The Probability That the Gold & Silver Miners Bear Market is Over is Now High

Commodities / Gold and Silver Stocks 2014 Feb 21, 2014 - 02:22 PM GMTBy: Rory_Gillen

It’s been a tough bear market for the gold and silver miners. The Philadelphia Gold & Silver Miners Index (XAU) reached a weekly high in April 2011 (225.79) and declined some 64% peak to trough by December 2013 (weekly low 80.43). After an 11-year bull market in the gold price from 2001 to 2013, which took it from $255 a troy ounce to a peak of $1,900 an ounce and back to $1,300 currently, the gold miners are not just back to 2001 levels, but also the mid-1980s levels. In other words, the gold and silver miners have not added value for investors over the long-term, and even a quadrupling in the gold price in the 2000s did not see them deliver higher and sustainable earnings, cash flows and dividends for investors.

It’s been a tough bear market for the gold and silver miners. The Philadelphia Gold & Silver Miners Index (XAU) reached a weekly high in April 2011 (225.79) and declined some 64% peak to trough by December 2013 (weekly low 80.43). After an 11-year bull market in the gold price from 2001 to 2013, which took it from $255 a troy ounce to a peak of $1,900 an ounce and back to $1,300 currently, the gold miners are not just back to 2001 levels, but also the mid-1980s levels. In other words, the gold and silver miners have not added value for investors over the long-term, and even a quadrupling in the gold price in the 2000s did not see them deliver higher and sustainable earnings, cash flows and dividends for investors.

The recent bear market set in well before there was any sign of weakness in the gold and silver prices. Miners had been struggling before that with an increase in political interference regarding mine permitting, a gradual lower grade of gold per tonne of mined material, industrial unrest in many jurisdictions and a higher oil price all adding materially to costs. In addition, ill-discipline on the acquisition front detracted rather than added to shareholder value.

The Beginning of the End of the Bear Market

In my view, the first signs of a market bottom in the gold and silver miners occurred in April 2013. As the chart shows, back then we saw the XAU Index capitulate by 33% below the 30-week moving average as investors fretted about the impact on miners of the falling gold and silver prices. Capitulation is a useful indicator in highlighting the speed of decline. Acceleration in the speed of decline often marks the bottom of a bear market, or at least the start of a bottoming process.

In this case, it was the start of the bottoming process. In late June 2013, the gold price itself then capitulated with a rare 20% decline below its own 30-week moving average. This led to a second capitulation in the gold and silver miners with the XAU Index once again declining 32% below its 30-week moving average in early July 2013. As the chart highlights, the gold price has only declined 20% below the 30-week moving average on three to four other occasions since 1969. Capitulation in the gold price, therefore, is a rare event.

The cause of the decline in the gold price is relatively well understood. Stock markets were signalling recovery and inflation remained benign. Profit taking set in after 11 years of strong returns.

In short, investor demand for gold and silver waned, typified by an exodus of investors from gold exchange-traded commodities (ETCs). It didn’t help that India, one of the world’s largest ongoing buyers of gold annually, raised duties on gold imports in an attempt to reverse weakness in the Rupee.

The Case for Precious Metals Appears Intact

Central banks are still printing money in vast quantities in the US, UK, Europe and Japan. The risks associated with all this money printing may not be known for a few years, but the risks have not gone away. Investors may have temporarily forgotten about these risks (inflation) but sooner or later investor demand for gold is likely to return. After all, gold is the only global currency where the supply cannot be increased at will by central banks. Hence, it protects investors against future inflation.

While none of us really knows the implications of the global experiment in money printing, I am of the view that investor demand for gold will return when investors realise that they need to protect portfolios against a scenario where inflation becomes a problem.

Having capitulated in late June, the gold price has not declined below the June lows since, and it appears to be on an upward trend once again. This does not surprise me.

In addition, as the chart highlights, the world’s largest gold mines are struggling to find and mine high grade gold deposits. According to IntierraRMG, the average grade of gold per tonne of material mined in 2012 was circa 1.15 grams. This is down from 5-6 grams per tonne a decade ago. As I highlighted earlier, this statistics goes a long way to explaining why gold miners have not really participated in the gold price rise from $255 a troy ounce in 2001 to $1,300 today. Mining costs have risen substantially, and in no small part reflecting lower grades of gold per tonne of material mined. If the grade of gold mined are lower than historically, this also adds to the argument that the gold price needs to be higher. Otherwise, miners will lower output and supply will fall behind demand.

