Stock Markets Are Still Loving The Economy’s Increasing Problems

Stock-Markets / Stock Markets 2014 Feb 22, 2014 - 03:15 PM GMTBy: Sy_Harding

The economic reports turn ever uglier, and the stock market loves it.

The economic reports turn ever uglier, and the stock market loves it.

Something seems wrong with that picture.

In recent months, it has been the unexpected widening of the U.S. trade gap, as exports decline and imports rise. It has been unexpected plunges in retail sales, home sales, auto sales, durable goods orders, and factory orders. It has been downward revisions of previous reports for December.

This week’s reports have been more of the same.

The Empire State (NY) Mfg Index plunged from 12.5 in January to 4.5 in February, considerably worse than the consensus forecast of a weather-related decline to 9.0. The Fed’s Phila Mfg Index plunged from a positive reading of +9.4 in January to -6.3 in February. The consensus forecast was that it would decline due to weather but remain positive at +7.3. Its new-orders component, an indicator for future manufacturing, plunged from + 5.1 to -5.2.

From the important housing industry, this week’s reports were that the Housing Market Index, which measures the confidence of national homebuilders, plunged from 56 in January to 46 in February, its lowest level in 9 months, more than 50% of homebuilders now pessimistic about the future. New housing starts plunged 16% in January and permits for future starts declined 5%. While weather was again blamed, housing starts in the weather-hammered northeast were actually up in January, and down sharply in the rest of the country, including the balmy south.

Friday’s report was that ‘existing home’ sales nationally fell 5.1% in January, as sales continue the downtrend that began last May when mortgage rates began to rise. Sales fell 7.3% in Western states, the region less affected by winter storms, a significantly larger decline than in the Northeast and Midwest. Meanwhile, mortgage rates rose again last week, the 30-year mortgage rate, at 4.33%, now 21% higher than a year ago.

Wall Street firms and major banks continue to slash their forecasts for the economy quite dramatically, not only for this quarter, but also for the fourth quarter of last year.

Last week’s quarterly filings with the SEC revealed that billionaire investor George Soros, a representative of so-called smart money if there ever was one, doubled his bearish bet that the S&P 500 will be tumbling. Not a minor bet either, but $1.3 billion in Put options on the S&P 500 Index, about 11% of the assets in his fund, and its largest position. He has had a large bet against the S&P 500 since last spring, which he apparently held through the market rally last year and doubled in the fourth quarter.

The world’s largest retailer, WalMart, reported disappointing fourth quarter sales and earnings, and warned it expects economic conditions will continue to weigh on its results.

The economic problems are not confined to the U.S.

The IMF warned on Wednesday that the global economic recovery is still weak and significant downside risks remain.

China, the world’s second largest economy, reported its manufacturing activity unexpectedly declined to a seven-month low in February. China’s HSBC PMI manufacturing index, which was already under the 50 level that indicates economic contraction, slid further from 49.5 in January to 48.3 in February.

Japan, the world’s third largest economy, reported its economy grew just 0.3% in the fourth quarter, missing the consensus forecast of 0.7%. For the year, Japan’s GDP rose just 1.0%, missing the consensus forecast of 2.8% by a wide margin. On Thursday, Japan reported additional negative news. Its trade deficit unexpectedly widened significantly in January, to a new record.

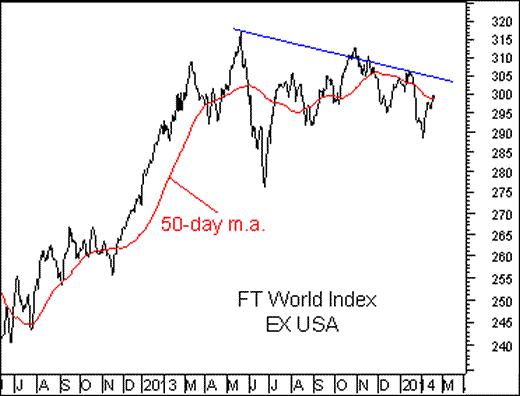

In general, global markets outside of the U.S. seem to have been factoring in concerns since May 2013, about the time George Soros began making his huge bet that the S&P 500 would tumble sharply.

However, the U.S. stock market recovered from its tumble in May and rallied back to a new record high at year-end.

It did decline for five straight weeks to begin 2014, after the negative economic surprises began. However, even as the negative surprises and corporate warnings have worsened significantly, the market has shrugged off its concerns and rallied strongly for the last two weeks.

The U.S. market usually gets it right in anticipating what lies ahead. However, so do global markets (and George Soros).

An odd situation that could soon be resolved quite dramatically one way or the other.

The stock market is betting it will be resolved when better weather proves the troubling appearance of a crumbling economy since December was simply weather related, with a back-up position that if not, the Fed will rush back in to the rescue.

Let’s hope it’s the U.S. market that has it right.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.