How to Profit from Palladium Huge Price Surge…

Commodities / Palladium Mar 31, 2014 - 01:54 PM GMTBy: Money_Morning

Peter Krauth writes: we last checked in on palladium, the precious metal so critical to the consumer electronics we use hundreds of times a day.

Peter Krauth writes: we last checked in on palladium, the precious metal so critical to the consumer electronics we use hundreds of times a day.

At the time I said I was bullish for a number of market reasons.

As it turns out, there were even more...

Now it's time for another close look, since the bullish forces are only picking up speed.

What's more, some new ones have materialized, pointing to a massively profitable palladium spike...

The Economic Factors Are Undeniable

When we talked about palladium back in October, I highlighted some of the underlying forces at play that were likely to support and push its price higher.

Those things - mainly sales of electronics and light vehicles - have powered ahead, helping to lift palladium prices as expected.

Palladium went from $710/oz. in October to $800/oz. on an intra-day basis just last week.

Expect the exclusive metal to head higher as recent developments are only adding to its bullish outlook.

You already know that South Africa and Russia are where nearly 80% of annual palladium supply is mined.

Since October, South Africa's problems with striking miners have only gotten worse. For three of the country's largest platinum producers (palladium is often a byproduct of platinum production), the recent nine-week strike has caused irreparable damage, costing the sector almost $1 billion in revenues.

Farther east, sales from Russian palladium stockpiles also appear to have reached their limits.

Traders closely track Russian shipments of palladium to Switzerland for clues on their supplies. That's because many believe Russia moves the bulk of its palladium through that country. February shipments were 6,500 ounces and have been trending lower since early 2011, according to Barclays, which expects a "sizable deficit" in 2014. And that's despite climbing prices.

Complicating matters are the developments in the Ukraine. The West is imposing sanctions on Russia, and that could limit their ability to export palladium, potentially badly denting supply... at exactly the wrong time.

Meanwhile, a perfect storm is building that could push palladium higher still...

Just when supply is being crunched, demand is popping.

Last Thursday, South Africa's Absa Bank Ltd. (JSE: ABSP) listed its NewPalladium ETF, allowing that country's investors an easy way to gain exposure to the physical palladium market.

In the weeks preceding its launch, Absa had accumulated 8,600 ounces of palladium, which according to the South African Reserve Bank, must be sourced in the country. Should the ETF prove popular, Absa will of course need to buy more palladium to satisfy demand.

Based on the company's experience with palladium's sister metal, demand could be very robust. Absa already runs the NewGold NewPlat ETF (JSE: NGPLT). Within just four months of its launch, NewPlat has become the world's largest ETF of its type. NewPlat ETF already holds 956,000 platinum ounces, and the company still expects significant growth.

Not to be outdone, Standard Bank has also just launched its own palladium ETF, introducing the second new palladium ETF in just the last week. Standard already offers a palladium-based ETN (exchange-traded note), but its newest addition is backed by physical metals held in London.

As these ETFs grow, its means more palladium will be removed from supply.

These Charts Plot the Way... to Your Profit

Platinum and palladium are sister metals. As part of the platinum group metals, they are often unearthed together.

These are metals that have similar applications, but are not necessarily interchangeable.

Most palladium is used for gasoline engine catalytic converters, whereas the largest single use for platinum is in diesel engine catalytic converters.

Technological applications for these metals are developed based on their specific properties. So it's nearly impossible in most cases to simply "swap" one for the other. That means palladium-based anti-pollution systems will keep using the metal even as its price rises.

Nonetheless, because these sister metals have similar properties and applications, their price relationship is something that's closely followed.

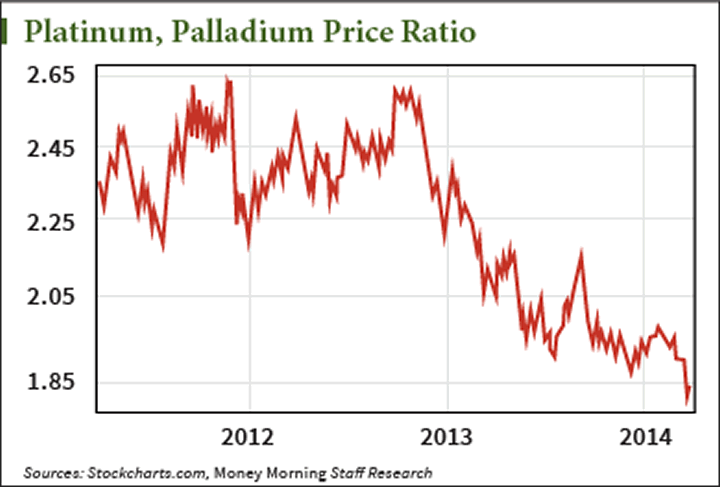

Right now, the spread between platinum and palladium prices has fallen to a 12-year low, as palladium prices have roared ahead to close the gap further.

The following chart shows that as palladium hit a 2 ½-year high last week, the platinum-to-palladium ratio has hit a marked low. While this may reverse in the short term, I expect these low levels to become a new norm.

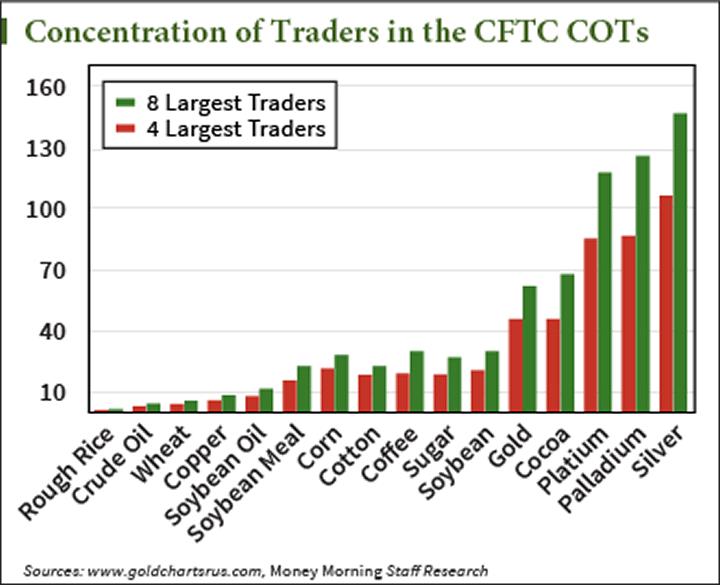

And while we're palladium chart gazing, have a close look at this next one.

Back in October I included this chart when I discussed palladium. At the time I pointed out that the eight largest futures traders were short 127 days of world palladium production. At the time, it was at a 13-year high, and palladium was in first place ahead of all other major commodities.

Today, palladium's still short about 127 days of production by its eight largest futures traders. The only thing that's changed is that silver has taken over the first spot in the chart.

If palladium prices spike, these traders could be forced to cover their large short positions by buying offsetting long contracts, reinforcing and potentially pushing price gains higher still.

As the setup for palladium (and platinum) continues to offer a bullish fundamental outlook, Real Asset Returns readers have recently added exposure to these metals through a superior ETF-type investment vehicle backed by physical metals.

Investors looking for exposure strictly to palladium should consider the ETFS Physical Palladium Shares ETF (NYSE: PALL), which does a pretty good job of tracking palladium prices with an annual net expense ratio of 0.60%.

The takeaway: remember that demand fundamentals remain strong, while South African and Russian supply challenges could exacerbate supply issues in short order.

All of this points to a very bullish outlook for a rare but increasingly necessary metal...

Source : http://moneymorning.com/2014/03/31/profit-huge-price-surge-youve-created/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.