In contrast, the XAU Index broke below its July lows (weekly low of 86.44 in early July 2013) in December 2013 (weekly low of 80.43). My view at the time (and shared with subscribers of GillenMarkets) was that without a new low in the gold price the breakdown in the XAU Index was unlikely to be sustained. That is indeed what happened with the XAU Index quickly recovering to close back above the July low. Technically, this was another clue that it was a bottoming process, and not the onset of a new leg down in this gold and silver miners bear market.

But Value is the Key

Technical indicators, like the ‘Capitulation’ indicator, are all very well in terms of assisting investors to understand when markets may be over-reacting (in this case to the downside). But if good fundamental value is not on offer at that stage, the odds of strong investor returns from that asset class on a 3 to 5-year view can still be low. But when good business values exist when an index or sector capitulates then the odds of strong returns from there are much higher.

As gold and silver generate no income, it is harder than normal to judge whether these precious metals offer value at any point in time. Some investors compare gold to an equity index or average house prices back in time to see how dear or expensive these precious metals are relative to these other assets. But, as gold and silver have merely match inflation over the millennia while equities and (commercial) property have delivered returns of circa 5% above inflation over the long-haul, personally I am somewhat dubious about such comparisons.

The positive, however, is that value in gold and silver miners’ is easier to judge. They are, after all, productive businesses capable of generating earnings, cash flows and dividends. In that regard, perhaps it makes more sense to compare the XAU Index levels with the gold price. The chart highlights that on average since 1983 the XAU Index has traded at 0.22 times the gold price. Today, following a near 3-year bear market in the gold and silver mining sector, the XAU Index is trading at 0.08 times the gold price. That leaves at lot of upside if history is our guide.

Fundamental Values in Gold Miners

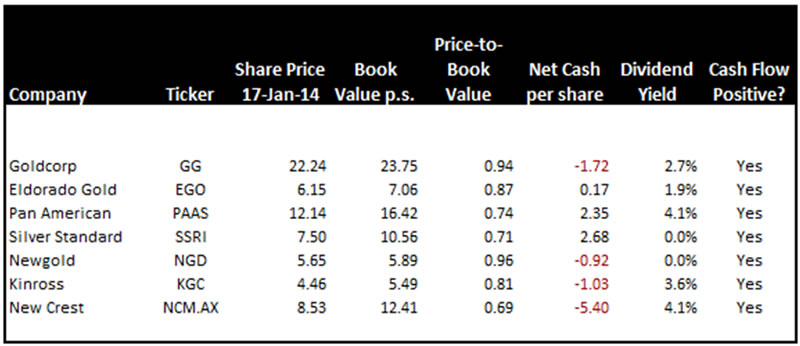

In terms of highlighting value in individual miners, in early January 2014, I highlighted on my website a list of gold and silver mining stocks trading below balance sheet value. As I excluded acquisition goodwill from these balance sheet values, their book values were decent proxies for replacement cost. On average, the list of stocks shown was trading at a price-to-book value ratio of under one times, after goodwill has been stripped out – that is, the value of gold miners in the market place is less than the value of tangible assets on the balance sheet.. The seven stocks we listed were all well financed, with some companies even having substantial net cash balances. All companies included in the list have positive operational cash flows.

Please note that all share prices and balance sheet values are presented in US dollars, except for New Crest, which is presented in Australian dollars.

As I write, the gold and silver miners have rallied 24% from the bottom made in late December 2013. How quickly sentiment can turn – but thus it always is! If you are like me, and believe that investors are once again starting to appreciate the protective values in gold, then the gold and silver mining sector has significant upside from current depressed levels.

Rory Gillen

GillenMarkets.com

Rory is the founder of GillenMarkets.com and the author of 3 Steps to Investment Success along with being a regular contributor to the media on issues affecting the financial services industry. He is a qualified Chartered Accountant, a former senior fund manager with Eagle Star, Ireland (now Zurich Ire.) and a co-founder of Merrion Capital in 2000 where he was Head of Equity Research among other roles for several years. In all, he has spent over twenty five years working in the financial services industry. He founded GillenMarkets (www.gillenmarkets.com) in 2005 as a stock market training company and obtained approval from the Central Bank of Ireland to provide investment advice in 2009.

© 2014 Copyright GillenMarkets - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.