Faked Stock Markets Waiting for the Real Thing

Stock-Markets / Stock Markets 2014 Mar 31, 2014 - 03:19 PM GMTBy: PhilStockWorld

How can you tell when the markets are FAKED?

How can you tell when the markets are FAKED?

I've been telling you for years about the various ways the market is rigged and now Michael Lewis has written a whole book about it called Flash Boys, which was featured last night on 60 Minutes. If you don't have time to read the book – at least PLEASE watch the 60 Minutes video.

While I find it morally repugnant and I spend countless hours speaking out against it and doing my best to bring these systemic abuses to light, for the purposes of helping our Members make profits at PSW, we live by a very simple rule:

While I find it morally repugnant and I spend countless hours speaking out against it and doing my best to bring these systemic abuses to light, for the purposes of helping our Members make profits at PSW, we live by a very simple rule:

We don't care IF the markets are rigged, as long as we are able to understand HOW they are rigged – so we can place our bets accordingly.

By understanding the mechanics of the BS that passes for the stock market these days and undersanding the process involved, we are able to line our bets up with the manipulors – or against the manipulated prices to take advantage of the counter-moves when the crooks are done playing with them. Certainly we never go more than a day without finding a good example!

While Lewis focuses on the blatant front-running scam by high-frequency traders, we tend to look at the broader picture of the manipulation of indexes and the media by funds who have a whole bag of tricks to stampede the sheeple in and out of positions almost at will.

We do that by focusing on the VALUE of stocks, not the PRICE and when PRICE becomes removed from VALUE, we look for a trading opportunity. It's not a complicated system really, once you accept the fact that prices are, in fact, manipulated. Today happens to be one of the 4 most-manipulated days of the year – the last day of the first quarter, when all the Banksters push stocks in their brochures to levels that will paint a pretty picture on their performance graphs.

Sure there are some people pushing down and some people pushing up but it's not an even game as the interests of the bulls tend to outweight the interests of the bears so, in absense of some overriding macros to the contrary, we can generally expect an up finish to the day.

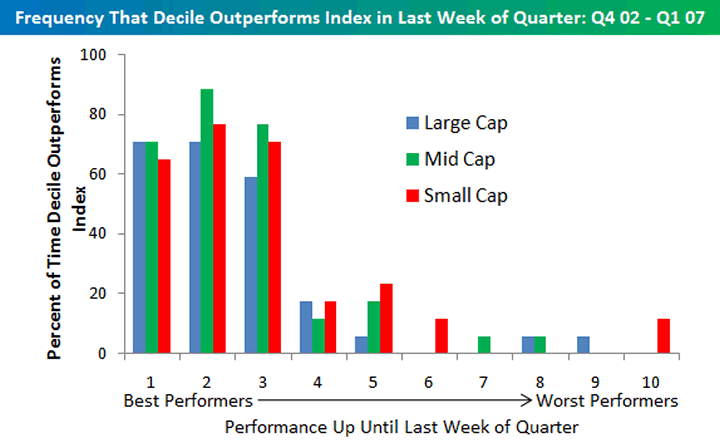

As you can see from the Bespoke chart on the right, about 70% of the best performing stocks outperform the indexes in the last week of the quarter. That's a 5-year study! Clearly we are way passed anything that can be labled a "coincidence" by any stretch of the imagination.

Another stupid hedge fund trick to look for is Fund Managers dumping losers today, especially into the bell. If you don't own your dog of a stock into the closing bell this afternoon – you don't have to show that specific loss to investors in your prospectus, so no one will ever know you bought SCTY in the $70s or NFLX for $450. Look for stocks that were higher ALL quarter than they are now, those are the top candidates for dumping.

As you can see on Dave Fry's Nasdaq chart, the entire index is essentially flat for the year at 3,571 (this is the 100, not the Composite) and we're just on the support level of the 22-week moving average. Of course we expect a bounce – notice we fell 2.23% for the week, which is our 5% Rule's™ expected 2.5% drop and then not even a 20% weak retrace of that bounce. Generally, that's an indication that we have more downside to come and in Friday's post I told you about our SQQQ (ultra-short Nasdaq) spread as well as our TZA spread.

But, today, we do not expect either of those indexes to drop. More likely we bounce (weakly) to 1,160 on the Russell and possibly, if the window-dressers are motivated, all the way to 1,170 but we plan to just sit back and enjoy the show today – tomorrow and the rest of the week we'll find out what is real and what's not.

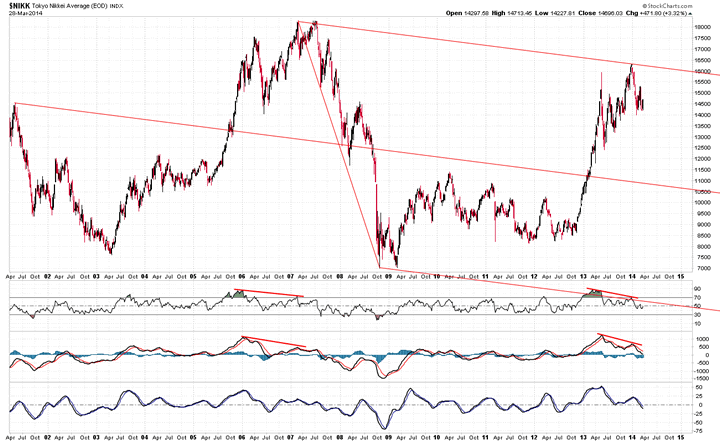

One thing that certainly doesn't seem real is the Nikkei Futures (/NKD) at 14,910 pre-market. We're still shorting it and we're encouraged by today's Japan Manufacturing PMI coming in at 53.9 (down from 55.5) and Industrial Production at 6.9% (down from 10.3%) and Housing Starts at 919,000 (down from 987,000) with the year/year number at 1% vs a 12.3% reading previously. It shows Japan's economy slip-sliding down hill and tommorrow the national sales tax goes up 3% – it seems very unlikely that's going to improve things.

To top it all off, the Dollar fell back to 80.20 this morning and, generally, the Nikkei doesn't like to see a weak Dollar but, today – we're dressing those windows!

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2014 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.