U.S. Dollar's Long Term Decline

Currencies / US Dollar Mar 06, 2014 - 12:58 PM GMTBy: Axel_Merk

The cleanest of the dirty shirts doesn’t necessarily preserve your purchasing power. Sure, the U.S. dollar has beaten the Russian Ruble and some others of late, but when it comes to real competition, the U.S. dollar has taken a back seat. The U.S. dollar’s long-term decline may be firmly in place and investors may want to buckle up to get ready for the ride.

The cleanest of the dirty shirts doesn’t necessarily preserve your purchasing power. Sure, the U.S. dollar has beaten the Russian Ruble and some others of late, but when it comes to real competition, the U.S. dollar has taken a back seat. The U.S. dollar’s long-term decline may be firmly in place and investors may want to buckle up to get ready for the ride.

Two years ago, in the midst of the Eurozone debt crisis, the euro beat the greenback and last year the euro was the best performing major currency. Over the years, we have written extensively about what may be the most misunderstood currency. However before we discuss why the euro may be doomed to soar higher, we should zoom in on the fact that the Federal Reserve might have the best printing press of them all:

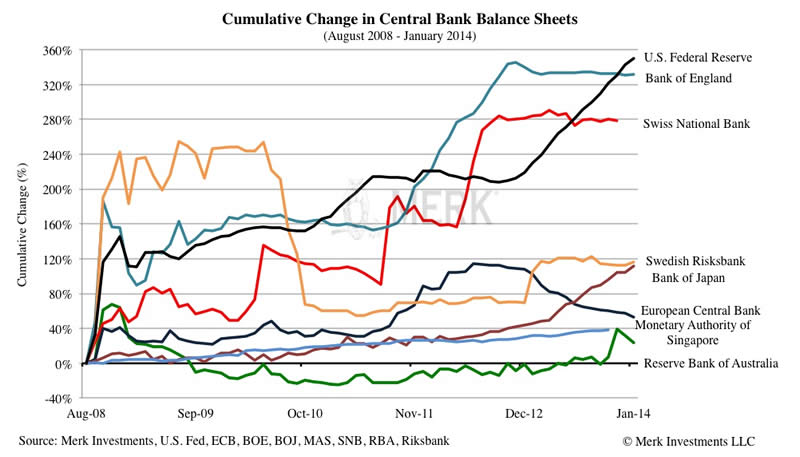

Even former Fed Chair, Ben Bernanke, referred to central bank balance sheet growth as printing money, although no physical currency may actually be printed. Instead, the Fed has been buying Treasuries and Mortgage-Backed Securities (MBS) through strokes of a keyboard, crediting the accounts of the banks that the securities were purchased from. While the Bank of Japan is trying to play catch-up as of late, the Fed remains the clear leader. Bank of England has also been busy “tapering” – plateauing out at a high level. Part of the reason why pundits try to talk up the greenback is because of what they perceive to be higher rates in the future. There are a couple of things wrong with that view:

- Historically speaking, the dollar has typically weakened in a rising rate environment. This is due to the fact that foreigners tend to be large holders of Treasuries, and as rates rise, those Treasuries are at risk of losing value, and provide a disincentive for foreigners to hold them. As a result, the dollar has historically benefited during late stages of a tightening cycle as the decline of Treasuries might be reverted yet again (i.e. the next bull market in Treasuries is anticipated). Having said this, we are not in a “typical” environment, which makes relying on myths even more problematic.

