The Huge Economic Indicator Everyone Misses

Economics / US Economy Mar 25, 2014 - 04:28 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: If you like bull markets, you better hope Janet Yellen is one of the most talkative Fed Chairs in history.

Keith Fitz-Gerald writes: If you like bull markets, you better hope Janet Yellen is one of the most talkative Fed Chairs in history.

It's not that she's going to say anything brilliant or insightful, just that she says something - anything - on a regular basis.

You see, there's a direct relationship between how much she says and what's happening in the markets. What she says is almost completely irrelevant.

I know people spend hours agonizing over the slightest nuances in each statement, but really none of those things matters.

Unless you are a policy wonk, Fed statements are pretty consistently useless pontifications made every 6 to 8 weeks by the head of a supposedly independent financial body that is, in fact, a highly politicized entity.

The Fed exercises little if any control over variables and targets that it changes at will and deems relevant at its sole discretion.

Harsh? You bet. But not without merit...

Flawed Fed Policies (Need Long Explanations)

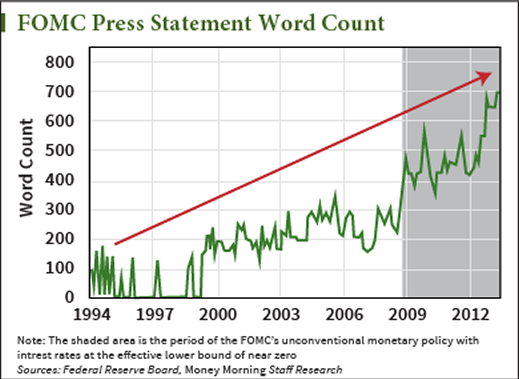

The first Federal Open Market Committee (FOMC) press statement was released on Feb. 4, 1994, and it was all of a whopping 99 words: short, succinct, and to the point.

By comparison, Yellen's first statement, issued after last week's FOMC meeting, was 877 words - a 785% increase in 20 years.

You can chalk this up to a more communicative Fed or the proliferation of media in the Internet Age if you want. It's not a stretch of the imagination with all the technology that we have at our disposal.

I think that'd be a big mistake.

I think the Fed is saying more in a deliberate attempt to explain its actions the way a child tries to justify getting his hand caught in the cookie jar. The goal is to bamboozle the American public into believing that expanding the Fed balance sheet by more than 450% in excess of $4 trillion is justifiable, responsible, and prudent.

I believe the fact that they are communicating more and saying less is very deliberate. Reality no longer fits their data, so Yellen is changing the data. She even blamed the weather, which is not too far from the "dog ate my homework."

As the Words Pile Up, So Do Fed Assets

The Fed missed the financial crisis in formation and has been wrong about critical inflation and jobs data for several years in a row now, which means that it's got to "explain" itself in other ways.

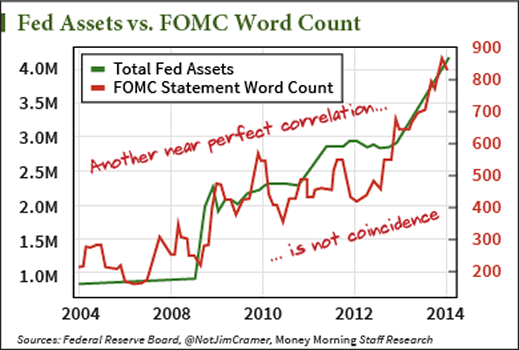

Coincidence? I think not... there is a direct correlation between the rising FOMC word count and Fed assets.

To be fair, statistically speaking, correlation is not causation. If you remember your high school statistics classes, the fact that one data set is highly correlated to another does not mean that one caused the other.

But when you tie a third data set in, and a fourth and a fifth... coincidence goes right out the window.

It's one thing to say that the Fed is simply doing a better job of communicating. And entirely another when you realize why...

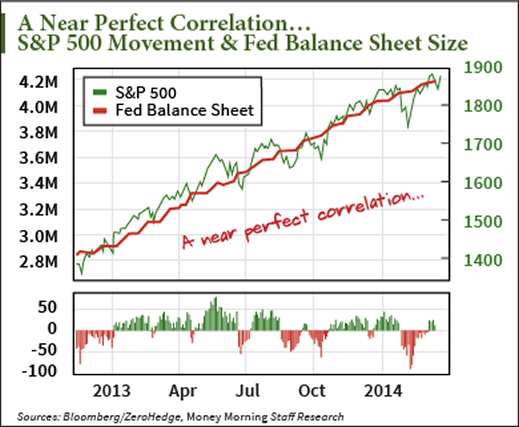

The bellwether S&P 500 has risen in near-perfect lockstep to the Fed's balance sheet, which, has in turn, risen nearly perfectly with the frequency and word count of the Fed's own minutes.

Ergo... if you want the rally to continue, you better hope that Yellen keeps talking... a LOT.

About what really doesn't matter.

Mark the Words, and Plan Your Next Steps

Key Takeaways:

- The Fed is well intentioned, but the rhetoric and "explanations" have risen commensurately with the complexity of what it thinks it's doing. Like the kid raiding the cookie jar, somebody's getting grounded. We just need to make sure it's not us.

- To that end, I cannot overstate the importance of two things right now - trailing stops and a ready-for-anything plan kept top drawer at all times. The former is for protecting capital while the markets grind higher, and the latter is for capitalizing on chaos.

- You'll know which plan to put in effect the moment the next FOMC minutes are released by doing nothing more complicated than a word count. If it's greater than 877 words or in the neighborhood, things will probably continue the way they are. But if it's dramatically shorter, get ready for rough sledding.

Source : http://moneymorning.com/2014/03/25/huge-economic-indicator-everyone-misses/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.