Long Term Change from Average Earnings Growth above RPI to AEI below RPI

Economics / Earnings Mar 07, 2014 - 02:30 PM GMTBy: Jonathan_Davis

There are many reasons why the evidence is building that we, in the West, may be #TurningJapanese (it’s a Twitterese I coined). Japan experienced deflation for over 20 years, had a generational depression and stocks and property fell 80%, from 1989 to 2012.

There are many reasons why the evidence is building that we, in the West, may be #TurningJapanese (it’s a Twitterese I coined). Japan experienced deflation for over 20 years, had a generational depression and stocks and property fell 80%, from 1989 to 2012.

It is by no means confirmed yet. Just that the evidence is building.

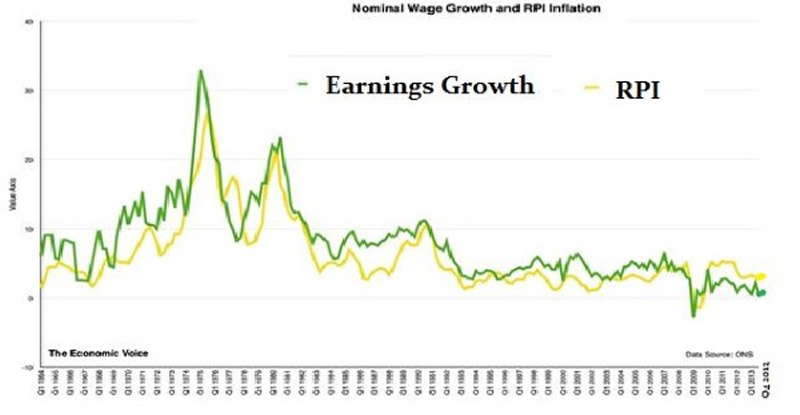

The above shows UK average earnings’ growth (in green) and The Retail Price Index (in yellow) over the last 50 years in the UK. The furthest right entry I added manually as the original ONS chart went up to March 2013. The chart now goes to December 2013. I hope you can see that until 2007, almost entirely during the prior 45 or so years, earnings’ growth outpaced the costs of living.

Inflationary.

Since 2008 the annual rises in the costs of living have been higher than earnings’ growth. So, think about that…for 45 years earnings almost always grew faster than costs. Now it is the other way around.If household spending has to be curtailed because costs are rising faster than incomes, this is net deflationary. It does not bode well.

I have been saying for several years that the game changer would be soon and then, from 2008, I have been saying we are seeing the game changing. This is yet more evidence that whatever those above the age of 50 or so experienced for ‘ever’ from the 70s through to the 2000s is over and – ever so gradually – reversing. Whatever the baby boomers experienced is NOT what their kids are experiencing or will experience. I think this chart is so crucial to the potentially ‘moving-into-a-depression’ thesis.

I was on with Robert Elms on BBC Radio London at the weekend, talking about whether or not going to University is worth it.

(My view is, unless studying vocationally for a high earning career, or going to a top Uni and getting a great grade, it’s not worth the paper it’s written on. You often don’t get a well paid job AND you are lumbered with £30-40,000 of debt!!!)

He replied something like ‘very interesting but quite wrong.’ He trotted out the usual crap that studies show that graduates earn £x00,000 more than non-graduates. I had to point out the bleeding obvious that that relates to graduates 30-40 years ago. NOT THE CURRENT CROP! This is how the (very highly paid Socialist / no charge educated) media thinks.

#BringBackCapitalism

By Jonathan Davis

http://jonathandaviswm.wordpress.com/

25+ year veteran of the world of financial services, the last 10 doing the same thing under his own name. We work with families all over the UK and in Switzerland and, indeed, on 2 other continents. If interested in our Wealth Management work, cast a glance at the firm’s website.

From time to time media folk call me and ask me to rant live or in the press. JD in the media.

I don’t buy hype. I don’t believe it’s the end of the world but I do believe, within a generation, the West will have no welfare state. The maths don’t lie. We’re toast. It’s obvious if you think about it.

© 2014 Copyright Jonathan Davis - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.