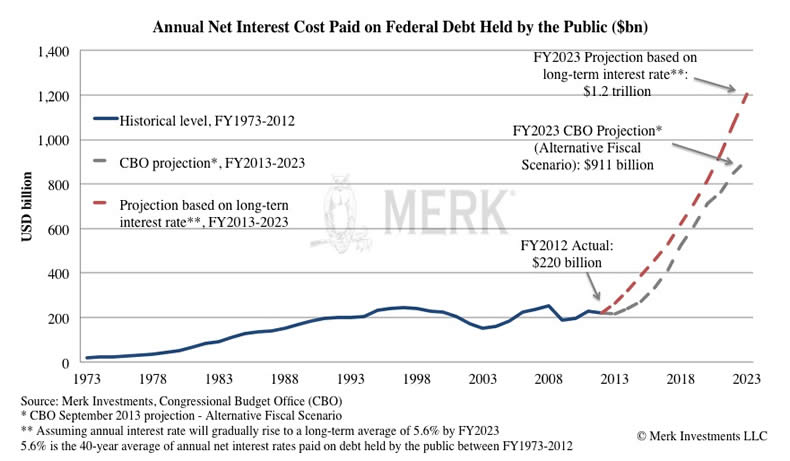

- More importantly, we don’t think we can afford positive real interest rates. The biggest threat we face might be economic growth, because a stronger economy may warrant higher interest rates in order to contain rising inflationary pressures. If interest rates were to be elevated so that the cost of borrowing for the U.S. Government would revert back to its historic average, the annual interest expense may rise from the current $220 billion a year to $1.2 trillion a year, thus crowding out other government spending.

- Fed Chair Janet Yellen testified in no uncertain terms that the Fed’s dual mandate to promote both price stability and maximum employment is no conflict because inflation is not a problem. I don’t recall former Fed Chair, Ben Bernanke, ever explicitly denouncing the Fed’s price stability mandate and to provide further substance to this view, the Fed has all but promised to be late in raising rates. That’s not a surprise; we think the Fed needs inflation to push up home prices (to bail out millions of home owners that are still ‘under water’ as they otherwise make for bad consumers) and to dilute the value of government debt. Higher inflation rates will likely spell bad news for the U.S. dollar.

- As the central bank balance sheet comparison shows, the European Central Bank (ECB) has been mopping up liquidity rather than “printing” more money. Unlike the Fed that prints a boatload to buy securities, the ECB’s liquidity operations are demand driven. That means so-called long-term refinancing operations (LTROs) are conducted to temporarily give banks cash for posting collateral. However, for a variety of reasons banks have returned unwanted liquidity.

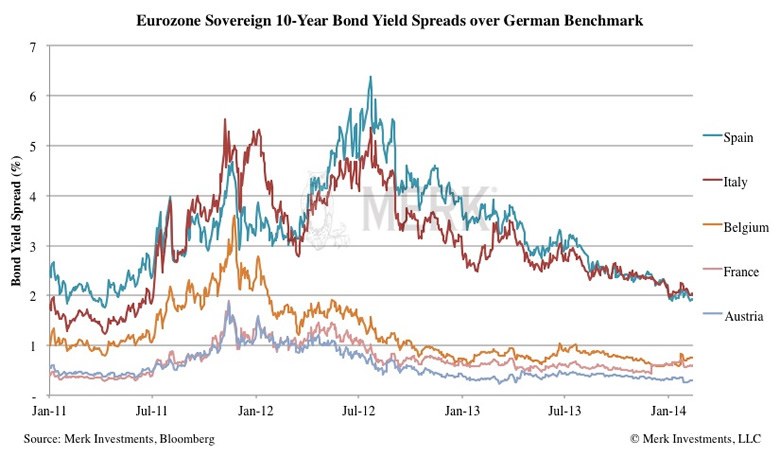

- At the same time, there’s an amazing stimulus where it is needed most: the cost of borrowing for weaker Eurozone countries has been falling since August 2012. This may be the most powerful stimulus the Eurozone has; it’s a stimulus that’s ongoing and intensifying:

