Crimea Crisis - Euro-zone Economy Hide and Seek

Interest-Rates / Euro-Zone Mar 07, 2014 - 04:04 AM GMTBy: Raul_I_Meijer

Crimea just declared itself part of Russia. Well, its government did. What the status is of that government is unclear, but then that’s also true for the Ukrainian government, which the west is all too eager to declare the one and only. Perhaps the first thing to do for the US and EU is to sit down with Russia and agree on the legal standing of the Kiev government, since without any such agreement no progress can be achieved. They’d have to do that without “Yats” present, because Russia doesn’t recognize him as a talking partner. Putin can promise to leave Yanukovych home if the US does the same with “Yats”.

Crimea just declared itself part of Russia. Well, its government did. What the status is of that government is unclear, but then that’s also true for the Ukrainian government, which the west is all too eager to declare the one and only. Perhaps the first thing to do for the US and EU is to sit down with Russia and agree on the legal standing of the Kiev government, since without any such agreement no progress can be achieved. They’d have to do that without “Yats” present, because Russia doesn’t recognize him as a talking partner. Putin can promise to leave Yanukovych home if the US does the same with “Yats”.

First burst of sanctions just in: US visa restrictions for Russians AND Crimeans (that was fast…). Toothless nonsense of course, that only makes diplomacy harder. Obama and Putin were on speaking terms until recently, did things on Syria and Iran together, wonder what happened. Planning to blame it all on Putin? Not wise. “Yats” says Crimean declaration today and March 16 referendum are illegal, but they were accepted by Crimean parliament, just as he claims his presidency was in Kiev. Under international law, a region can’t just switch nations, but it does have the right of self-determination. Russia has vowed to wait for results of the referendum. As long as no-one starts shooting, that might work.

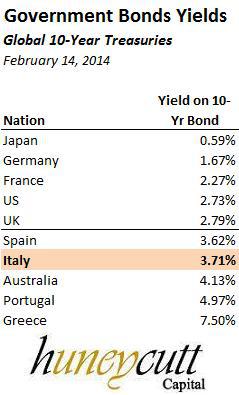

But I was going to address something else today. I saw something to the tune of record low yields for Italy and Spain last night, and I was thinking that’s very peculiar. Like a sign of how much the world has been turned on its head. Things that look good at first sight but are not at all when you lift the veil. Mario Draghi just did a press-op and tried to sound cheery when explaining the ECB decision not to cut rates, the usual we got it all under control meme, which nobody believes but then all they want is for him to keep up stimulus. And they bet he’s going to do QE at some point anyway, if only because he can’t cut rates much from 0.25%, and the IMF too hinted he should QE. Draghi’s Kodak moment of the day came when he said that ” … inflation should be around 1.7% by the final quarter of 2016″. That’s 3 years from now, and Mario has a hard time seeing ahead 3 weeks.

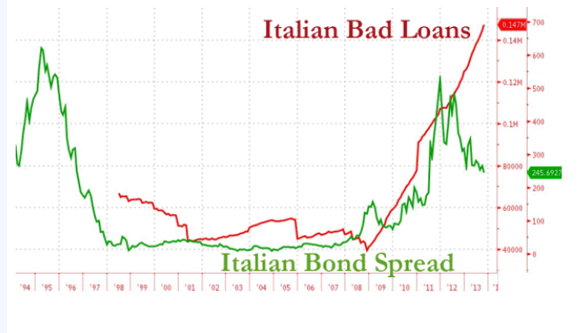

Still, it’s true, Italian and Spanish 10 year yields are at 3.36% or so now, the lowest since about 2006, so pre-crisis. and that’s down from 3.6-3.7% 3 weeks ago, and 7% in 2011. That’s right, that’s when Draghi said he’d do anything to protect them. He managed to push that beyond Germany because they think he won’t have to, and anyway it won’t cost them, but they could be wrong in that. See this graph for instance, that shows bond spreads Italy vs Germany have come down a lot, but numbers and percentage of bad loans just keep increasing.

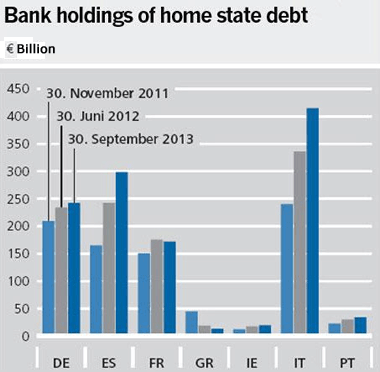

The ECB, and hence Germany, are now effectively guaranteeing those loans. In the same way that they’re propping up the huge holdings in domestic sovereign bonds held by Italian and Spanish banks. You may remember the story behind those purchases: the ECB can’t lend to nations, but it can lend to banks, so governments push banks to borrow in Frankfurt and buy sovereign bonds with the proceeds. The fact that this practice is still ongoing assures us that Draghi is in on it.

