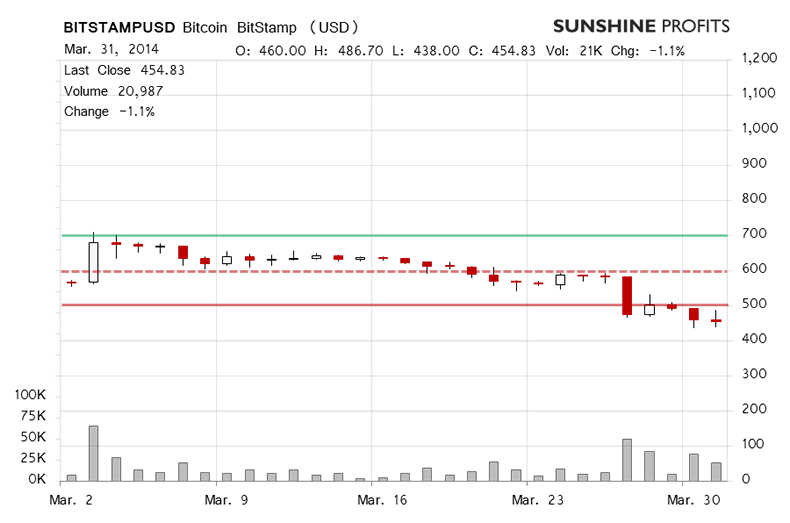

Yesterday, Bitcoin moved up and down on BitStamp, finally stopping at 1.1% lower than the previous close. The volume at almost BTC21,000 was lower than on the day before but still relatively significant. The action yesterday seemed to indicate that a significant move was possible. Yesterday in our Bitcoin commentary we wrote the following:

Taking all of the above into account, it seems that the short-term situation is bearish. The thing that could stop you from opening short positions at this time is the fact that we have elevated volume levels but no clear trend today. Because of that, it is possible that the next big move will be to the upside. We don’t bet on it and we’re inclined to think that another move down is possible but the mere fact that a strong move up is possible should make you particularly cautious.

It turns out that the suggested caution has paid off since we didn’t support opening shorts yesterday and Bitcoin has moved higher since then (this is written before 6:30 a.m. EDT).

Today, the move has been up, to over $480, 6.4% higher than the last close. The volume is also relatively strong. If Bitcoin closes the day above $500 (solid red line on the chart), we might see additional strength. A close below $500 could add to the bearish short-term outlook.

On BTC-e Bitcoin closed yesterday 1.2% lower than the previous close and trading was relatively heavy, heavier than on Sunday. The price went up and down during the day and the whole move suggested there was a lot of tension in the market. A strong move in either direction seemed possible. Because of the possibility of a move up, we didn’t support going short.

Today the move has been 6.0% up on strong volume. Bitcoin went up above $500 in early trading but has come back below this level since then. The crucial thing to observe right now seems to be the exchange rate at which the currency will end the day. If it goes above $500 again and stays above this level, we will have a bullish short-term indication. On the other hand, another close below $500 could reaffirm the short-term bearish outlook.

Summing up, in our opinion no short-term positions should be held in the Bitcoin market now.

Trading position (short-term, our opinion): no positions. Another close below $500 could be a bearish short-term confirmation.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.