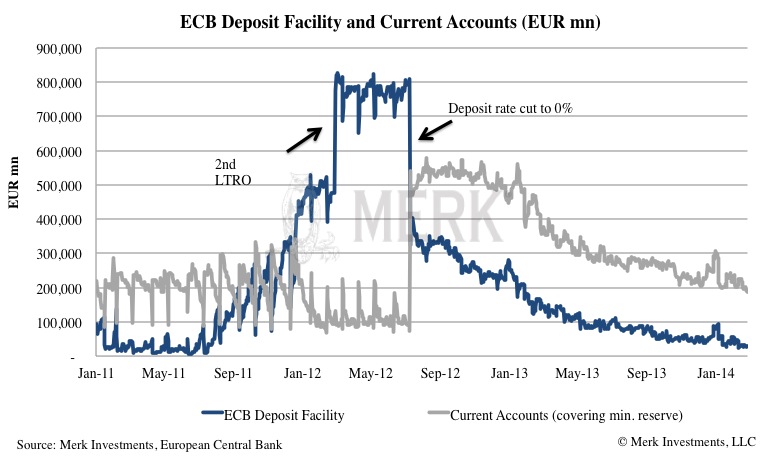

- Yet, inflation in the Eurozone has been running below the ECB’s target causing lots of pundits to call for the ECB to do more to stimulate the economy. Most recently, the International Monetary Fund (IMF) joined the fray, calling for further rate cuts, possibly even negative deposit rates. The deposit rate is applied to what is referred to as the ECB deposit facility. In the summer of 2012, the interest banks received on deposits in that facility was lowered to zero. Not surprisingly, banks stopped using the facility and parked their cash in another account at the ECB. Without going into details of the inner workings at the ECB, the chart below shows how both facilities together amount to less than €250 billion. That may sound like a good chunk of change but lowering these rates are unlikely to change Eurozone inflation dynamics:

- Even more worrisome would be if the ECB were to indeed impose negative interest rates that may potentially cause a major public backlash. Let’s not forget that one of the missions of any central bank is to promote confidence in a currency and while we don’t think negative deposit rates would have a meaningful economic impact, the public outcry may be dramatic. Think of the headlines in German newspapers, “First they took our Deutsche Mark, now they steal our euros!” – In our opinion, it will be far less likely that German policy makers will go along with another bailout especially if public sentiment about the Eurozone could be put at risk. In fact, we think this would be an irresponsible tradeoff given the rather limited effectiveness, and potential for severe downside risk.

In practice the ECB has mostly limited itself to talking down the euro. Any attempt to talk down the euro has only lasted from a few hours to a few days. The ECB has also cut rates, causing the currency to weaken for a few weeks. ECB President Draghi has also encouraged the creation of an asset backed securities market, i.e. securitizing an amazing amount of Eurozone assets, in order to boost economic growth. The main problem with this idea is that it takes years to develop such a market (and has its own sets of risks). Then there’s the talk of the ECB engaging in broad based asset purchase programs akin to what the Fed has been doing. While technical issues of such a program might be overcome, what exactly would this program achieve? Lowering yields? Well, that’s happening where it’s needed, in the Eurozone periphery and Germany doesn’t need the additional jolt.

Just because it wouldn’t make much sense doesn’t mean it won’t happen. Maybe the euro will weaken if such a program is announced, but because of the limited effectiveness, such weakness may yet again prove temporary.

The Eurozone has another major advantage over the U.S. and although more difficult to quantify, the massive Fed purchase programs cause U.S. asset prices to become distorted. It may not be possible for capital to be allocated efficiently, and thus create the risk of asset bubbles. While U.S. policies cause ripple effects throughout the world (there are plenty of other central banks pursuing similar policies, most notably, the Bank of Japan), the Eurozone is showing important signs of healing. It’s important to note that when a crisis flares up in the Eurozone, we longer see the so-called risk of contagion like we did during the peak of the crisis in Cyprus, Spain. Where they held a Treasury auction paying the lowest yields since the early 1990s. Of late, hedge funds are buying Greek banks, as well as Spanish real estate. We are not suggesting these are good buying opportunities, but it is a very healthy development that so-called “risk friendly” capital is exposed to what are clearly risky assets. Should these investments fail, it is a hedge fund losing money, rather than a major European bank. A key driver behind many of the reforms that have been undertaken is from the pressure of the bond market. Don’t get us wrong there are plenty of challenges left in the Eurozone, especially as bond market pressure has abated. But in our assessment, it is wrong to conclude that the euro must be weak as a result.

Coming back to the U.S., one of the greenback’s greatest vulnerabilities may well be its current account deficit. In plain English, the current account deficit is the amount needed to come into the U.S. in order to keep the dollar from falling (hence the view that the deficit suggests foreigners want to invest in the U.S.). Even with recent improvements in the current account deficit, the U.S. still needs to attract over $1 billion U.S dollars every day to keep the currency from falling. Having said that, the current account balance is not a good predictor of exchange rates. In our analysis, it is an important indicator of the potential vulnerability of a currency. Think about what may get U.S. policy makers to make the tough decisions to get our deficits sustainable? We think it is the pressure of the bond market. However, for the Eurozone as a whole, budget deficits were financed internally, even during the peak of the crisis. In contrast, the greenback relies on inflows from abroad and as such, if bond market acts up the U.S. dollar might come under more pressure than the euro has ever seen and would force policy makers to impose reforms.

Don’t miss another Merk Insight: sign up for our free newsletter where we discuss how the U.S. dollar, gold and currencies impact investors’ portfolios.

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.