Bitcoin Price Move Below $600 Continues

Currencies / Bitcoin Mar 22, 2014 - 02:38 PM GMTBy: Mike_McAra

Cutting right to the chase: we don't think going short is a good idea yet.

Cutting right to the chase: we don't think going short is a good idea yet.

Just when you would think the situation with Mt. Gox couldn't get any stranger, it has. Apparently, the exchange "found" almost BTC 200,000 in one of its old wallets this month. The coins would be currently worth approximately $115 million. A statement published yesterday on the exchanges website reads:

MtGox Co., Ltd. had certain old-format wallets which were used in the past and which, MtGox thought, no longer held any bitcoins. Following the application for commencement of a civil rehabilitation proceeding, these wallets were rescanned and their balance researched. On March 7, 2014, MtGox Co., Ltd. confirmed that an old-format wallet which was used prior to June 2011 held a balance of approximately 200,000 BTC (199,999.99 BTC). MtGox Co., Ltd. investigated the presence of these 200,000 BTC, immediately reported it to its counsels in the application for commencement of a civil rehabilitation proceedings ("counsels"). A hearing took place on March 8 where a detailed explanation of the situation was made to counsels. Immediately on Monday (March 10), counsels reported the existence of the 200,000 BTC to the Court and the Supervisor.

Wait a moment... They found $115 million (!) which they had thought missing.

If you remember our comments on Bitcoin and Mt. Gox from earlier this month, you'll recall that we mentioned theories that admitted the possibility that Mt. Gox still held over 400,000 bitcoins in its accounts. Any ideas that Mt. Gox may actually be sitting on more bitcoins than it had publicly announced just gained a lot of credibility.

Another question is: how is it remotely possible to forget almost $115 million? We more and more come to see what kind of organization Mt. Gox is (or used to be). The statement cited above ends on an even more uncertain note:

Please note that the reasons for their disappearance and the exact number of bitcoins which disappeared is still under investigation and that the above figures may still change depending on the results of the investigation.

Mt. Gox themselves admit they don't have the certainty that this is the last surprise in its accounts.

Now, let's turn to the charts.

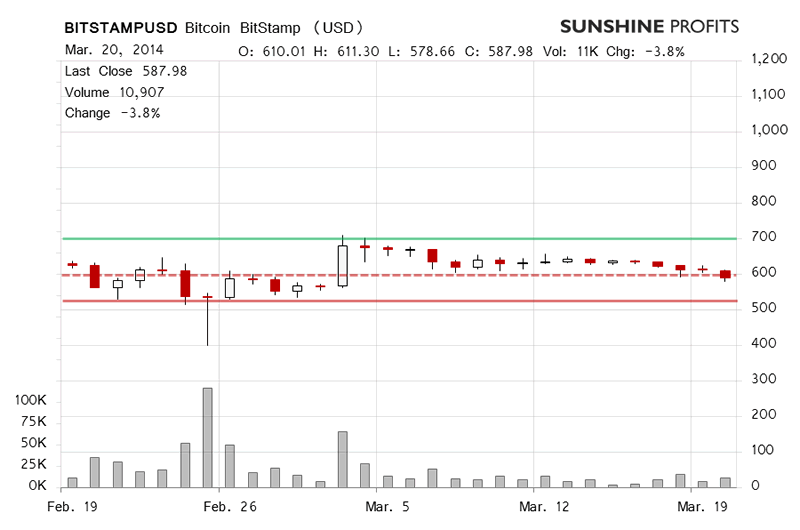

Yesterday Bitcoin slipped below $600 (dashed red line on the chart) on BitStamp and closed the day below that level. This is an important piece of information since this was the first daily close below $600 since Mar. 2. The short-term outlook became more bearish than not.

This is reinforced by the moves today. At the moment of writing (before 11:30 EDT), Bitcoin is 2.5% down from yesterday's close. What is important, Bitcoin attempted to get back above $600 earlier today but failed to do so. The price is still below $600. The move above $600 and the subsequent pullback suggest that there is short-term weakness in the market. The short-term outlook is now bearish reinforced by increased trading volume. The question remains whether this is enough to open short positions.

In our opinion, going short now might prove profitable but it also is risky. We would like to see Bitcoin actually close below $600 today before going short.

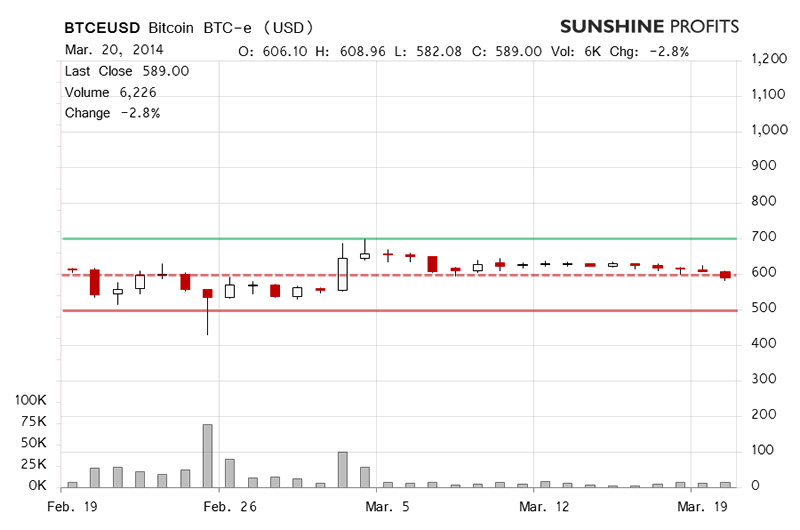

On BTC-e we saw Bitcoin go 3.8% down yesterday on increasing volume. The currency closed the day below $600 (dashed red line on the chart) and the short-term outlook became bearish.

Today, we have seen a continuation of the move down, interrupted by a strong move above $600 which was quickly denied. If anything is different on BTC-e than on BitStamp, it is the fact that the volume on BTC-e hasn't increased as much as on BitStamo. It is still already heavier than yesterday but the overall bearish short-term implications are weaker for BTC-e.

Even though the situation is now more bearish than yesterday, we would like to see Bitcoin close today below $600 before expressing any opinions on shorting Bitcoin. The current action suggests a more serious move down just around the corner but this is not a sure bet.

Summing up, in our opinion one should wait for at least another close below $600 before going short.

Trading position (short-term, our opinion): no positions. If Bitcoin closes today below $600, we might consider shorts but we'll take into account the overall market environment.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.