Staples Store Closings Part of an Ugly Retail Sector Trend

Companies / Sector Analysis Mar 10, 2014 - 12:21 PM GMTBy: Money_Morning

David Zeiler writes: The news that Staples Inc. (Nasdaq: SPLS) plans to close 225 stores illustrates a grim trend in retail that will accelerate over the next couple of years.

David Zeiler writes: The news that Staples Inc. (Nasdaq: SPLS) plans to close 225 stores illustrates a grim trend in retail that will accelerate over the next couple of years.

The store closings are expected to save Staples $500 million by the end of 2015 and represent 12% of the office supply chain's 1,846 North American stores.

Title: staples nasdaq spls - Description: staples nasdaq spls"Our customers are using less office supplies, they're shopping less often in our stores and more online, and their focus on value has made the marketplace even more competitive," Staples Chief Executive Officer Ronald Sargent said.

The announcement on store closings came amid a disappointing Q4 earnings report. The company's earnings per share of $0.33 were well below expectations of $0.39. Revenue slipped 11% to $5.87 billion, which also missed expectations.

Guidance was poor as well, with Staples warning of lower profits and revenue for the current quarter.

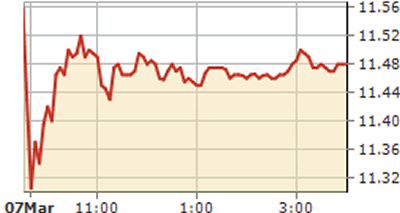

Investors punished Staples stock, which slumped 15% to $11.30 in mid-day trading. So far in 2014, SPLS is down nearly 28%.

Staples' woes are just the latest example of how retail stocks are struggling with the rise of e-commerce, which is often both more convenient and cheaper.

Note: We've a lot of market volatility this year - but that doesn't have to be a bad thing. Investors can make it work for them. Here's how to trade the market's most powerful index...

While retailers have made the move online - half of Staples' sales come from its website - the costs of maintaining a large number of physical stores that are generating less and less revenue has become a growing burden.

The office supply subcategory has already been hit hard. Shrinking sales forced rivals Office Depot Inc. (NYSE: ODP) and Office Max Inc. to merge last year.

Analysts had little sympathy for Staples.

Analysts had little sympathy for Staples.

"The company had years to close and shrink the store base and stuck to its guns, and that decision is likely to impact them for the foreseeable future. This is too little, too late," said Janney Capital Markets analysts in a note to clients while cutting their rating from "buy" to "neutral."

Staples Inc. (Nasdaq: SPLS) Not Suffering Alone

The Staples store closings come on the same day that Children's Place Retail Stores (NYSE: PLCE) announced it would close 85 more stores through 2016 in addition to the 41 it shuttered last year.

And RadioShack Corp. (NYSE: RSH) said on Tuesday that it planned to close 1,100 of its approximately 5,200 U.S. stores.

It's all part of a wave of closings, consolidation, and layoffs hitting brick-and-mortar retailers of all stripes as their customers migrate online to merchants like Amazon.com (Nasdaq: AMZN).

Earlier this year, JCPenney Inc. (NYSE: JCP) said it would be closing 33 stores and cutting 2,000 jobs, while Macy's announced plans to close five stores and lay off 2,500.

"There is often a mismatch between the number of stores retailers operate today compared to how many they would choose to operate if they had to do it all over again," Wells Fargo analyst Paul Lejuez told CNBC.

Store closings like we're seeing at Staples are becoming increasingly common as retailers desperately try to adjust.

"I believe we're going to hear a lot more announcements in the coming months," Michael Burden, a principal with Excess Space Retail Services, told CNBC. It's "an indication that there is a shift in the retail environment and it's one that will continue."

What do you make of the store closings at Staples, and of the larger trend affecting brick-and-mortar retailers? Would you miss shopping at physical stores, or do you shop exclusively online now? Share your thoughts on Twitter ;@moneymorning or Facebook.

Another source of pressure on retailers is the drive to raise the minimum wage to $10.10, an issue that the Democrats have put front-and-center for the November mid-term elections. Here are the top 10 U.S. companies with the most minimum wage workers...

Source : http://moneymorning.com/2014/03/06/staples-inc-nasdaq-spls-store-closings-part-ugly-trend/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.