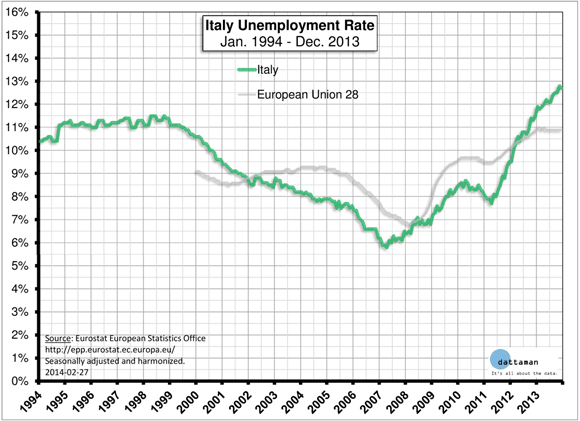

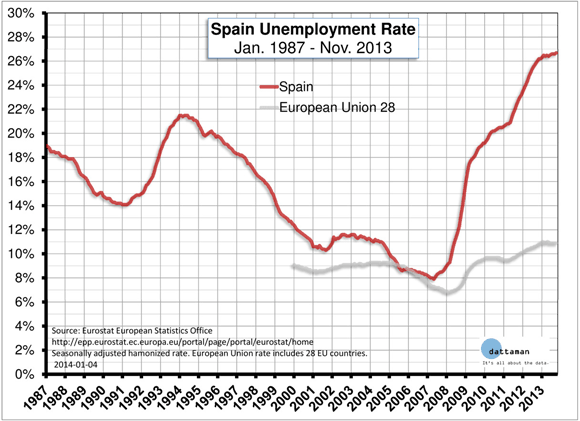

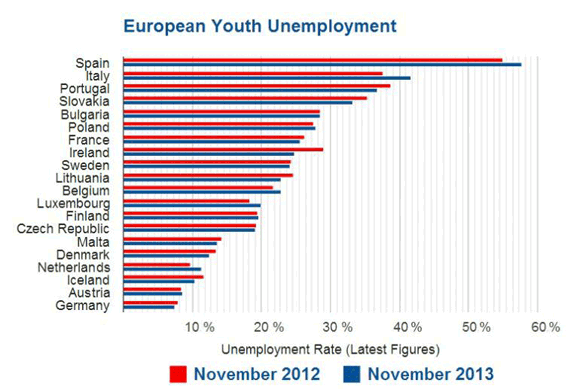

The tale out of the ECB is that Italy and Spain are doing much better. But that doesn’t show anywhere other than in made up financial stats. There is not a single healthy economy on the planet that has unemployment issues such as these:

And you must wonder about the Italian 13% rate vs the Spanish 26%, certainly in light of youth unemployment rates. Which are worse in Spain than Italy, but not by the 100% the overall unemployment numbers differ.

But just look at that last graph, and tell me how it can be that an economy can be considered healthier than it was (which makes yields fall) two years ago, when – youth – unemployment stats just keep getting worse. If those yields were any sort of barometer of an economy, why are they where they are today?

Look at French and German jobless youth, and then at their 10 year yields. Do the same with Spain and Italy vs Germany. And then please explain what’s going on.

I think the only conclusion is that Mario Draghi has created a very distorted – picture of – Europe. The markets don’t care as long as he keeps pumping money in. And they may even buy Italian and Spanish bonds as long as these a’re de facto guaranteed by Germany. But Spain still has an enormous real estate problem, and Italy unveils more bad loans by the day. And the EU just promised $15 billion to Ukraine that it clearly doesn’t have and even if it did could be put to good use among member states.

Yes, it all looks good, those yields. But they also mean that Spain and Italy can borrow more, cheaper. And while that sounds nice, is it really a good idea that they can get even deeper into debt? What Mario Draghi does is paper over the cracks, but the cracks just keep getting wider – see the unemployment stats – and he will need ever more paper. Until he runs out.

China, Japan, the US, Britain and the EU, they’re all playing the exact same game. Hide and don’t seek. It’s a stupid game, and it’s even stupider that people believe what they’re told they see.

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.