Stock Market SPX Nearing a Sell Signal

Stock-Markets / Stock Markets 2014 Mar 19, 2014 - 10:08 AM GMT SPX completed a 77.7% retracement of its initial decline in exactly 12.9 hours today. The A-B-C appears to be complete. Today’s experience is a “déjà vu all over again” of Putin’s first press conference. We know how that ended.

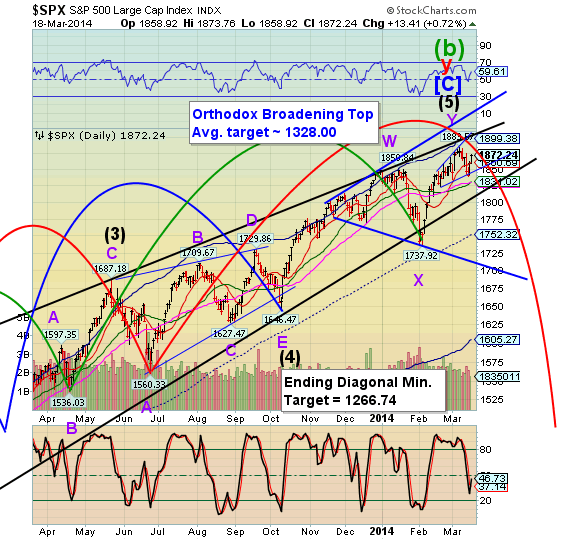

SPX completed a 77.7% retracement of its initial decline in exactly 12.9 hours today. The A-B-C appears to be complete. Today’s experience is a “déjà vu all over again” of Putin’s first press conference. We know how that ended.

The Hi-Lo ended the day at 225, 20 points above its mid-Cycle resistance at 205.00. That lifts the sell signal with this indicator, but we expected that. Give it another day, since things can change that quickly.

The Trigger for the Broadening Wedge formation is at 1850.00. Below that level the SPX is on a confirmed sell signal.

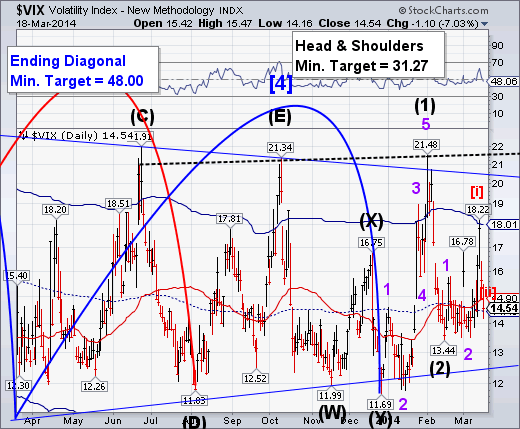

VIX closed just above its mid-Cycle support/resistance at 14.50. This leaves the VIX confirming the sell signal in SPX.

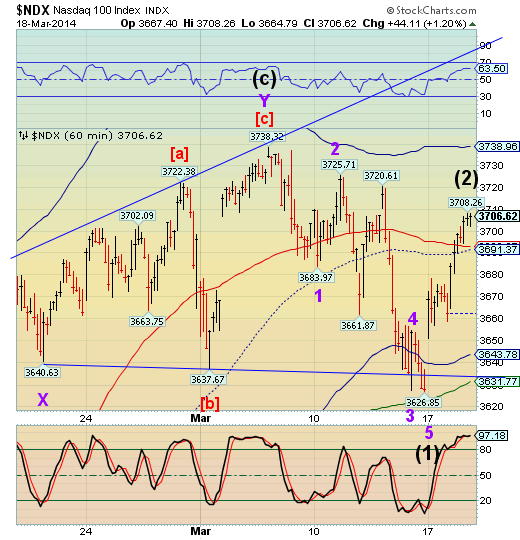

NDX also completed its retracement in 12.9 hours. The initial selling point is the mid-Cycle support at 3691.37. The sell signal is confirmed at the lower trendline of its Orthodox Broadening Top at 3635.00.

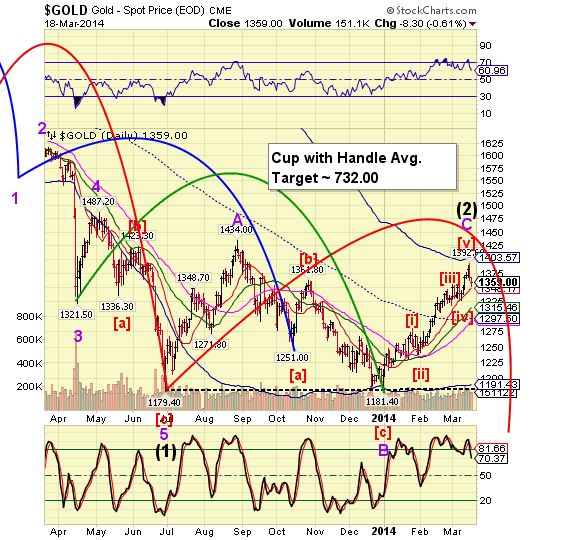

Gold is making its reversal. The initial support level that will confirm the decline is Short-term support at 1348.17. Usually a reversal off the Cycle Top at 1403.75 would be our initial sell signal. However, it fell short of that target, so I am being a bit more careful with the sell order.

I hope you all have a good night!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.