Shadow Banking Stealth Mutation: The Acronyms for the Next Financial Crisis

Stock-Markets / Credit Crisis 2014 Feb 21, 2014 - 03:15 AM GMTBy: Gordon_T_Long

According to the latest study by the Financial Stability Board (FSB) the unregulated $72 Trillion Global Shadow Banking System is now larger than the global regulated banking system. How could an unregulated and opaque industry, which is larger than the entire world's GDP, operate with such little attention? Even the FSB is not a government entity and operates under the auspices of an entity with a highly checkered and mysterious background - The Bank of International Settlements in Basel Switzerland.

According to the latest study by the Financial Stability Board (FSB) the unregulated $72 Trillion Global Shadow Banking System is now larger than the global regulated banking system. How could an unregulated and opaque industry, which is larger than the entire world's GDP, operate with such little attention? Even the FSB is not a government entity and operates under the auspices of an entity with a highly checkered and mysterious background - The Bank of International Settlements in Basel Switzerland.

The FSB has had only two Chairmen since its inception who were able to see the full extent of the operations of this global industry: Mario Draghi who is now head of the European Central Bank (ECB) and Mark Carney who is now the Governor of the Bank of England (BOE). Ben Bernanke's wrote academically on the subject before being quickly catapulted to the Chairmanship of the Federal Reserve. Sounds like these are important qualifications if you are to run the world's financial apparatus.

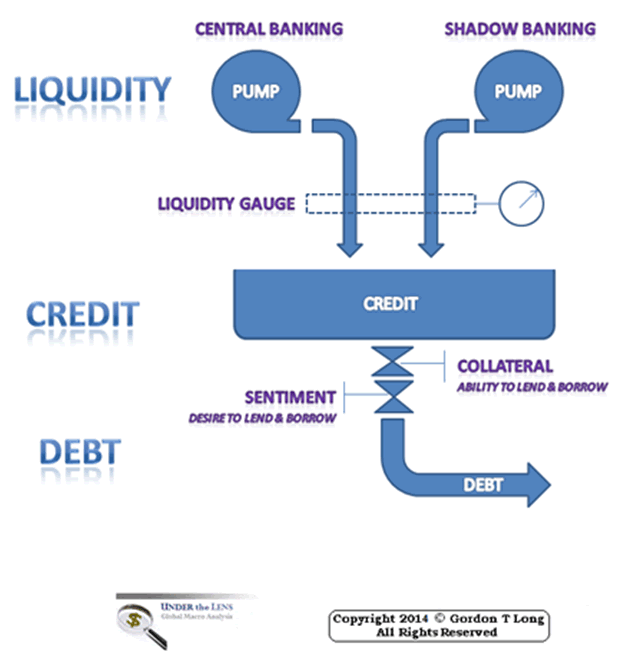

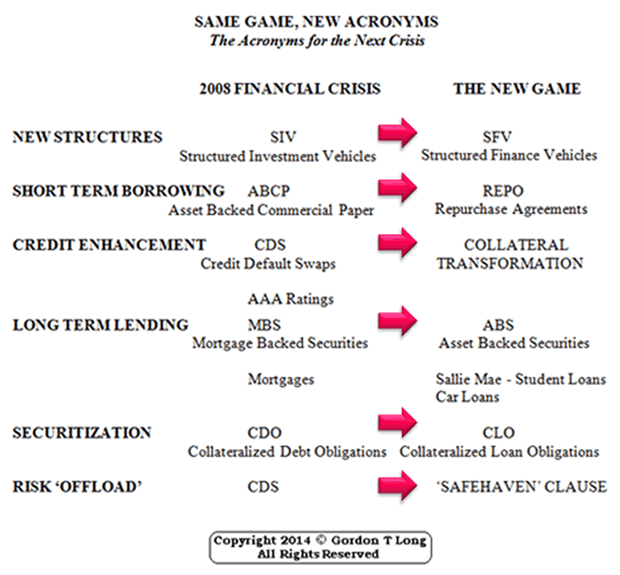

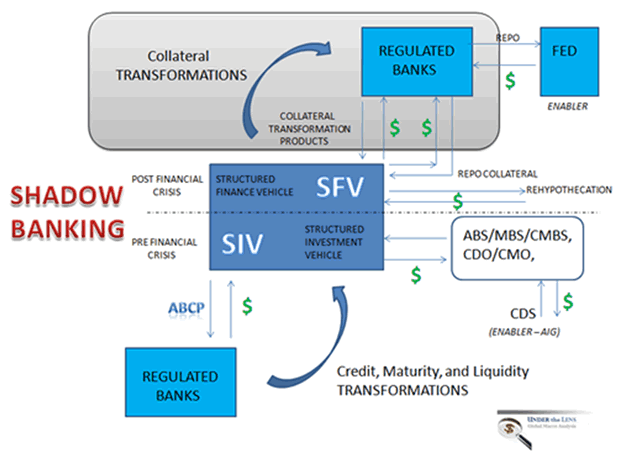

A tipping point for the 2008 Financial Crisis was short term lending problems associated with Asset Backed Commercial Paper (ABCP) liquidity which was used to fund the Shadow Banks Structures Investment Vehicles (SIVs). It was this short term funding that was used to buy what is after the fact now euphemistically referred to as 'toxic waste' (CDOs et al).

Dodd-Frank has done absolutely nothing to change any of this despite the CCP (Central Counter Party) exchange, if it is ever implemented. What has changed is that the Shadow Banking System by necessity, and with policy makers turning a blind eyed, morphed into something far more dangerous.

The New Shadow Banking Structure

Conclusions

The Shadow Banking System is almost completely unregulated.

- How can a $72 Trillion banking function which is larger than the highly regulated Banking System go unregulated?

- How can a $700 Trillion OTC, Off-Balance Sheet, Off-Shore, Unregulated SWAPS market go unregulated?

The global GDP is smaller than the Shadow Banking System and less than 10% of the SWAPS market.

Until we can answer these questions we should conclude that risk is mispriced and price discovery for global financial markets is obscured!

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long Publisher & Editor general@GordonTLong.com

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2014 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.