Gold Price Off To A Good 2014 Start

Commodities / Gold and Silver 2014 Feb 22, 2014 - 03:37 PM GMTBy: Aden_Forecast

Gold has moved to the front burner. It's risen nearly 11% from its December low to a 3+ month high. So 2014 is off to a good start.

Gold has moved to the front burner. It's risen nearly 11% from its December low to a 3+ month high. So 2014 is off to a good start.

Gold shares stronger

Gold shares are rising even more than gold. We like gold shares and recommend buying both gold and gold shares. The upside is open to at least a decent intermediate rise.

Silver is also breaking out, after dragging in recent months. Platinum, and especially palladium, are looking good too. In fact, the whole precious metals universe is looking a lot better.

This upcoming rise will tell us a lot about the overall strength (or weakness) in the gold and precious metals markets. But for now, the fundamentals and the technicals are on very positive ground.

Growing demand, keeps growing

Obviously the Fed is fearful of a runaway gold price. Manipulation can keep pressure on the gold price, but we believe that strong demand will eventually win in this normally "free market."

It's no secret that China is the world's top producer and biggest buyer of gold. It had record production and consumption according to the China Gold Association. China's 2013 consumption topped 1000 tons for the first time.

China is on a mission to push up its gold reserves. It now holds the third largest amount of gold, behind the U.S. and Germany.

The U.S. Mint, for example, also saw a robust January with gold purchases surging 63%, while silver coin sales were even more impressive, almost quadrupling.

This is just a sample of the demand around the world. Japan's biggest bullion retailer, for instance, saw gold sales reach a 5 year high as investors sought refuge from Abe's campaign to fuel inflation and weaken the yen.

This is a worldwide phenomenon and it's increasing demand for coins, bars and jewelry in many countries.

We had previously talked about the physical market being stronger than the paper market. And while this is still true, we also saw the biggest jump in holdings in the largest ETF, GLD, since Nov 2011.

Be prepared

With all this demand, we could be in for surprises this year, and we want to be prepared. Keep in mind, gold has appeal, in spite of its bear market. Plus, it's especially appealing with interest rates so low.

Gold Timing: 'C' rise starting!

Gold's breakout, above $1265 shows that an intermediate rise has started. Gold is now clearly above its 15 week moving average and gold shares are too.

C rises tend to be the best rise in the recurring pattern, and in a bull market this leg up reaches new record highs. We don't expect anything like that now, but depending on its strength we'll see if the bear market tries to turn bullish.

The last C rise was the best and longest C rise in the bull market. It lasted from Apr 2009 to Sept 2011 and gold gained almost 120%.

Considering the Fed pumped more than $2 trillion into the financial system from Dec 2008 to June 2011, you can understand why this was by far the best C rise in the bull market.

Before this, we saw a range of gains from 11% to 56%, with a solid average being around 30%.

What To Watch For

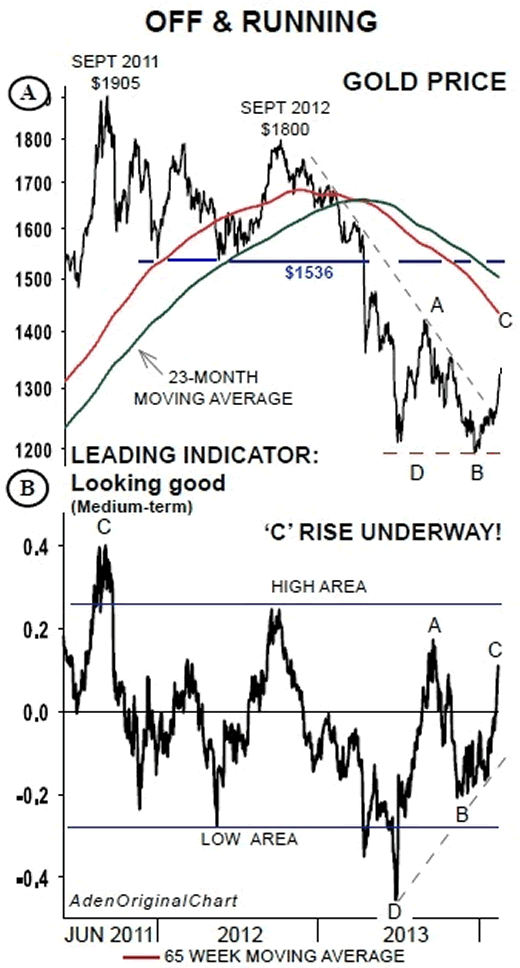

For now, if gold stays above $1265, it could rise to the $1420 level, which was the A peak last August (see Chart 1A). This also coincides with the 65-week moving average level, and it would be a nearly 20% rise from the December lows.

Chart 1A and 1B

If this is all the rise we get, then the bear market will still have its grip on gold.

If the $1420 level is surpassed, however, we could see gold jump up to the $1536 level, which was the old support of a year ago before gold fell last April. And it's also near the 23 month moving average.

In this case, it would be an impressive almost 30% rise from the Dec lows but again, if this is all we get, then the bear would still be in the driver's seat.

Keep in mind, this type of rise, as good as it would be, would merely be erasing the worst part of the 2013 decline. The market won't begin to look like it's really bullish until it surpasses the $1536 level.

These are the stepping stones we could see going forward.

Meanwhile, on the downside, gold below $1265 means it could test the Dec lows once again.

By Mary Anne & Pamela Aden

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

Aden_Forecast Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.