Bitcoin Price Pause at $500. Is It Temporary?

Currencies / Bitcoin Mar 28, 2014 - 05:35 PM GMTBy: Mike_McAra

If you don’t have time: we think shorts could become more profitable.

If you don’t have time: we think shorts could become more profitable.

We’ve long been discussing Mt. Gox’s fall and the credibility of Mt. Gox’s claims that their Bitcoins might have been stolen via transaction malleability exploits. It now turns out that Christian Decker and Roger Wattenhofer of the Swiss Federal Institute of Technology in Zurich came up with a paper in which they analyze Bitcoin transactions on Mt. Gox starting with data from January 2013.

The findings are puzzling, at best:

The transaction malleability problem is real and should be considered when implementing Bitcoin clients. However, while MtGox claimed to have lost 850,000 bitcoins due to malleability attacks, we merely observed a total of 302,000 bitcoins ever being involved in malleability attacks. Of these, only 1,811 bitcoins were in attacks before MtGox stopped users from withdrawing bitcoins. Even more, 78.64% of these attacks were ineffective. As such, barely 386 bitcoins could have been stolen using malleability attacks from MtGox or from other businesses. Even if all of these attacks were targeted against MtGox, MtGox needs to explain the whereabouts of 849,600 bitcoins.

Of course, it is still possible that funds were stolen before January 2013 but the results of the study are rather unsettling. It could suggest that the scale of the transaction malleability problem for Mt. Gox might have been overstated by the exchange. It also leaves more questions open, such as “what actually happened with the coins?”

This comes in as another analysis actually questioning the possibility of all the exchange’s fund disappearing due to transaction malleability theft. Earlier this month, the exchange supposedly found BTC 200,000 (over $100 million at that time) in an “unused” wallet. We have also previously written about speculation that Mt. Gox might have actually lost access to bitcoins it stored rather than was hacked.

All of this is, however, highly speculative. Mt. Gox is now under investigation by the Japanese authorities. We’ll be curiously waiting for the findings of this investigation.

Now, let’s move on to the charts.

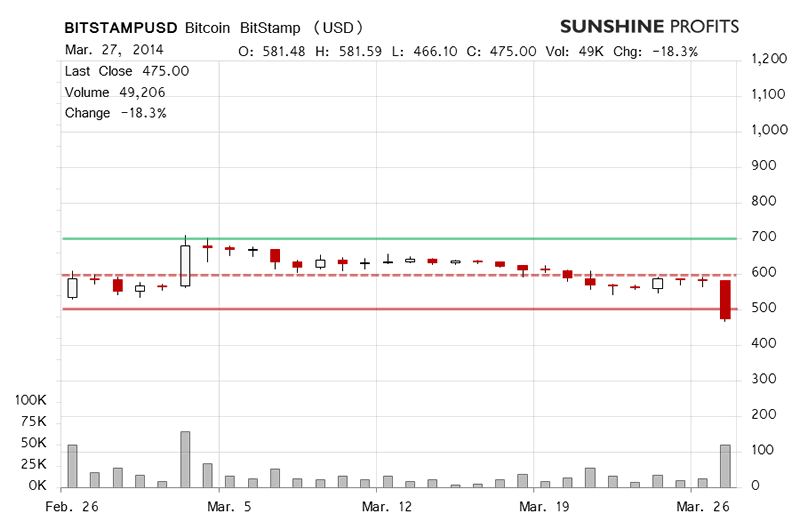

Bitcoin lost 18.3% on BitStamp yesterday. The volume at over BTC 49,000 was the heaviest since Mar. 3. Importantly, Bitcoin broke below the $500 level (solid red line on the chart). The situation at the close yesterday was extremely bearish.

Today, we’ve seen appreciation and currently Bitcoin is trading slightly above $500 (this is written before 11:30 a.m. EDT). The volume looks like it won’t be as heavy as yesterday but it is relatively strong nonetheless. The most important question for us now is whether Bitcoin closes the day above $500 or below this level.

Our view is that if we see a close above $500, shorts should be closed as far as speculative capital is concerned. If the currency closes the day below $500, we won’t immediately suggest closing short positions but will wait for the situation to evolve.

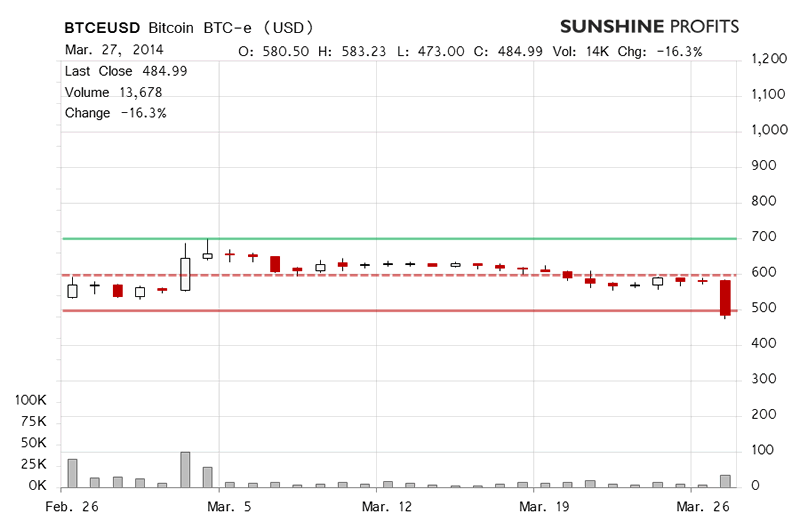

On BTC-e, Bitcoin lost 16.3% yesterday slipping below $500 (solid red line on the chart) on volume more than 4 times higher than on the day before. This was a major bearish development.

Today, we’ve seen a move back above $500, the volume has been high and it’s possible that it will end up not significantly lower than yesterday. Just as is the case for BitStamp, today’s close might clear things up a bit. If Bitcoin stays above $500, we will suggest closing shorts. If the end-of-day price is under $500, we will suggest keeping shorts and monitoring the market closely (this is our opinion).

Summing up, in our opinion short positions should be kept at this moment but one needs to be particularly careful since a close above $500 on BitStamp or BTC-e would serve as a signal to close those positions.

Trading position (short-term, our opinion): short; stop-loss at $550 ($50 lower than yesterday). If we see a daily close above $500 on BitStamp or BTC-e, short positions should be closed.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.