Venezuela Exchange Controls and Plunging Petroleum Production

Economics / Venezuela Feb 19, 2014 - 03:00 PM GMTBy: Steve_H_Hanke

Foreign airlines have begun to restrict ticket sales in Venezuela. As the bolivars’ value evaporates, and with exchange controls in force, the airlines fear that the funds they have in Caracas will evaporate, too. By restricting ticket sales, the airlines will limit the amount of new money that is trapped behind the government’s wall of exchange controls.

Of course, President Nicolas Maduro isn’t the first autocrat to impose exchange controls, and he won’t be the last to impose these confiscatory policies. Indeed, the pedigree of exchange controls can be traced back to Plato, the father of statism. Inspired by Lycurgus of Sparta, Plato embraced the idea of an inconvertible currency as a means to preserve the autonomy of the state from outside interference.

So, the temptation to turn to exchange controls in the face of disruptions caused by hot money flows is hardly new. Tsar Nicholas II first pioneered limitations on convertibility in modern times, ordering the State Bank of Russia to introduce, in 1905–06, a limited form of exchange control to discourage speculative purchases of foreign exchange. The bank did so by refusing to sell foreign exchange, except where it could be shown that it was required to buy imported goods. Otherwise, foreign exchange was limited to 50,000 German marks per person. The Tsar’s rationale for exchange controls was that of limiting hot money flows, so that foreign reserves and the exchange rate could be maintained. The more things change, the more they remain the same.

This brings me to Nobel laureate Friedrich Hayek’s 1944 classic, The Road to Serfdom. Many thought Prof. Hayek hurt his case because he was extreme. What nonsense. Just consider the Wall Street Journal’s reportage from Caracas about the real concerns of foreign airlines that have funds locked up in Venezuela. And then reflect on the following insightful analysis from the Road to Serfdom:

The extent of the control over all life that economic control confers is nowhere better illustrated than in the field of foreign exchanges. Nothing would at first seem to affect private life less than a state control of the dealings in foreign exchange, and most people will regard its introduction with complete indifference. Yet the experience of most Continental countries has taught thoughtful people to regard this step as the decisive advance on the path to totalitarianism and the suppression of individual liberty. It is, in fact, the complete delivery of the individual to the tyranny of the state, the final suppression of all means of escape—not merely for the rich but for everybody.

Hayek’s message about convertibility has regrettably either been overlooked, or thought to be too extreme. Exchange controls are nothing more than a ring fence within which governments can expropriate their subjects’ property. Open exchange and capital markets, in fact, protect the individual from exactions, because governments must reckon with the possibility of capital flight.

Plunging Petroleum Production

A hallmark of socialism and interventionism is failure. Venezuela is compelling proof of this, having spent the past half century going down the tubes. Indeed, in the 1950’s, it was one of Latin America’s most well off countries. No more. Now it is a basket case – a failed state that’s descending into chaos.

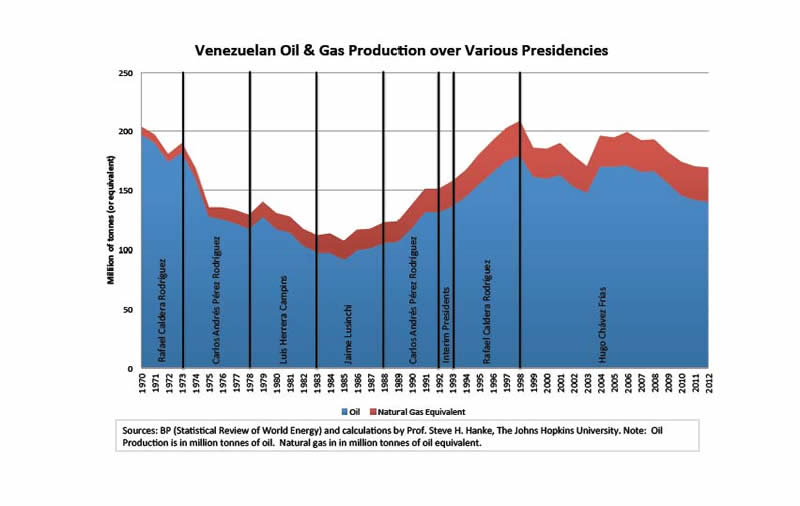

How could this be? After all, Venezuela’s combined reserves of oil and gas are second only to Iran’s. Well, it might have reserves, but thanks to the wrongheaded policies of President Hugo Chavez, Venezuela is the only major energy producer that has seen its production fall over the past quarter of a century. The following chart tells that dismal tale:

By Steve H. Hanke

www.cato.org/people/hanke.html

Twitter: @Steve_Hanke

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2014 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.