Is Ben Bernanke Worth $250k Per Speech?

Politics / US Federal Reserve Bank Mar 25, 2014 - 05:34 PM GMT “Bernanke Enjoys the ‘Fruits of the Free Market,’” or so we’re told in a Reuters headline from March 4 about the former Fed chairman’s 40-minute speech in Abu Dhabi for which he received, ahem, $250,000. In the Reuters author’s defense, he was only quoting a DC lobbyist who was defending the amount, and added, Bernanke “will personally experience supply and demand.”

“Bernanke Enjoys the ‘Fruits of the Free Market,’” or so we’re told in a Reuters headline from March 4 about the former Fed chairman’s 40-minute speech in Abu Dhabi for which he received, ahem, $250,000. In the Reuters author’s defense, he was only quoting a DC lobbyist who was defending the amount, and added, Bernanke “will personally experience supply and demand.”

Well, yes, it’s just supply and demand and all that. No big deal and if you don’t like it, you must have something against markets. Still, it would be nice (and a bigger deal) if these reporters would quote someone outside of the accepted intellectual class of the Boswash corridor so compromised by being among the primary beneficiaries of all the new money Chairman Ben and his comrades created, ex nihilo, when he wasn’t shooting baskets in the Marriner Eccles building. If they did, they might hear some healthy skepticism about these events in which top officials cash in on their “public service” via contacts with the very industries they benefited while in office.

George Stigler explained such paybacks in his capture theory of regulation for which he received (rightly) the Nobel Prize in Economics, although I’d say they are better explained by the phrase, “quid pro and here-you-go!”

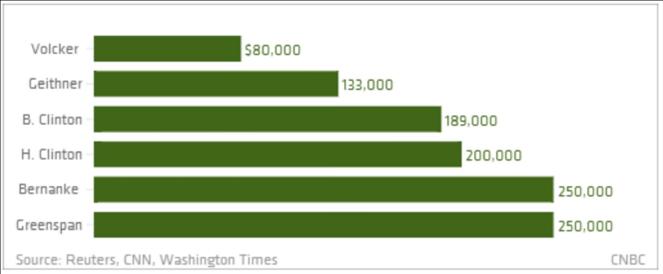

Figure 1: Speech honoraria immediately upon leaving term of office. From CNBC.

Less-beholden observers might pause during Bernanke’s victory lap and note that the dollar has lost almost 30 percent of its value since he joined the Fed in 2002, and that’s only if you accept the lowball metrics used in official CPI statistics. It is likely twice that amount if price inflation is measured in more traditional ways, including forgotten factors such as the full inflation for out-of-pocket expenses or the cost to maintain a constant cost of living. Americans of 1977 may have had to suffer through bad hair and disco music, but at least they didn’t suffer discrepancies between (a) what they experienced the value of the dollars in their pockets to be and (b) what the government said it was. We do.

Yet, today, the Establishment celebrates Bernanke for keeping the funds flowing to those parties it needs to remain in power. But while Paul Krugman wonders where the inflation is, I did some back-of-the-envelope calculations of Bernanke’s speech honorarium. Again using the CPI’s numbers, $250,000 today buys roughly what $193,000 bought in 2002, which would have purchased 603 ounces of gold at the time. Today, those 603 ounces of gold would be worth over $805,000.

The point isn’t that all Fed chairs should contract their post-retirement speeches in gold at the beginning of their term of service, although maybe they should. It’s that payoffs such as this reflect about what you’d expect when a currency receives monopoly protection and legal tender status, neither of which has anything to do with the free market. And notwithstanding the opinions of DC lobbyists, neither does Bernanke’s speech.

It followed the most reckless term of service of any central banker in U.S. history. He printed trillions of dollars to rescue a portion of Wall Street that could have internalized its post-crash losses and financed budget deficits that served to transfer capital to the fringes of military empire and out of reach of domestic workers. He “depression-mongered” the U.S. economy in September 2008 even though that market meltdown paled in comparison to those of 1987 and 2000-2001, thus setting the stage for Depression 2.0, and many billions in stimulus spending, bailouts, and other malinvestments.

Was all this simply an effort to test his faulty academic research of the 1930s? Perhaps partly. But remember that cartelizing factions on Wall Street created the Federal Reserve itself in 1913 for the cartelizing factions on Wall Street. Since those who receive the new money first benefit the most, it stands to reason that those interested parties would shower accolades and a share of the loot on Bernanke in the form of $6,250 per speech minute — and assume Mrs. Yellen is paying attention.

An amusing backdrop to the speech news is the continuing crises affecting Bitcoin and Mt. Gox, the fraudulent and now bankrupt Bitcoin exchange that appears to have lost deposits while itself engaged in fractional reserve banking, something only the protected class of modern banks are allowed to do. Understanding the uncertain future of both the dollar and the country’s power elite in the post 9/11 United States is key to understanding the rise of competing digital currencies (of which Bitcoin is just one). Their demand would never have been as strong had the dollar been inflated relatively less, and had market corrections been allowed relatively more, during the years of the so-called Great Moderation. It is safe to assume that establishment bankers are trying hard to use the Mt.Gox fiasco to demonize any movement toward peer-to-peer banking, which could easily have the effect of making banking as we know it go the way of the buggy whip industry in the nineteenth century.

If it does, one casualty just might be Bernanke’s future honoraria.

In a rational world, being paid $250,000 for this speech would cause many to wonder what is really going on. But such a world has not existed in banking since, perhaps, the 1830s. Until another one comes about, appreciate the irony that Bernanke is being paid in a fiat currency he himself helped devalue, and since his own successor at the Fed promises to continue operating in a Bernankean tradition, he will pay someone to diversify it, quickly, into real assets to protect its purchasing power.

Bernanke’s speech has little to do with supply and demand. It has more to do with being rewarded for extending the road down which we have been kicking the economy can. It’s a road that will eventually dead end.

Christopher Westley is an adjunct scholar at the Ludwig von Mises Institute. He teaches in the College of Commerce and Business Administration at Jacksonville State University. Send him mail. See Christopher Westley's article archives. Comment on the blog.![]()

© 2013 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.