Bitcoin Market Tensions Building Up

Currencies / Bitcoin Mar 19, 2014 - 09:57 AM GMTBy: Mike_McAra

To the point: we don’t support any positions in the market just now.

To the point: we don’t support any positions in the market just now.

Mt. Gox has enabled users to log into their accounts and check their wallet balance. Before users get excited – this doesn’t mean that they will be able to access their money. For all we know, these balances are nothing more than numbers on a computer screen, or if you will in a database. Mt. Gox reminds of that using different wording:

Important announcement to all users confirming their account

This balance confirmation service is provided on this site only for the convenience of all users.

Please be aware that confirming the balance on this site does not constitute a filing of rehabilitation claims under the civil rehabilitation procedure and note that the balance amounts shown on this site should also not be considered an acknowledgment by MtGox Co., Ltd. of the amount of any rehabilitation claims of users.

Rehabilitation claims under a civil rehabilitation procedure become confirmed from a filing which is followed by an investigation procedure. The method for filing claims will be published on this site as soon as we will be in situation to announce it.

Again, Mt. Gox doesn’t even acknowledge that these are the amounts owed by them to customers. It is unclear whether the actual numbers are up-to-date or just figures from the past. The announcement doesn’t really change anything as far as the situation of Mt. Gox’s customers is concerned and we wouldn’t pay too much attention to it unless it turns out that the amounts shown in account balances are backed up with bitcoins.

Let’s move on to the charts.

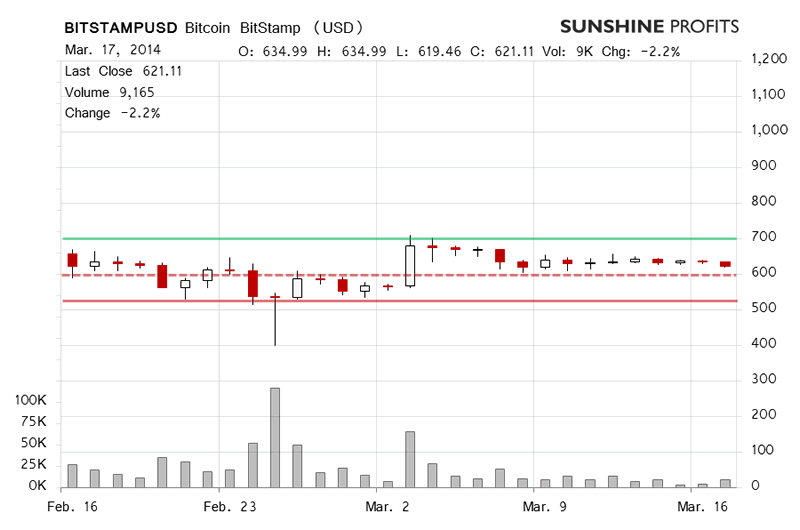

The move down has picked up in the last two days on BitStamp. Yesterday, Bitcoin lost 2.2%, a second day of increasing volume. The outlook was not changed since the currency didn’t break below $600 (dashed red line on the chart). Overall, yesterday there was more action than during the preceding days but not enough to support short positions.

Today the move down has deepened. At the moment of writing (before 10:30 a.m. EDT), Bitcoin is down 1.7% and the volume has already topped what we saw yesterday. We have a move down on increasing volume, which looks like a classic shorting opportunity. Is this enough to go short at this time? We don’t thinks so. The price briefly went under $600 but has retraced since and is currently around $610. This means that the move down has lost some of its steam, at least for now and at this moment, we don’t support going short.

It is conceivable that this is only a temporary break and Bitcoin will slip under $600 in the hours to come. If such a move indeed takes place and the volume picks up, there might be a shorting opportunity. We’re not quite there just yet.

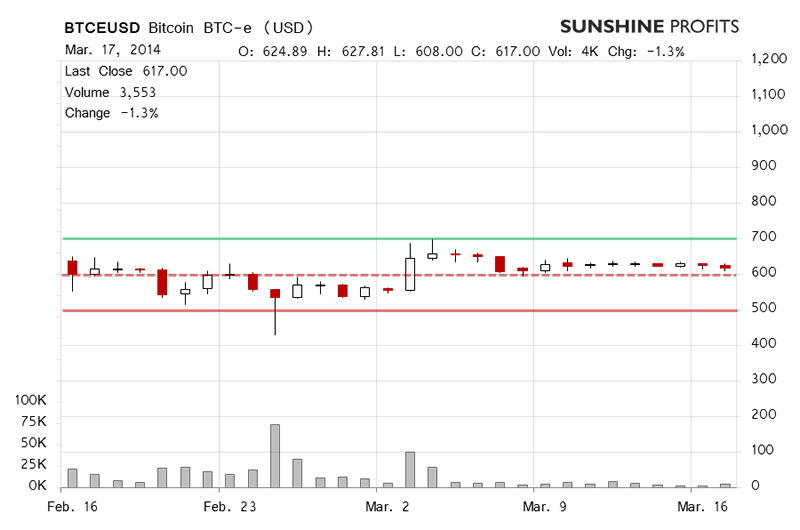

The picture on BTC-e is consistent with what was seen for BitStamp. We have a move down on increasing volume. If anything, the move today has so far been stronger than yesterday, even taking into account the small rebound from $600 (dashed red line on the chart) seen earlier today.

On the other hand, Bitcoin hasn’t gone as low on BTC-e as it has on BitStamp. For the time being today’s low on the former exchange is $598.00 compared with $591.13 on the latter. The most important part seems to be the fact that the currency has gone back above $600.

Right now, the situation is tense and we might see further moves down quite soon. At this moment, however, the possibility that such action will be stopped above $600 is significant enough for us not to support opening short positions just yet.

Summing up, in our opinion no positions should be kept in the market. This may change in the following hours if Bitcoin breaks below $600 on strong volume.

Trading position (short-term, our opinion): no positions. A break below $600 on strong volume would be a bearish short-term sign now.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.