Gold for Investors In Need of Financial Safety

Commodities / Gold and Silver 2014 Mar 15, 2014 - 12:20 PM GMTBy: Aden_Forecast

Gold is a safe haven

Gold is a safe haven

The emerging market turmoil in January got the safe haven ball rolling. The slowing U.S. economy then added another boost, especially with Yellen keeping the same policies as Bernanke.

And now geopolitical concerns, like the crisis in Ukraine, are giving gold yet another safe haven push upward.

Plus, with the U.S. dollar under pressure, while interest rates stay low, it's also bullish for gold.

Overall, physical demand and economic jitters are boosting the gold price.

The ever growing demand

Clearly, the world has plenty of uncertainty. From Russia, Ukraine, Venezuela, emerging currency devaluations, the sluggish U.S economy, as well as the slowdown in China, the world has hot spots.

With this backdrop it's easy to understand why demand continues to grow. The world wants gold.

Today gold is in a C rise that began with the December lows.

So far gold's 15% rise looks good and gold is strong above $1300. Gold could now easily rise further to test its August high near $1420.

In fact, if gold rises back up to its 23 month moving average and prior support, we could see the $1485 - $1536 level tested.

Keep in mind, a rise of this type would be a very good looking rise. But gold won't really turn bullish until it can rise and stay above these levels.

Gold stronger than gold shares... but for long?

Gold has fallen less than gold shares. Clearly, they are the volatile ones of the group. Gold shares tend to rise more, and fall more than gold does.

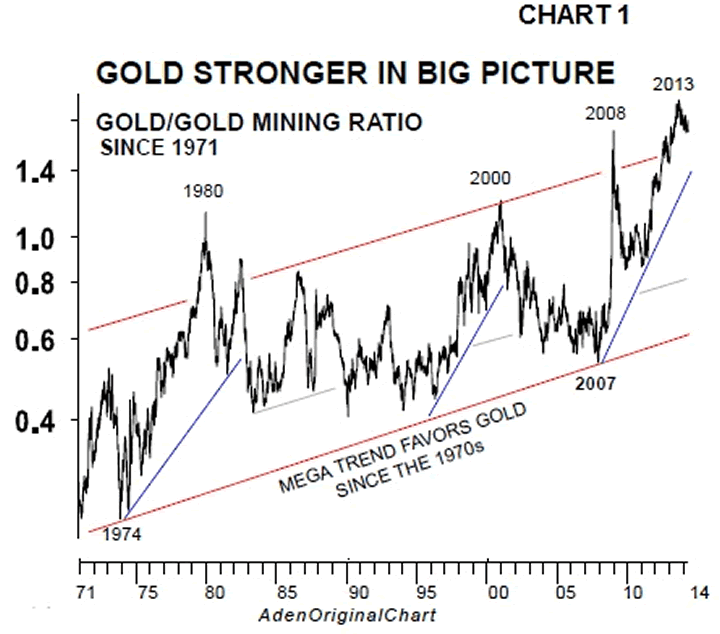

But comparing gold to gold shares, you can see on Chart 1 that the mega trend still favors gold.

In gold shares' case, the ratio rose to an extreme high in 2013, favoring gold, because gold shares collapsed when gold fell. This is saying that gold shares are poised to continue outperforming gold until a more balanced situation evolves.

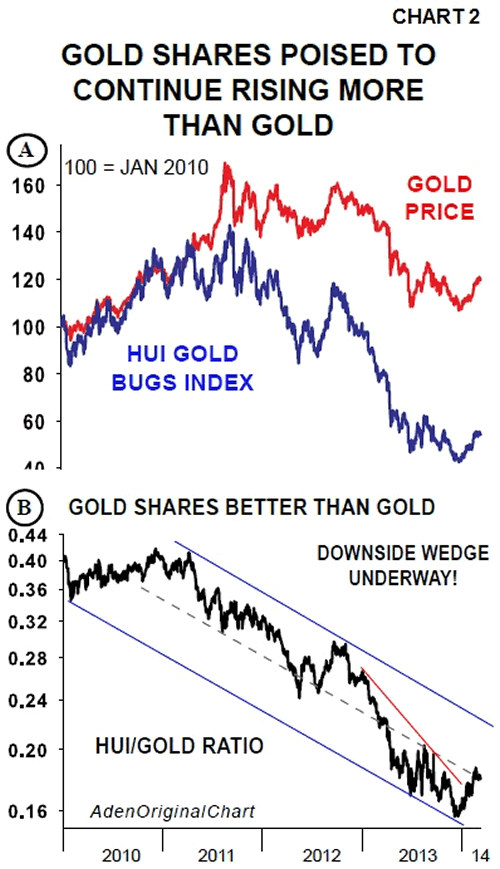

Chart 2A provides another angle. Here you can see how much weaker gold shares have been compared to gold since the 2011 peak. This weakness widened the most last year. But as the ratio (B) shows, it's formed a downside wedge also suggesting that gold shares will continue to outperform gold this year, and possibly beyond.

Gold shares are up 33% on average since their mid-December lows, which suggests that a major shift in sentiment is taking place. Investors are starting to turn toward gold and gold shares.

We recommend buying and keeping both.

By Mary Anne & Pamela Aden

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

Aden_Forecast Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.