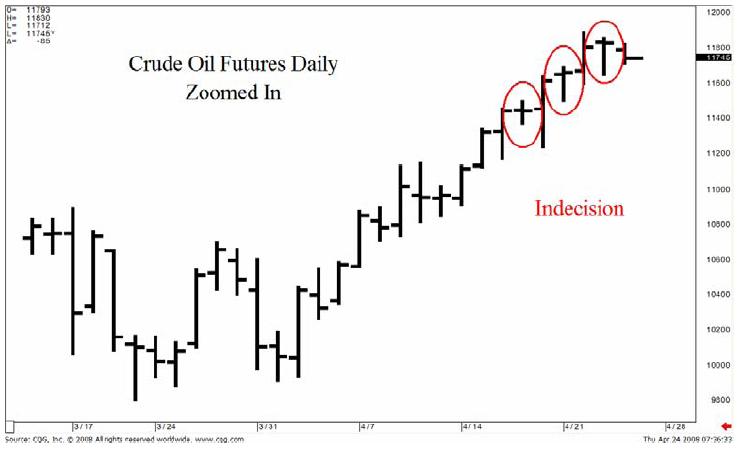

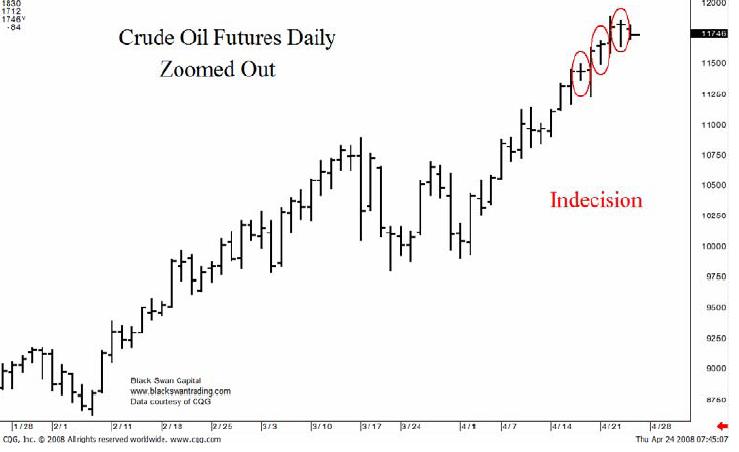

Crude Oil Bulls Show Technical Signs of Weakening

Commodities / Crude Oil Apr 24, 2008 - 07:31 AM GMTBy: Black_Swan

There’s not a whole lot of technical analysis you can do when an underlying security or asset is shooting straight up through uncharted territory, record high after record high.

But regardless of the situation, you can always analyze price action one day at a time.

For crude oil, this is the only way to approach it right now – dissecting the daily battle between the bulls and the bears. It’s obvious the bulls have been in control for quite some time, but it looks as though their stampede is being challenged a bit.

The daily bars that are circled show indecision - a stalemate among the bulls and the bears. The open and close on those days are roughly equivalent and means that no one side was dominant in moving prices. These days become more meaningful at trend extremes since this indecision could mark a turning point in trader sentiment.

Might the technicals be enough to stop crude oil dead in its tracks? I’d be willing to bet that if the technical picture initiates a nearterm top, many analysts will begin to reconsider the fundamentals driving crude to such ridiculous levels. After that, anything can happen.

Jack Crooks

Black Swan Capital LLC

http://www.blackswantrading.com/

Black Swan Capital's Currency Snapshot is strictly an informational publication and does not provide individual, customized investment advice. The money you allocate to futures or forex should be strictly the money you can afford to risk. Detailed disclaimer can be found at http://www.blackswantrading.com/disclaimer.html

Currency Currents is available for only $49 per year. Just visit the sign-up page on our website to subscribe: http://www.blackswantrading.com/Currency_Currents.html

Black Swan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.