Gold Continues Healthy Consolidation Before Next leg Higher

Commodities / Gold & Silver Apr 23, 2008 - 02:23 PM GMTBy: Mark_OByrne

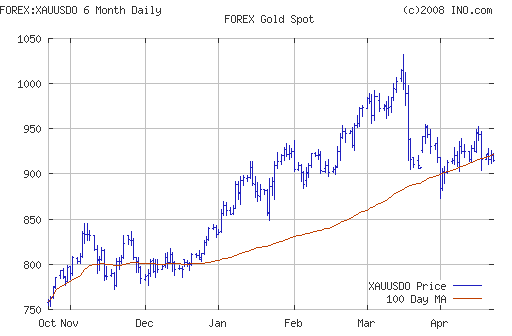

Gold remains in lockdown and is range bound in a narrow channel between $910 and $926. A close above or below this channel will likely see gold test support at $880 or challenge resistance at $950 (see Technical Analysis below).

Gold remains in lockdown and is range bound in a narrow channel between $910 and $926. A close above or below this channel will likely see gold test support at $880 or challenge resistance at $950 (see Technical Analysis below).

Gold was up $7.40 to $922.10 per ounce in trading in New York yesterday and silver was up 27 cents to $17.61 per ounce. The London AM Gold Fix at 1030 GMT this morning was at $916.25, £ 459.50 and €573.95 (from $ 920.75, £464.21 and €576.98 yesterday).

Stagflation is clearly a real threat as inflation appears to be accelerating and growth is clearly slowing. While gold has yet to respond to oil's recent surge and the dollar's record low against the euro, it would be prudent to focus on the medium and long term. We believe gold's historic correlation with the oil price will be reasserted in the coming days as gold plays catch up with oil. The historic ratio of gold to oil is 15 barrels of oil to 1 ounce of gold. Thus, if the ratio is reasserted as we strongly believe it will then we should see gold trade at some 15 times a barrel of oil or at today's prices (15 X 115) some $1,725 per ounce. Importantly gold tends to vastly outperform oil towards the end of their respective bull markets as oil is more subject to demand destruction than gold. Unlike gold, oil is not a finite currency used as a safe haven asset and store of wealth.

The financial crisis is continuing to spread to the wider economy as the woes of Wall Street are now clearly being felt on Main Street.

The slump in the U.S. housing market could cause prices to fall substantially more than they did in the Great Depression. Yale University economist Robert Shiller has said there's a good chance housing prices will fall further than the 30 percent drop in the historic depression of the 1930s. The U.S. in the 1930's was the largest creditor nation in the world, unlike today.

Home prices in the U.S. already have dropped 15 percent since their peak in 2006. It is worth remembering that house prices in Japan fell by nearly 90% between 1990 and 2006. This was a low painful decline and there was no banking and credit crisis as there is today. Also, Japan's largest trading partner, the U.S. was in a far sounder fiscal and financial position then it is today – with the U.S. being the world's largest debtor nation and suffering from massive financial imbalances in the budget, trade and current account deficits .

| 23-Apr-08 | Last | 1 Month | YTD | 1 Year | 5 Year | ||

| Gold $ | 915.95 |

-0.34% |

9.91% |

32.78% |

176.55% |

||

| Silver | 17.65 |

2.81% |

19.52% |

25.92% |

282.95% |

||

| Oil | 117.80 |

15.67% |

18.78% |

79.24% |

342.02% |

||

| FTSE | 6,047 |

10.03% |

-6.03% |

-6.68% |

52.65% |

||

| Nikkei | 13,579 |

8.78% |

-11.29% |

-22.20% |

74.24% |

||

| S&P 500 | 1,376 |

3.49% |

-6.29% |

-7.09% |

49.71% |

||

| ISEQ | 6,107 |

-0.84% |

-11.93% |

-37.05% |

44.71% |

||

| EUR/USD | 1.5962 |

3.44% |

9.44% |

17.54% |

45.73% |

||

| © 2008 GoldandSilverInvestments.com | |||||||

Gold Continues to Outperform All Currencies including Sterling

As pointed out yesterday, many investors, advisers and others in the financial media incorrectly assume that gold's strength is purely a function of dollar weakness. Nothing could be further from the truth. Dollar weakness is just one of the myriad of strong fundamental factors driving the gold price as seen in the Gold/ GBP chart.

http://www.research.gold.org /prices/daily/

Technical Analysis

Outlook

Gold should hold trend support at $893 through this period of consolidation. As the period of consolidation extends the moving average continues to rise currently $818 up from $797 at the beginning of the month. This period of consolidation is healthy as trading at a significant distance from a long term moving average is unsustainable in the long term. The difference between the spot price and the 200 day moving average should continue to close and help the metal form a base for the next leg higher in the bull market.

Failure to hold trend support at $893 opens the way for a deeper correction testing the April 1st low at $870 and a further retest of the $848 support of 22nd of Jan. On the upside resistance remains at the recent $953/954 high of April 17. This topside resistance is forming a rising triangle which should be bullish long term but it could require a longer period of consolidation at these levels before gaining momentum to break to the upside. Confirmation of the upside break would given on a close above $955/960 and should pave the way for a retest of the all time nominal highs at $1033. However, notwithstanding a major market event, this will unfold more gradually than before as it should be underpinned by the strong fundamentals of the market rather than just the irrational speculative exuberance in the derivatives market seen in March. This will be very positive for the long term as fast money tends to distort normal market behaviour.

Prices to Watch

$922 - 100 Day Moving Average

$818 - 200 Day Moving Average

$848 – Support 22nd Jan and Resistance previously 8th Nov

$893 – rising trend support

$954 – resistance from 21st Feb, 26th Mar and 17th Apr

Silver

Silver is trading at $17.52/17.58 per ounce at 1215 GMT.

PGMs

Platinum is trading at $2005/2015 per ounce (1215 GMT).

Palladium is trading at $448/453 per ounce (1215 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.