Did Today’s Flow of Funds Report Predict the Fed’s Next Confession?

Politics / US Federal Reserve Bank Mar 07, 2014 - 04:12 AM GMTBy: F_F_Wiley

In return for speaking fees reported to be “at least” $250,000, Ben Bernanke confessed a few of the Fed’s missteps while speaking to guests of the National Bank of Abu Dhabi on Tuesday:

- “Bernanke says he underestimated impact of subprime problem.”

- “This is going to sound very obvious but the first thing we learned is that the U.S. is not invulnerable to financial crises,” Bernanke said.

- “Bernanke says he thought slowdown would be ‘moderate’.”

Bernanke’s gentle mea culpas had us wondering what kind of confessions we may hear next. It’s probably not surprising that we didn’t have to wait long for clues.

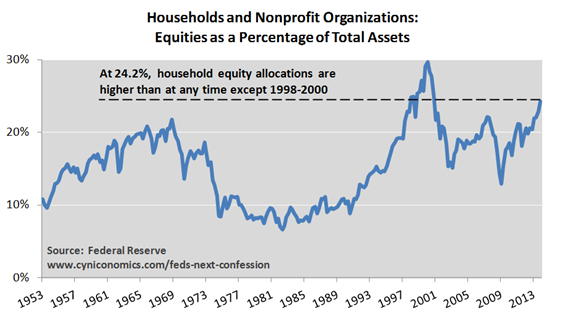

Consider this chart created from the household balance sheet in today’s Flow of Funds report:

As shown, the aggregate equity allocation for U.S. households is now at a level that’s only ever been reached in the Internet bubble years of 1998 to 2000.

This will surely lift spirits at the next FOMC meeting. (Cue the laugh track.) Higher equity allocations are exactly what the Fed tries to achieve with its so-called portfolio balance channel – their jargon for driving up the prices of a few assets by enough that you push investors into other assets (risky assets, such as equity, in the present case).

It doesn’t seem like such a good result to us, though. As we discussed here and here, there are a variety of indicators linking today’s S&P 500 valuation to at least the middle stages of the Internet bubble. Now the household balance sheet puts us right back in, well, the middle stages of the Internet bubble. What could possibly go wrong?

The Fed’s confessions haven’t gone far enough

Getting back to Bernanke’s speech on Tuesday, the conference attendees in Abu Dhabi were told that: “For the future, I’m in a mode of reflection.”

Unfortunately, such reflection – whether by Bernanke or his former colleagues still at the Fed – only extends so far. The Fed’s basic beliefs and workings are clearly sacrosanct, no matter how many times they fail. And as long as that continues to be the case, expect current and future Fed Chairs to follow Bernanke’s lead and draw up a list of boom-bust blunders shortly after leaving office. They can then offer a first-hand reading sponsored by large financial institutions at $250,000 a pop. It’s nice work if you can get it.

F.F. Wiley

F.F. Wiley is a professional name for an experienced asset manager whose work has been included in the CFA program and featured in academic journals and other industry publications. He has advised and managed money for large institutions, sovereigns, wealthy individuals and financial advisors.

© 2014 Copyright F.F. Wiley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.